Puig (PUIG.ES) could become the most important IPO on the Spanish market since Acciona Energía in 2021. The multinational company has decided to go public after record results in 2023, with sales of €4,304 million. The Puig family is opening the door to its fashion and fragrance company consisting of major brands such as Carolina Herrera, Jean Paul Gaultier and Rabanne. All indications are that the company's valuation will make it one of the most important IPOs in the Spanish market in recent years, surpassing some major international IPOs, but how exactly will the process take place? In this article we provide the keys to this operation.

Source: XTB Research Team

What is the Puig Group?

The Puig Group is an international fashion and cosmetics company with a 110-year history, founded by businessman Antonio Puig Castelló in Barcelona. The group, now controlled by the Puig family, consists of 17 global brands that strategically complement each other, focusing on different segments. The multinational has a good track record of acquiring companies where it retains the founders and encourages them to work together. In fact, sometimes the founders own shares in the company. In this way, a high convergence of interests continues to be generated, while giving it greater financial strength.

With this strategy, Puig achieved record results in 2023, accumulating two years of solid growth. In fact, they may revise their targets for 2025. Some €4,500 million in revenue was projected for that year, but with €4,304 million reported in 2023, that number has been virtually achieved. In this context, it's worth noting that this is not the first time the Puig Group has achieved its goals ahead of schedule, as it set a target of €3,000 million for 2023, which it far exceeded.

Source: XTB Research Team. The data comes from the company's reports.

In addition, the Puig Group has a good diversification of its revenues, both geographically and by business sector. In fact, China, one of the biggest worries for luxury brands, is doing well for Puig. So much so that in 2023 it achieved 27% sales growth in the country, with Charlotte Tilbury leading the brand. So looking ahead, we hope that China could be a good opportunity for Puig to further expand internationally.

Source: XTB Research Team. Data taken from company reports.

What are the Puig Group's brands?

The Puig Group currently operates in 32 countries through 17 brands, which can be divided into two different types: proprietary and licensed. However, the majority of the multinational company's revenue comes from the brands it owns, which gives it greater management control.

Prominent among Puig's own brands are Carolina Herrera, Jean Paul Gaultier, Nina Ricci and Rabanne, which contributed 23% of the company's total revenues, exceeding 1,000 million in net sales in 2023. In this context, it is also worth noting the latest acquisitions of the multinational: cosmetics brand Charlotte Tilbury and perfume company Byredo.

For his part, Puig's most notable licenses are Louboutin, where he operates exclusively in the cosmetics sector, Banderas or Adolfo Dominguez, a perfume line that he owns 15% of the company's total. In addition, the group also holds non-majority stakes in brands such as Isdin, Granado and Scent Library.

Which shares are subject to issuance?

First of all, we need to define the two types of shares held by Puig, as they do not have the same rights from a shareholder perspective. The A shares, which the Puig family will continue to hold, carry the right to 5 votes at the shareholders' meeting, while the B shares, which will be issued as part of the IPO, will have only 1 voting right. Although the family was willing to leave up to 49% of the company in the hands of other shareholders, given the demand for the offering, it will ultimately retain 77% of the shares and more than 90% of the voting power. Specifically, the Puig Group's IPO will consist of two parts. The first consists of a €1,250 million issue of new shares, and the second of a €1,360 million public offering of existing shares.

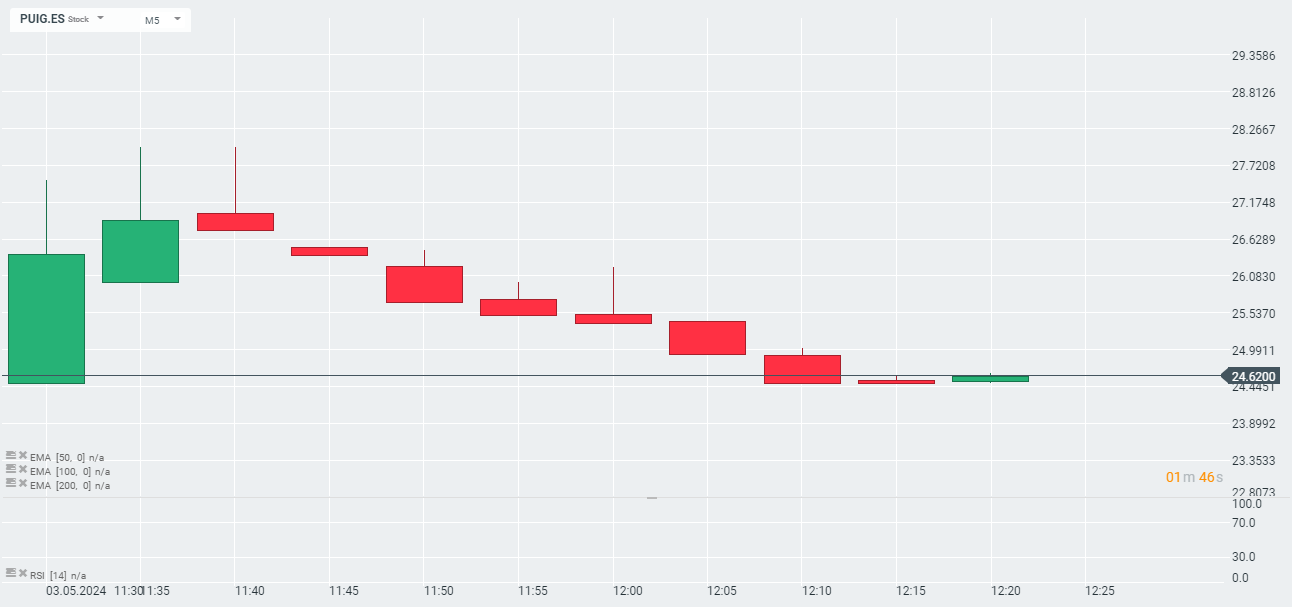

Today is the first day of trading in the company's shares

The IPO schedule has been intense, although the key days for investors interested in Puig shares are as follows:

- April 30: both the official price of Puig shares and the final issue size were set.

- May 3: First day of trading on the stock exchange. The most important date for investors, as the stock begins trading on the Spanish stock exchange on this day.

The company's shares are currently trading above the €25 per share level. This gives the company a final valuation of more than 13.9 billion euros. These figures exceed the international group's first estimate of a valuation of €10 billion, and show strong investor interest in buying Puig shares, as they are willing to pay a higher multiple than competitors. To put these numbers in context, if Puig were part of the Ibex 35, it would rank fifteenth in terms of market capitalization after listing, leaving it in the middle of the table.

The company's shares are currently trading above the €25 per share level. This gives the company a final valuation of more than 13.9 billion euros. These figures exceed the international group's first estimate of a valuation of €10 billion, and show strong investor interest in buying Puig shares, as they are willing to pay a higher multiple than competitors. To put these numbers in context, if Puig were part of the Ibex 35, it would rank fifteenth in terms of market capitalization after listing, leaving it in the middle of the table.

Source: XTB Research Team. Refinitiv

Initially, Puig shares will not be part of the Ibex 35, although they perfectly meet the market capitalization criterion. In fact, since it would be part of the twenty companies with the largest market capitalization, it could be included even with a reduced trading volume. However, for a company to be included in the Ibex 35, it must have been listed for at least six months. In addition, the committee that decides which companies enter and leave the index usually makes decisions at its June and December meetings. Consequently, Puig could enter the Ibex 35 index at the end of 2024.

What will Puig's dividend policy be?

Although the dividend policy has not been set at the new stage as a listed company, Puig has paid out 40% of its profits over the past 20 years. This is known in financial jargon as a 40% payout. If we take 2023 as an example, this payout will amount to 186 million euros. In this sense, Puig expects to make its first dividend payment as a listed company in 2025, as reflected in the prospectus sent to CNMV.MV.

The material was prepared by the Spanish branch of XTB.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street