Alaska Air Group (ALK.US) is losing more than 6% today following the release of its 2Q24 results and the presentation of its forecasts for the next quarter. The company, despite its solid results, disappointed investors most strongly precisely with its projections for the next quarter, which differed sharply from analysts' predictions.

The company generated $2.9 billion in revenue in 2Q24, an improvement of 2.1% over the previous year, marking a record quarter for the company. Sales of premium seats accounted for 33% of the company's total revenue, and it was this segment that led to such a strong result.

The company recorded similar growth in RPM, or the value equivalent to one mile traveled by one paying passenger (revenue passenger miles). The company recorded RPM 15.3 billion (+2.5% y/y). Stronger growth was recorded in cpacity, as measured by the ASM value (a measure of 1 seat allowing to travel 1 mile). In this value, Alaska Air achieved 6% y/y growth to a value of 18.2 billion. The value of RASM, which stands for revenue per ASM unit, declined y/y by 3.7% because of higher capacity growth.

Adjusted EPS came in at $2.55, compared to $3 a year earlier, a stronger result than the $2.38 the market had predicted.

The company expects capacity growth to diminish in the following months, while for the full year of 2024 it expects growth to decline to 2.5% y/y, due to lower deliveries from Boeing than it had previously anticipated.

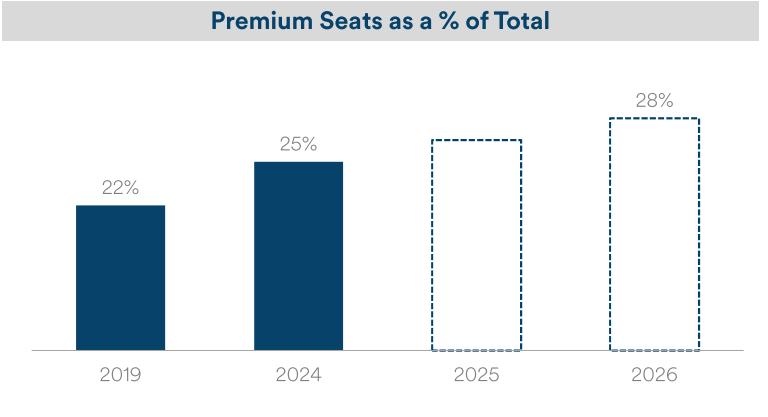

Alaska Air also announced an increase in the share of premium seats on its aircraft, which should boost both the company's revenue and its margins. Fleet modifications this September include adding premium seats to 64% of the group's aircraft. Ultimately, by 2026, the share of premium seats in the number of total seats offered is expected to rise to 28% from 25% today.

Source: Alaska Air Group

Source: Alaska Air Group

The company, despite solid results, disappointed investors most strongly with its predictions for the coming periods. In 3Q24, it expects to deliver $1.4-1.6 in adjusted earnings per share versus Wall Street's average expectation of $2.06. The drop in projected profit is due to following in the footsteps of its competitors including United AIrlines Holdings and Delta Air Lines, which have decided to cut prices for the summer season, which translates into increased competition for the record number of passengers expected to travel this summer, some 270 million. The price cut will also affect profitability for all of 2024, with the company lowering its forecast to $3.5-4.5 (previously: $3.25-5.25). The market consensus was for $4.52 for the full year.

The company is losing more than 6% today after the release of results and forecasts, approaching the support level at around $37 set by the consolidation zone from February this year. The company has remained in a downtrend since the April peaks. Source: xStation

2Q24 RESULTS:

- Revenues: $2.9 billion (+2.1% y/y), expected: $2.93 billion

- Revenue from passengers: $2.65 billion (+2.1% y/y), expected: $2.68 billion

- RPM: $15.3 billion (+2.5% y/y), expected: $15.74 billion

- ASM: 18.2 billion (+6% y/y), expected 18.17 billion

- RASM: 15.92c (-3.7% y/y)

- Adjusted EPS: $2.55 (vs. $3 a year earlier), expected $2.38

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.