On September 15, 2025, Alphabet, the parent company of Google, surpassed a market capitalization of $3 trillion for the first time in its history, becoming the third technology company to reach this milestone, alongside Apple and Microsoft. This breakthrough is not merely a symbol of market success but a reflection of investors’ confidence in the company’s strategic direction across artificial intelligence, cloud infrastructure, and digital services.

One of the key catalysts behind this strong growth was a U.S. court ruling that dismissed the possibility of a forced breakup of Alphabet into smaller entities, which would have affected products like the Chrome browser and the Android operating system. This decision was interpreted as a stabilizing signal for investors, allowing the company to continue its expansion without the risk of compromising the integrity of its technology ecosystem.

The second foundation of this record valuation lies in Alphabet’s consistently improving quarterly financial performance and the rapid development of AI-based services. A particularly important driver has been the continued advancement of the Gemini language model, which is increasingly viewed as a viable alternative to ChatGPT. Alphabet has successfully integrated Gemini into its key products and services, including its search engine, the Workspace productivity suite, advertising platforms, and cloud solutions.

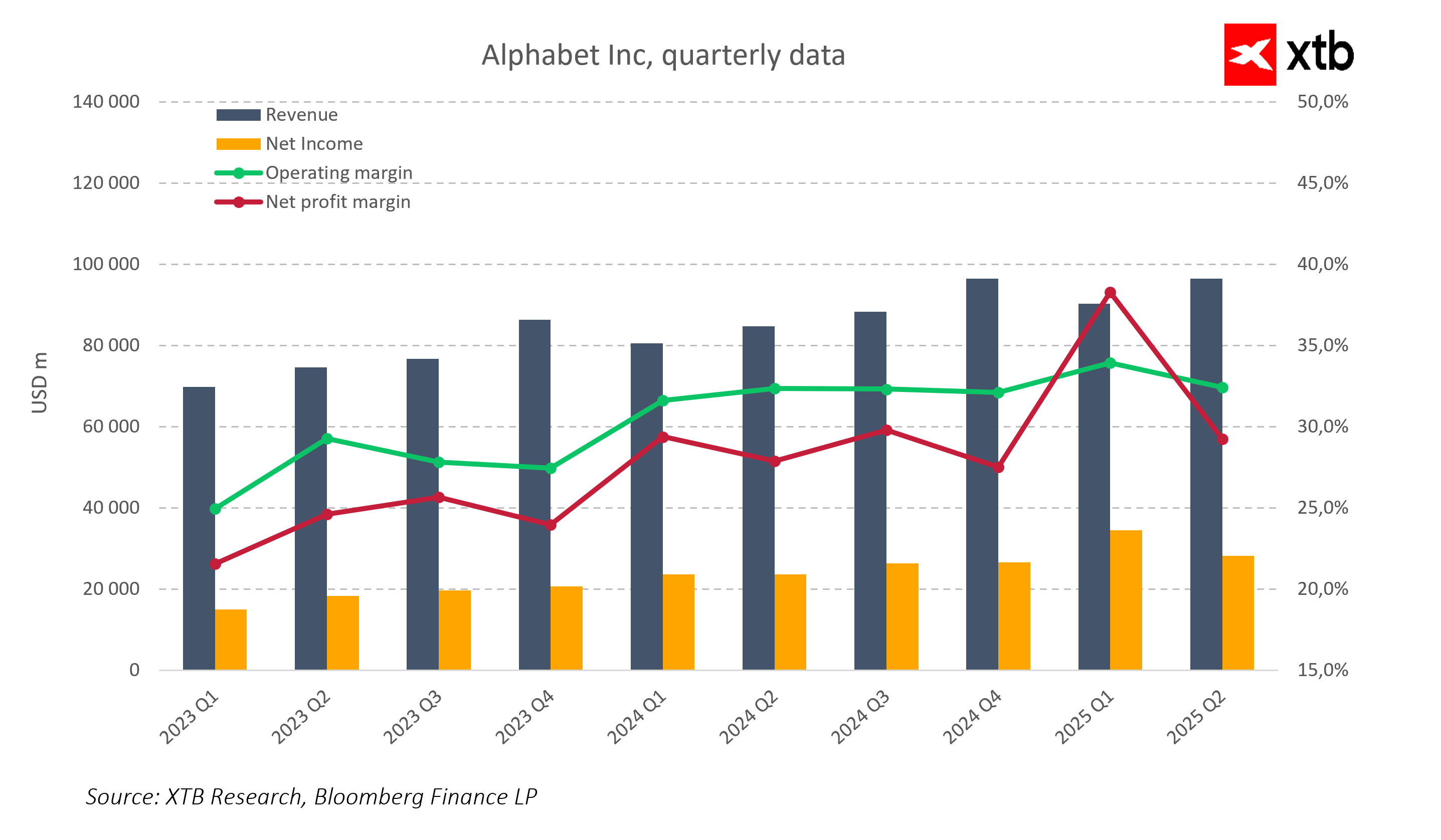

Between early 2023 and the second quarter of 2025, Alphabet’s revenue increased from approximately $70 billion to over $95 billion. At the same time, net income rose from just under $20 billion to nearly $35 billion in Q1 2025, marking a record-high result for the company. In Q2, net income remained strong, hovering around $30 billion. The company has also seen a steady increase in profitability.

Operating margin exceeded 30% by late 2023 and hovered around 34–35% in 2025. Even more striking was the net profit margin, which reached nearly 38% in Q1 2025—meaning that Alphabet was able to convert almost four out of every ten dollars of revenue into pure profit.

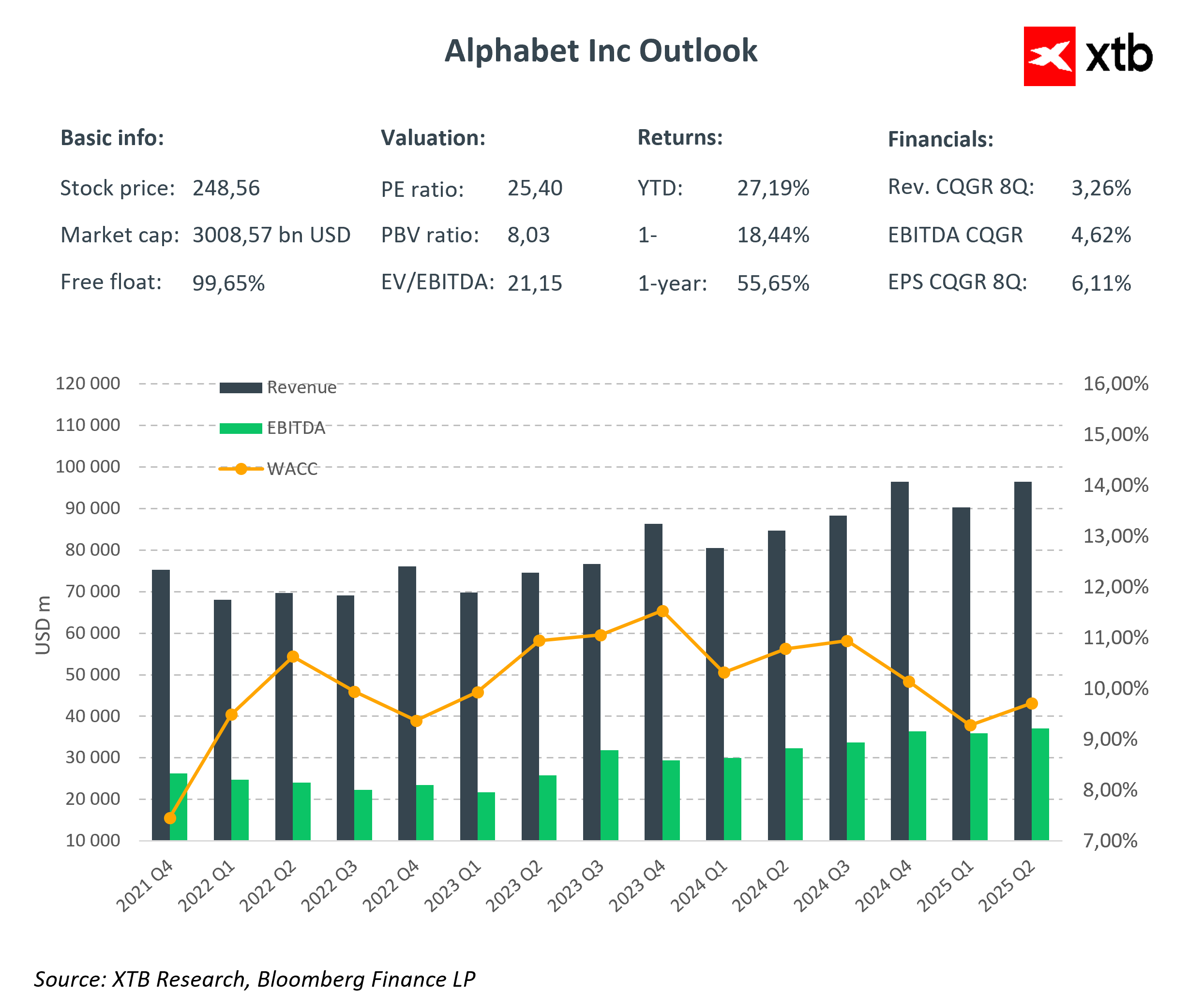

Long-term data confirms the sustainability of this improvement. Notably, the company maintains high capital efficiency with an EV/EBITDA ratio of 21.15 and a relatively low cost of capital (WACC), which in recent quarters stabilized below 10%. In practice, this means Alphabet is generating increasingly higher profits with relatively lower investment risk—an essential factor for institutional and long-term investors.

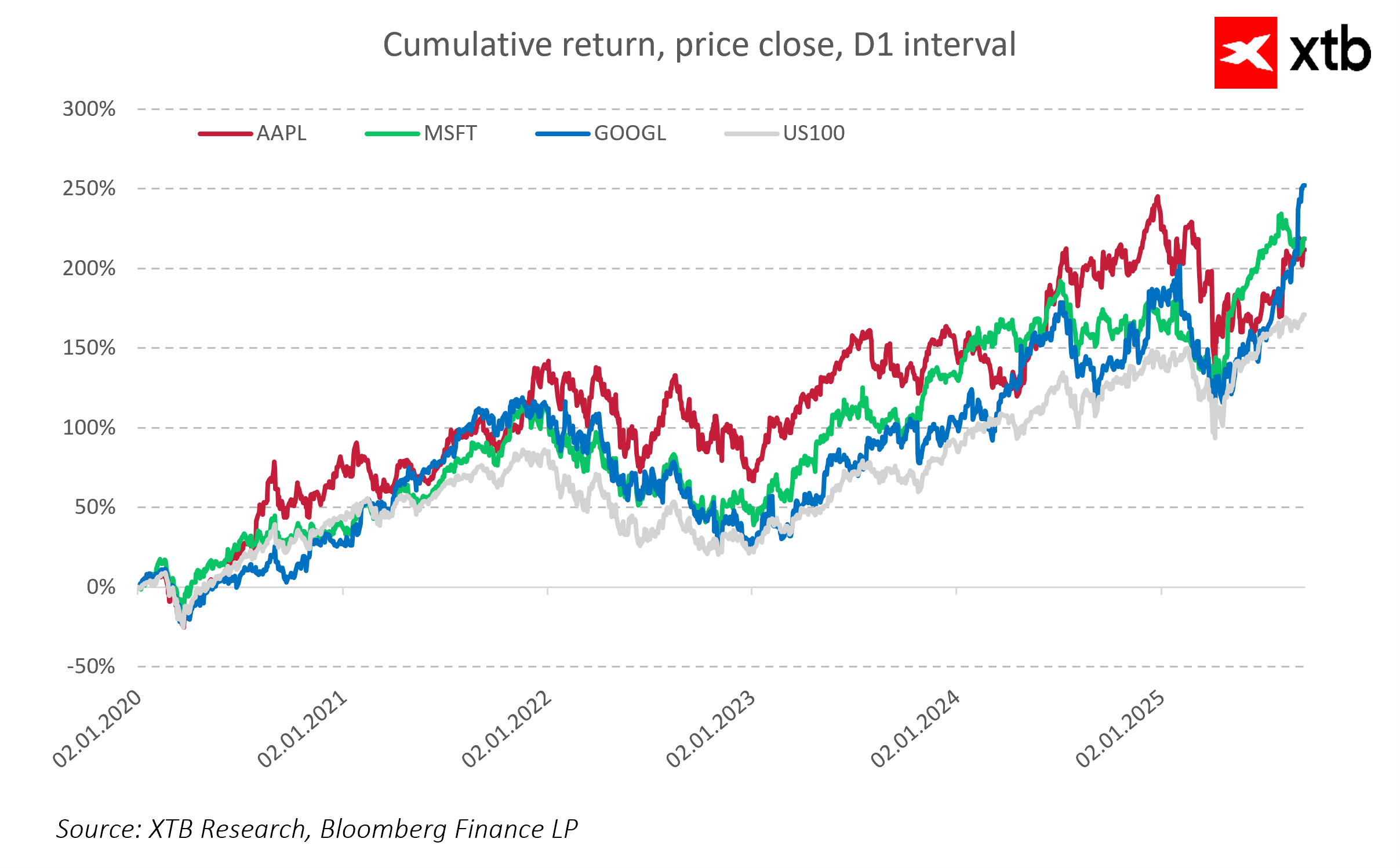

The company also delivers exceptionally strong returns to shareholders. Since the beginning of 2020, Alphabet’s cumulative return has exceeded 250%, placing it at a level comparable to Microsoft and Apple. All three companies have significantly outperformed the Nasdaq 100 index, which gained just over 150% in the same period. This demonstrates that Alphabet is not only keeping pace with its competitors but is also steadily building its position as one of the primary beneficiaries of the digital transformation.

In this context, however, it’s important to note that Alphabet is not currently the world’s largest tech company. That title now belongs to Nvidia, whose market capitalization has exceeded $4 trillion. As a provider of critical infrastructure for AI models—including GPUs and data center solutions—Nvidia has become a cornerstone of the new digital revolution. Its growth trajectory positions it as the main challenger to the market’s previous leaders. Although Alphabet remains a strong player, it now faces Nvidia’s growing dominance in the race for AI leadership.

Ultimately, Alphabet’s success is not just the result of temporary market enthusiasm but a long-term process of transformation. The company has evolved from a search engine into a multidimensional technology platform, encompassing artificial intelligence, cloud computing, mobile systems, digital media, enterprise and consumer solutions, as well as future-forward projects such as autonomous vehicles and quantum computing. If it can maintain its current pace of innovation and effectively manage regulatory challenges and competition in AI, Alphabet is well-positioned to remain a pillar of the digital economy for the next decade.

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.