- Anthropic is negotiating a multibillion-dollar cloud deal with Google, which could accelerate the development of advanced AI models.

- Despite positive signals, Alphabet faces competitive pressure from OpenAI and its new ChatGPT Atlas browser.

- Anthropic is negotiating a multibillion-dollar cloud deal with Google, which could accelerate the development of advanced AI models.

- Despite positive signals, Alphabet faces competitive pressure from OpenAI and its new ChatGPT Atlas browser.

Alphabet’s shares are rising in pre-market trading following news that the artificial intelligence startup Anthropic is in advanced negotiations with Google regarding a potential multibillion-dollar cloud services deal. Under this agreement, Google Cloud would provide significant computing power to enable Anthropic to further develop and scale its advanced AI models.

Anthropic, best known for its AI assistant called Claude, which directly competes with OpenAI’s ChatGPT, has previously received substantial financial support from Google. This potential collaboration highlights the critical importance of cloud infrastructure in developing modern AI technologies and demonstrates Alphabet’s intention to strengthen its role as a key service provider for innovative companies in this field.

Although negotiations are ongoing and have not been officially confirmed, this partnership could bring significant financial benefits to Google Cloud and accelerate the development of AI solutions offered by Anthropic. It also signals that Alphabet is actively investing in strategic relationships that will help it effectively compete in the rapidly growing AI market.

It is worth noting, however, that Alphabet is also facing increasing competition in the AI sector. Yesterday, its stock price dropped by more than 2% after OpenAI announced its new AI-powered web browser, ChatGPT Atlas. This new browser offers features such as an AI assistant for online tasks and a memory function that improves search accuracy, directly competing with Google Chrome and potentially threatening Alphabet’s advertising revenues.

Source: xStation5

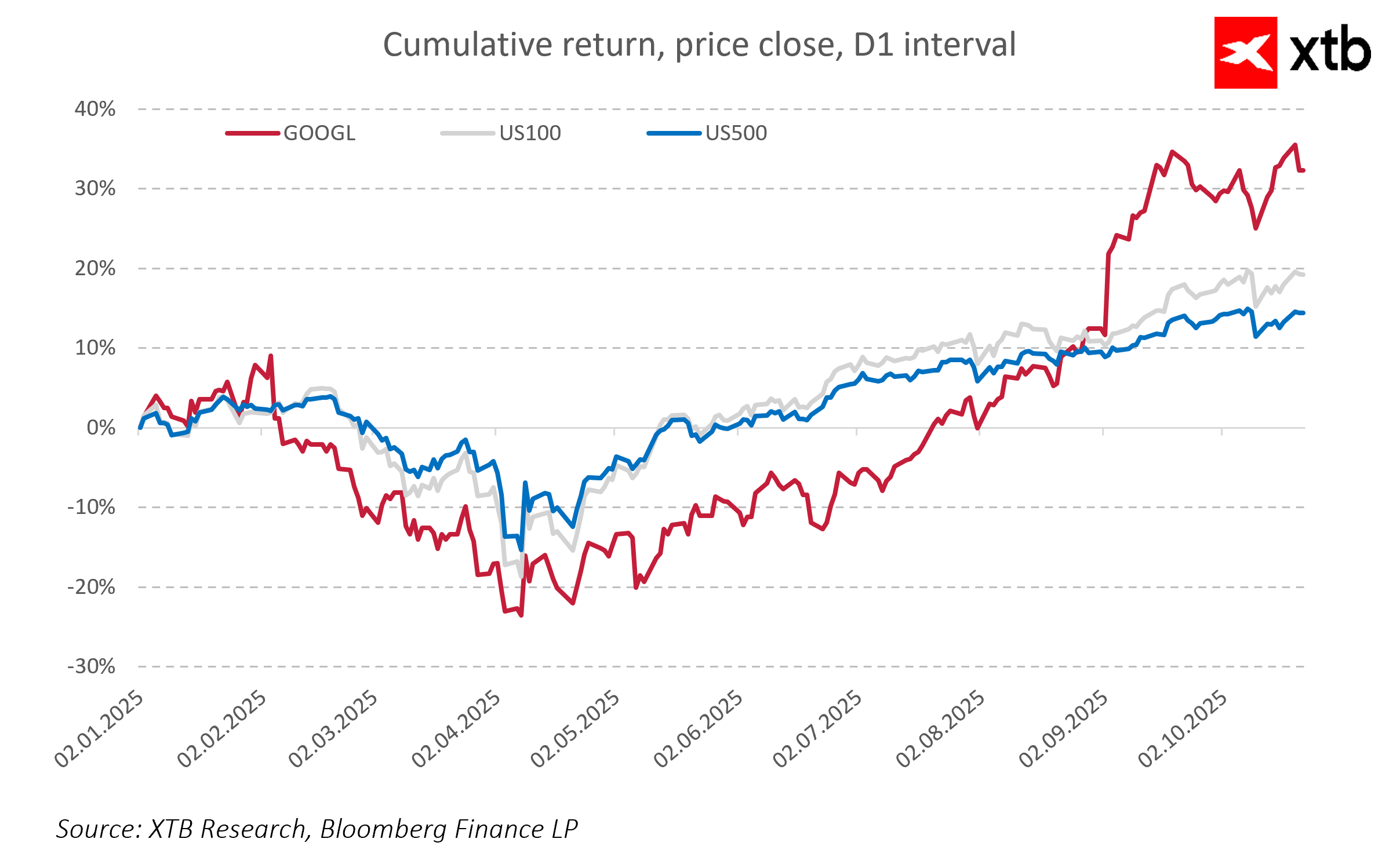

Despite these challenges, Alphabet’s shares have remained in a strong upward trend since the beginning of the year. The company is expected to release its quarterly report at the end of October, which investors are eagerly awaiting for further insights into the company’s prospects in the rapidly evolving technological environment.

Daily Summary – Wall Street Rises Ahead of “Magnificent Seven” Earnings

Palantir and Nvidia Join Forces in Advanced Artificial Intelligence Development

Microsoft and OpenAI: Strategic Restructuring and the Upcoming Report as an AI Market Barometer

Cameco Shares Hit Record Highs Following Strategic Partnership Announcement with the US!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.