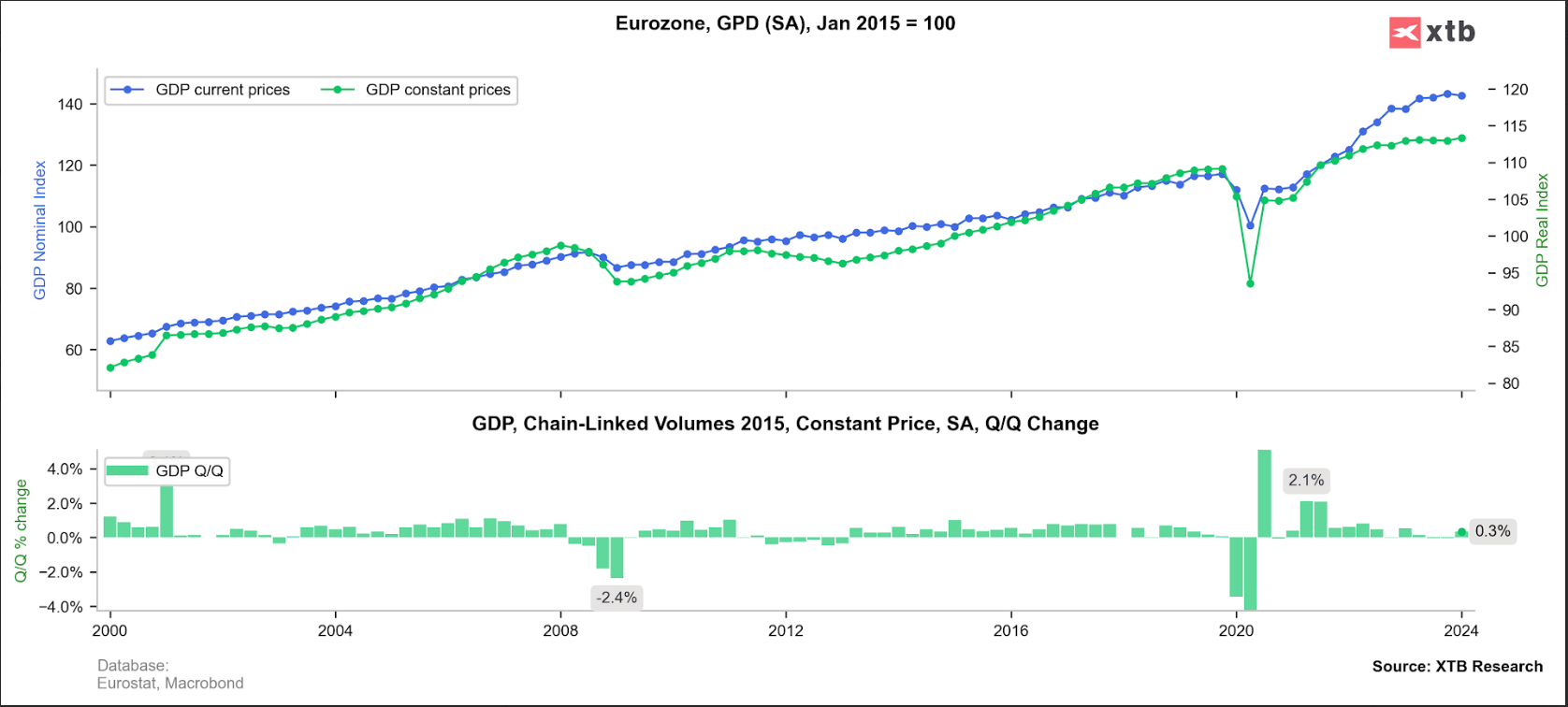

The euro is back above $1.0720 vs. the USD after stronger than expected European GDP for Q1. Quarterly GDP rose by 0.3%, which was stronger than the 0.1% expected, and ‘bounced’ back from the -0.1% dip in growth registered in Q4. Growth was broad-based across the currency bloc, with the largest economy Germany, also exiting recession. However, southern European economies continue to outperform their Northern counterparts.

The stronger GDP report was driven by France, where the economy is now growing at a 1.1% annual rate, driven by robust consumer spending. German GDP also recovered in the first quarter, GDP rose by 0.2% in Q1, higher than expected, and a decent recovery considering growth contracted by 0.5% in Q4.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appThe North/ South divide in Europe continues, Spain’s rate of growth was 0.7% on the quarter, with the annual rate rising to 2.4% from 2.1% in Q4. Italian GDP also posted an upside surprise on Tuesday, rising by 0.3% last quarter, and posting a 0.6% annualized rate of growth.

Chart 1: Eurozone growth

Source: XTB

Why higher growth will not shift the dial for the ECB

This data suggests that Europe’s economy has turned a corner, however, will it impact the timing of expected ECB rate cuts? The interest rate futures market is still expecting the ECB to cut rates in June, due to the April inflation print, which was in line with expectations at 2.4%. Core prices were slightly higher than expected at 2.7%, however this is still lower than the 2.9% recorded for March and the lowest level for nearly 2 years. German and French CPI also registered 2.4% annual CPI growth, which is within touching distance of the ECB’s 2% target.

The bounce in the euro on the back of this report has hit some resistance at $1.0725, and it does not change the overall picture for the single currency: it remains in a tight range between $1.0600 and $1.0750. This trading range is the lowest level since Oct/ Nov 2023.

The scepter of the Fed meeting hangs over EUR/USD this week. The Fed will meet on Wednesday, and the fear is that they sound hawkish, which renews dollar strength. The dollar has strengthened against every major currency this year and is higher by nearly 3% vs. the euro YTD. The driver is the wide difference in interest rates between the US and elsewhere. US interest rates are expected to be 1.7% higher than Eurozone rates by the end of this year, which could limit Euro upside in the medium term.

Sell the rumour, buy the fact?

While stronger growth could drive the euro higher on Tuesday, unless it makes a significant break above $1.0750, any gains could be short lived. Also, expect some volatility in this pair ahead of the Fed. Is the market selling the rumour, only to buy the fact? If the Fed is considered hawkish, and/ or leaves the door open to further rate hikes, then the dollar is likely to surge.

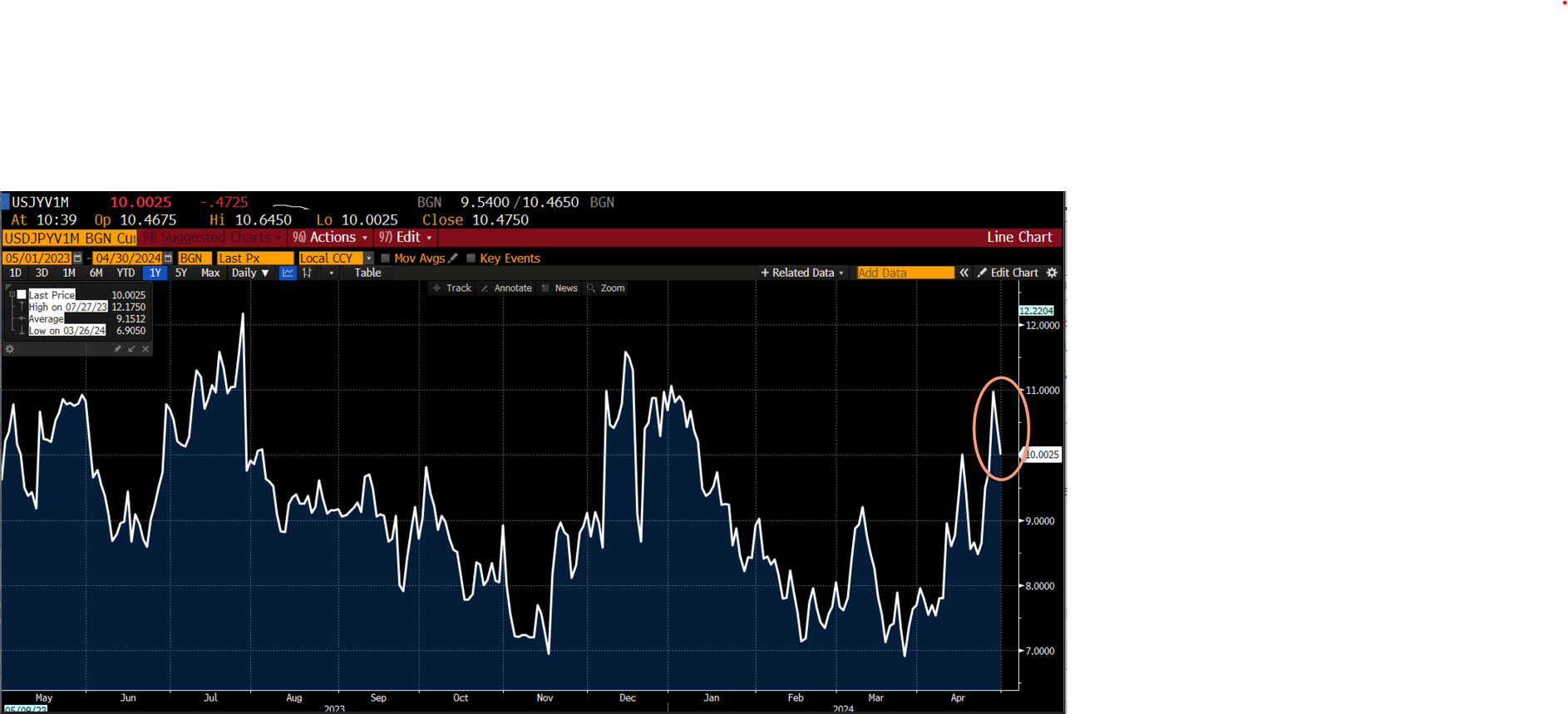

USD/JPY: intervention watch as volatility eases

The euro is the only G10 currency higher vs. the USD on Tuesday, as the dollar continues to hold up well on a broad basis. This could be driven by month-end flows. All eyes are on USD/JPY today, which has risen back towards 157.00, however, it is stabilizing around this level for now. BOJ officials continue to refuse to confirm if they intervened in the FX market to strengthen the yen after USD/JPY surged to 160.00 on Monday. However, May 1st BOJ current account balances will be watched closely to see if there is a sign that they did intervene, and if so, how large was the intervention. The Japanese authorities have a large war chest of FX reserves worth more than $1 trillion, so they could intervene further if necessary. The biggest impact of the suspected intervention in USD/JPY on Monday was to dampen volatility. 1-month USD/JPY volatility has retreated sharply, as you can see below, although yen volatility still remains high by historical standards. However, if the BOJ did intervene then the market has taken notice. We think this pair could be stable in the short term, although whether the market pushes USD/JPY back towards 160.00 may depend on the outcome of the Fed meeting on Wednesday.

Chart 2: USDJPY 1-month options market volatility

Source: XTB and Bloomberg

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.