Fed cuts rates by 25 bps to 3.75% in line with Wall Street expectations. Vote in favor of policy decision was 9-3, with Miran preferring a half-percentage-point cut and Goolsbee and Schmid preferring no cut..

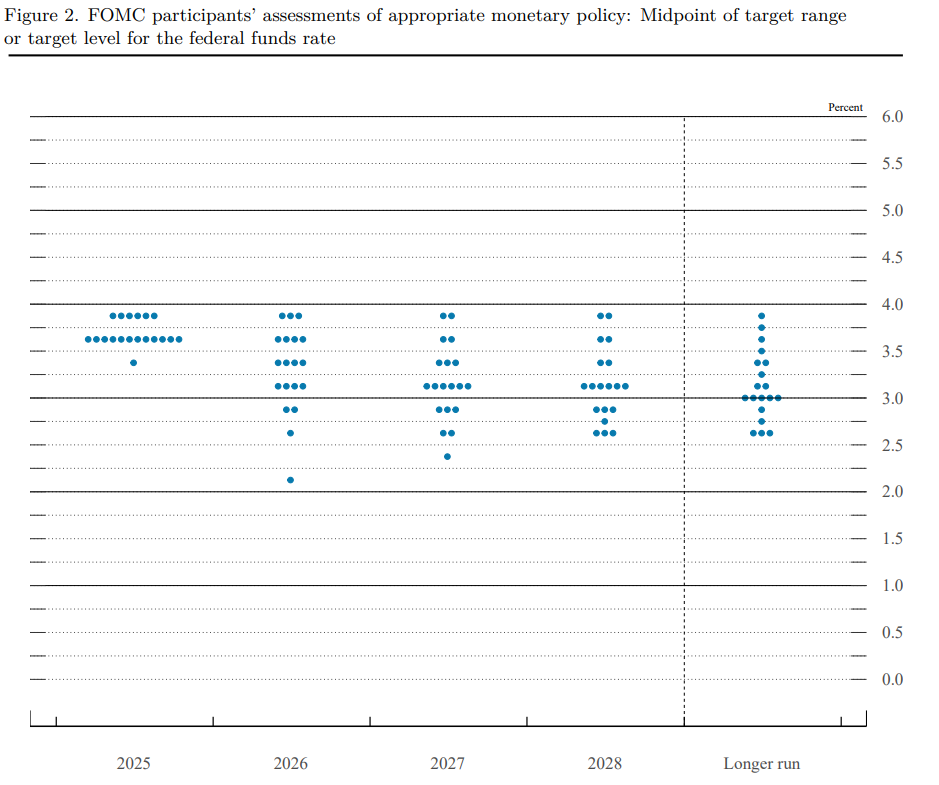

In first reaction to data futures on Nasdaq 100 (US100) gain. Fed median projection maintains 25 bps of rate cuts in 2026; seven officials penciled in no rate cuts for 2026. Four Fed members signalled in two quarter-point cuts for 2026. Fed policymakers see end-2026 PCE inflation at 2.4% (vs. 2.6% prior); core at 2.5% (vs. 2.6%). Projections show wide divergence of views for the path of rates in 2026 and beyond.

- Fed median unemployment projection 4.5% in '25, 4.4% in '26.

- Fed median projection shows rates at 3.1% by the end of 2028.

- Unemployment edged up through September.

- Fed median projection shows rates at 3.4% in '26, 3.1% in '27.

- Median GDP projection at 1.7% in 2025, 2.3% in 2026.

- Fed will buy $40 billion of treasury bills over the next 30 days and consider the extent and timing of additional adjustments.

- Four officials see at least three-quarter-point cuts for 2026.

- Pace of future reserve management purchases likely to be significantly reduced.

- Initial Treasury bill buying to be elevated 'for a few months'; Fed ends operational limit on standing overnight repo operations.

Fed Projections

- Fed Median Rate Forecast (Next 3 Yrs): 3.125% (Forecast 3.125%, Previous 3.125%)

- Fed Median Rate Forecast (Next 2 Yrs): 3.125% (Forecast 3.125%, Previous 3.125%)

- Fed Median Rate Forecast (Current): 3.625% (Forecast 3.625%, Previous 3.625%)

- Fed Median Rate Forecast (Next Yr): 3.375% (Forecast 3.375%, Previous 3.375%)

- Fed Median Rate Forecast (Long Run): 3% (Forecast 3.125%, Previous 3%)

Federal Reserve signals uncertainty about the outlook remains elevated with 'attentive to risks on both sides of mandate', downside risks to employment have risen. However, the US economy is expanding at moderate pace; job gains have slowed, and unemployment has edged up. Inflation has risen from earlier in the year and remains elevated.

Source: xStation5

Source: Federal Reserve

BREAKING: US wholesale sales lower than expected

BREAKING: US jobless claims above expectations🗽

Turkey has decided to lower the weekly repo rate to 38%

BREAKING: Swiss national bank holds the rates! ↔️

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.