-

Oracle is deploying 50,000 AMD chips to its cloud as an alternative to Nvidia.

-

Competition among chipmakers is gaining momentum, and Oracle's decisions have the potential to change the balance of power.

-

Oracle is deploying 50,000 AMD chips to its cloud as an alternative to Nvidia.

-

Competition among chipmakers is gaining momentum, and Oracle's decisions have the potential to change the balance of power.

Oracle's (ORCL.US) Cloud Infrastructure division announced that it will deploy 50,000 AMD (AMD.US) GPUs starting in the second half of 2026 as an alternative to Nvidia solutions for artificial intelligence applications. This signals intensifying competition in the AI GPU market, where Nvidia has long held a dominant position – its chips were used, among other things, to develop ChatGPT, and it holds over 90% market share in the data center market. For Oracle, the next-generation AMD Instinct MI450 chips will be integrated into its cloud infrastructure for advanced AI applications, particularly in the area of inference, which Oracle highlights as a key area for customer adoption of the new chips.

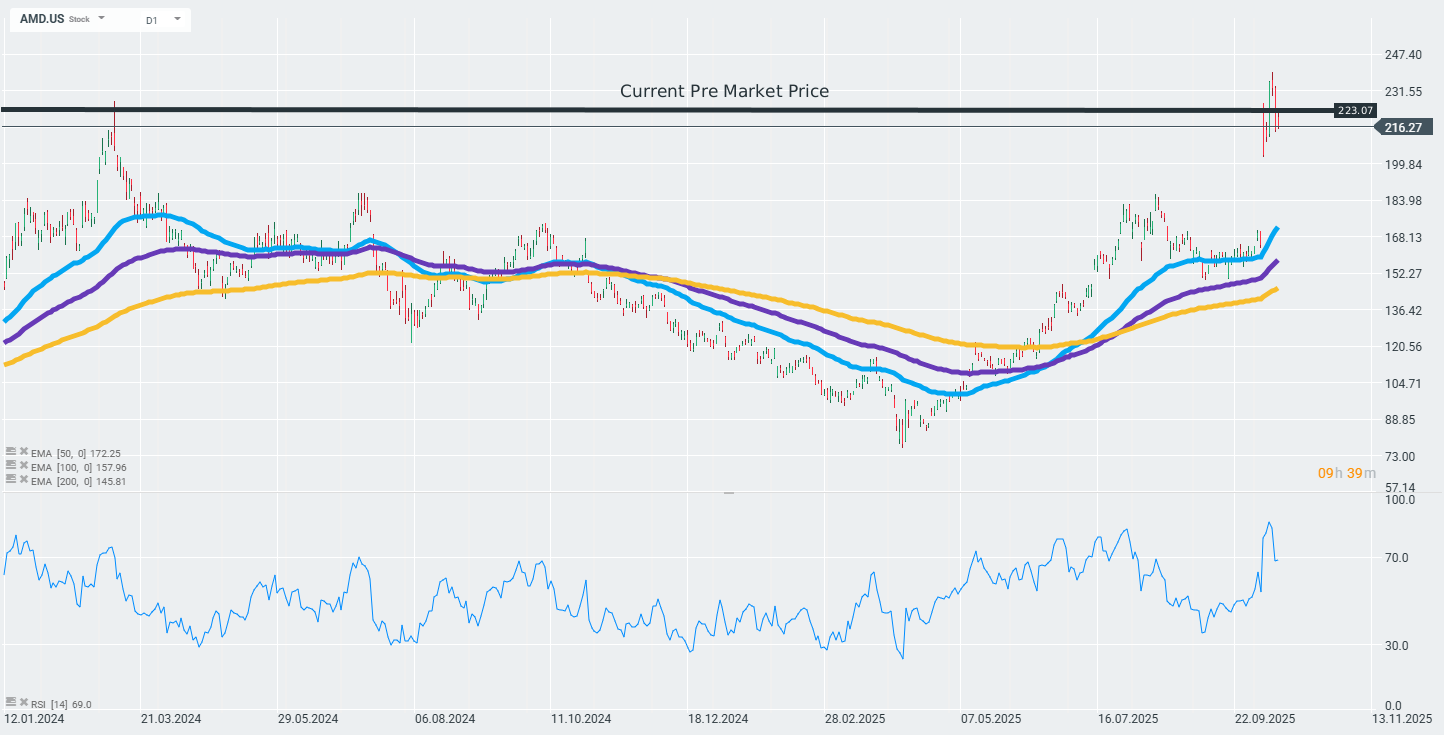

For the stock market, the announcement had an immediate impact. AMD shares gained 3.07% in pre-market trading on Wall Street. More broadly, the market has seen a clear shift in infrastructure investment preferences towards AI solutions in recent weeks. OpenAI itself, until recently closely associated with Nvidia, has signed a new multi-year agreement for AMD chips (6 GW of capacity over several years), which, if fully implemented, could translate into OpenAI owning as much as 10% of AMD's shares.

With today's gains before the US markets open, the company's shares remain close to their all-time highs. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.