US ISM Services PMI : 54.4 vs. 52.2 exp.(prior 52.6)

- Prices Paid : 64.3 vs. 65.4 prior

- New Orders : 57.9 vs. 52.9 prior

- Employment : 52.0 vs. 48.9 prior

US JOLTS Job Openings Actual 7.146M (Forecast 7.6475M, Previous 7.670M, Revised 7.449M)

- Job Openings Rate: 4.3% (prev 4.6%; prevR 4.5%)

- Quits Level: 3.161M (est 2.995M; prev 2.941M; prevR 2.973M)

- Quits Rate: 2.0% (prev 1.8%; prevR 1.9%)

- Layoffs Level: 1.687M (est 1.816M; prev 1.854M; prevR 1.850M)

- Layoffs Rate: 1.1% (prev 1.2%)

US Durable Goods Orders (M/M) Oct F: -2.2% (est -2.2%; prev -2.2%)

- Durables Ex Transportation (M/M): 0.1% (est 0.2%; prev 0.2%)

- Cap Goods Orders Nondef Ex Air (M/M): 0.5% (prev 0.5%)

- Cap Goods Ship Nondef EX Air (M/M): 0.8% (prev 0.7%)

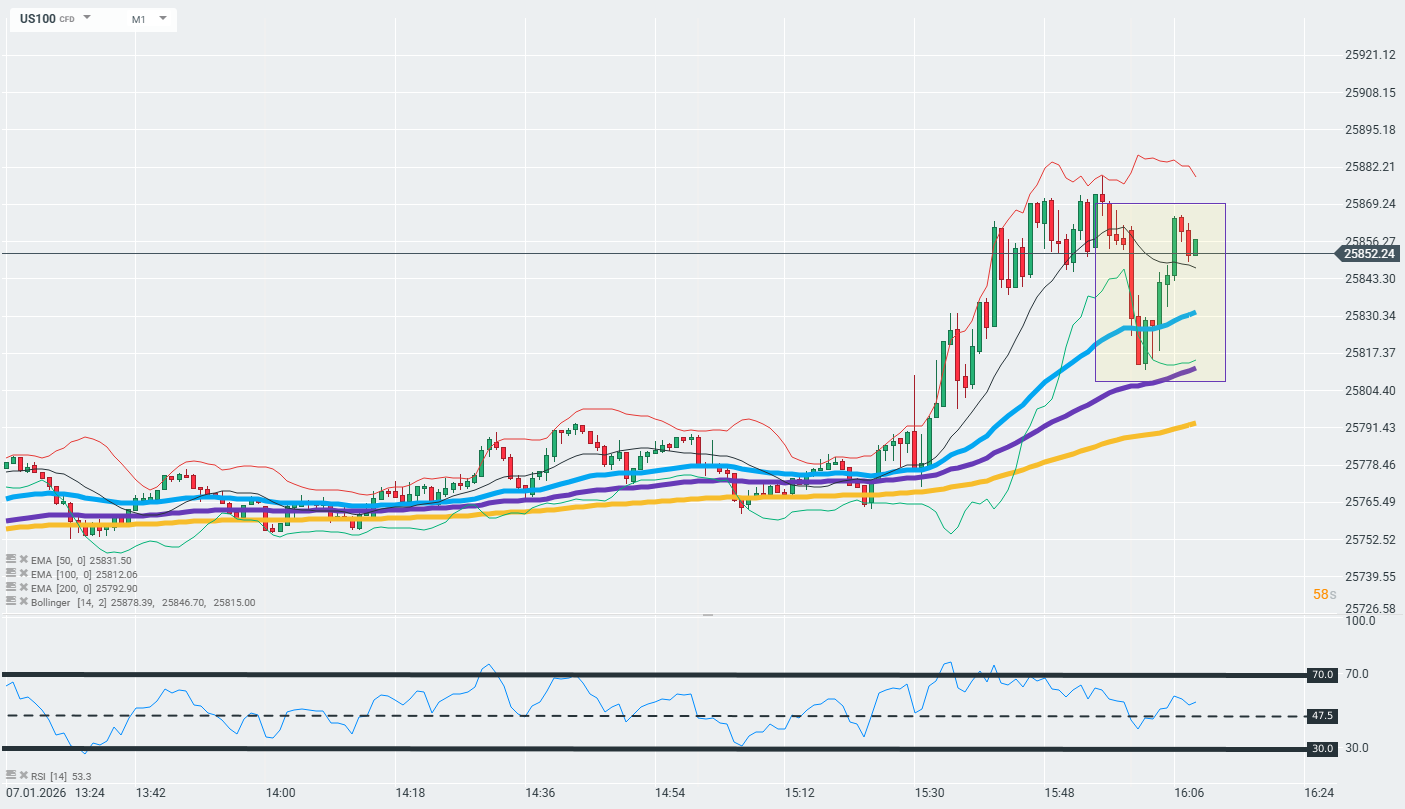

Solid ISM Services print (US services activity expanded in December at the fastest pace in more than a year, fueled by solid demand growth and a pickup in hiring.). Weak JOLTS data. Interesting mix however the intial drag on US equities was reversed. Overall, today's reports do not point to a single common conclusion for the market. Weakness in the job market and orders for durable goods is offset by high PMIs for services. However, the rapid rebound in stocks after publication (as it was at the opening of the session) may indicate that the market is increasing the chances of further interest rate cuts in the USA which might be seen as positive for equities.

Daily summary: exceptionally low US trade deficit; dollar remains strong 📌

NY Fed Survey: higher inflation expectations, but also higher equity price expectations 📄🔎

Cryptocurrencies sell-off 📉Ripple loses despite Amazon partnership

BREAKING: EURUSD reacts to US jobless claims & labor costs data 🗽

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.