US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls. Data on Tuesday showed a higher than expected Employment Cost Index for Q1, which rose by 1.2%, more than expected and the highest rate of increase since Q1 2023. Added to this, the Conference Board consumer confidence reading for April slipped to 97.0, from 102.1 in March. This is the lowest reading since July 2022, and suggests that US economic momentum could be waning. The Citi economic surprise index has also fallen sharply, suggesting that more US economic data is surprising to the downside.

Stagflation risks for the US economy

The prospect of stagflation in the US: where inflation is rising, but growth is waning, is a threat to the global economy, and puts the Fed in a difficult position. The market believes that a stagflation threat to the US economy will mean fewer interest rate cuts. Right now, traders are paring back their expectations of a second rate cut in the US this year. There is now only one cut priced in for 2024, with virtually 0% chance of a second cut. Right now, the market expects US interest rates to end the year at 5.02%, vs. 3.65% in January. There has been a massive hawkish repricing of US rate expectations, as you can see in the chart below, which shows US rate expectations for December.

Chart 1: US market-based expectations for December

Source: XTB and Bloomberg

Source: XTB and Bloomberg

The market is positioned for a hawkish message from the Fed chair Jerome Powell this week, and this is weighing on stocks ahead of the meeting. If Powell mentions the disappointment in wages making the Fed less confident in the outlook for inflation, and the potential for a delay to the first rate cut, then this could be perceived as hawkish.

The question now is, are higher rates actually that bad for markets, and could the market be underestimating the risk of the Fed cutting rates this year?

April: a bad month for stocks, but good news for gold as inflation threatens the US economy

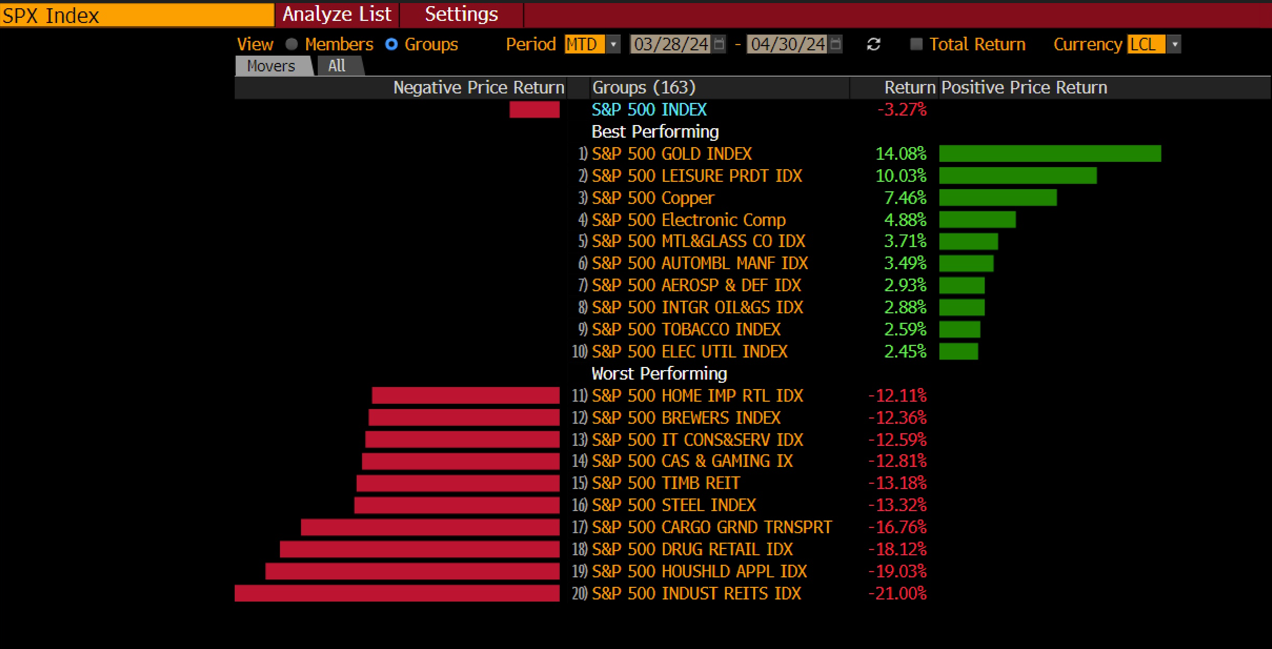

Stock markets have been remarkably resilient in the face of higher interest rates, however, stock market momentum has faded. The S&P 500 is on track to register its first monthly loss this year and is currently lower by 3.3% in April, the Nasdaq is also lower by 3%, while the Dow Jones is down by 4.37%. The sectoral split in the performance of the S&P 500 this month is interesting: Gold is the top performer and is higher by 14%. In contrast, commercial property, the steel and the home improvements retail index are the weakest sectors on the S&P 500 this month.

Chart 2: Sector performance for the S&P 500 in April

Source: XTB and Bloomberg

Gold is an inflation hedge, the price of gold per tonne has had a mixed month – reaching a record high, before pulling back. The price per ounce of gold is higher by 2.95% in April, easily outperforming US and global stock indices. The gold price will be sensitive to the Fed meeting on Wednesday, a hawkish Fed could see the price of gold, and gold stocks, decline as it would suggest that the Fed is still fighting inflation. In contrast, a dovish surprise at this week’s meeting could see the price of gold surge.

Reasons to cut rates this year

There are some growing arguments in favour of Fed rate cuts. For example, some believe that higher rates are boosting household income, through higher deposit rates etc, and this is fueling the US consumer. There is not much evidence of this, with wage gains and a tight labour market likely to be the bigger drivers. However, it is true that higher interest rates in this cycle are not having the same dampening effect on consumption as they have done in previous cycles.

Could the Treasury blunt the Fed’s hawkishness?

Another factor that may impact the Fed to take a less hawkish stance in the coming months is the Quarterly Refinancing Announcement from the US Treasury, which is also released on 1st May. This will detail Q2’s borrowing needs, and is worth watching due to the US economy’s elevated debt levels. The market is expecting total net debt issuance of $243bn in Q2, which is slightly higher than the $202bn the Treasury forecast at the start of the year. Issuance is seasonal, and Q2 tends to see lower levels of issuance. For example, issuance is set to rise sharply in Q3 to $847bn.

The domestic risks from elevated US interest rates grow

The US deficit is nearly 6% of GDP, and Treasury issuance for 2024 does not suggest that this is going to return to pre-covid levels any time soon. The risk is that the US’s funding needs are so great, there could be a dearth of buyers. Added to this, the dollar is strong, so FX hedging costs could also put potential foreign buyers of US Treasuries off. The US interest rate bill is huge, and is rising, and the Fed is also trying to shrink its balance sheet. Thus, the situation for the Treasury market is fragile, and there is a risk of a failed auction/ funding squeeze. If this happens it would likely trigger a major risk off event for global financial markets. The Fed has a fiduciary duty to ensure full employment and stable inflation, a failed US bond auction could threaten these.

Thus, the Fed will also be wary of how they proceed going forward. While we don’t expect a dovish surprise at Wednesday’s meeting, we could see a less hawkish Fed in the coming months, as the risks of higher interest rates start to build.

BREAKING: Massive increase in US oil reserves!

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Join NFP Live Now

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.