- The Australian dollar is the strongest G10 currency today, gaining 0.25% against the U.S. dollar and 0.3% against the euro.

- CPI inflation surged to a more-than-one-year high of 3.2%, reducing expectations of further interest rate cuts.

- The AUD is further supported by a global rise in risk appetite.

- The Australian dollar is the strongest G10 currency today, gaining 0.25% against the U.S. dollar and 0.3% against the euro.

- CPI inflation surged to a more-than-one-year high of 3.2%, reducing expectations of further interest rate cuts.

- The AUD is further supported by a global rise in risk appetite.

AUDUSD gains 0.25% on the back of Australia’s strongest CPI inflation data in over a year, which reduces the likelihood of further rate cuts. Hawkish expectations toward the Reserve Bank of Australia (RBA), coupled with a broader risk-on sentiment and renewed optimism over a potential U.S.-China trade peace, are making the Australian dollar the best-performing G10 currency this week.

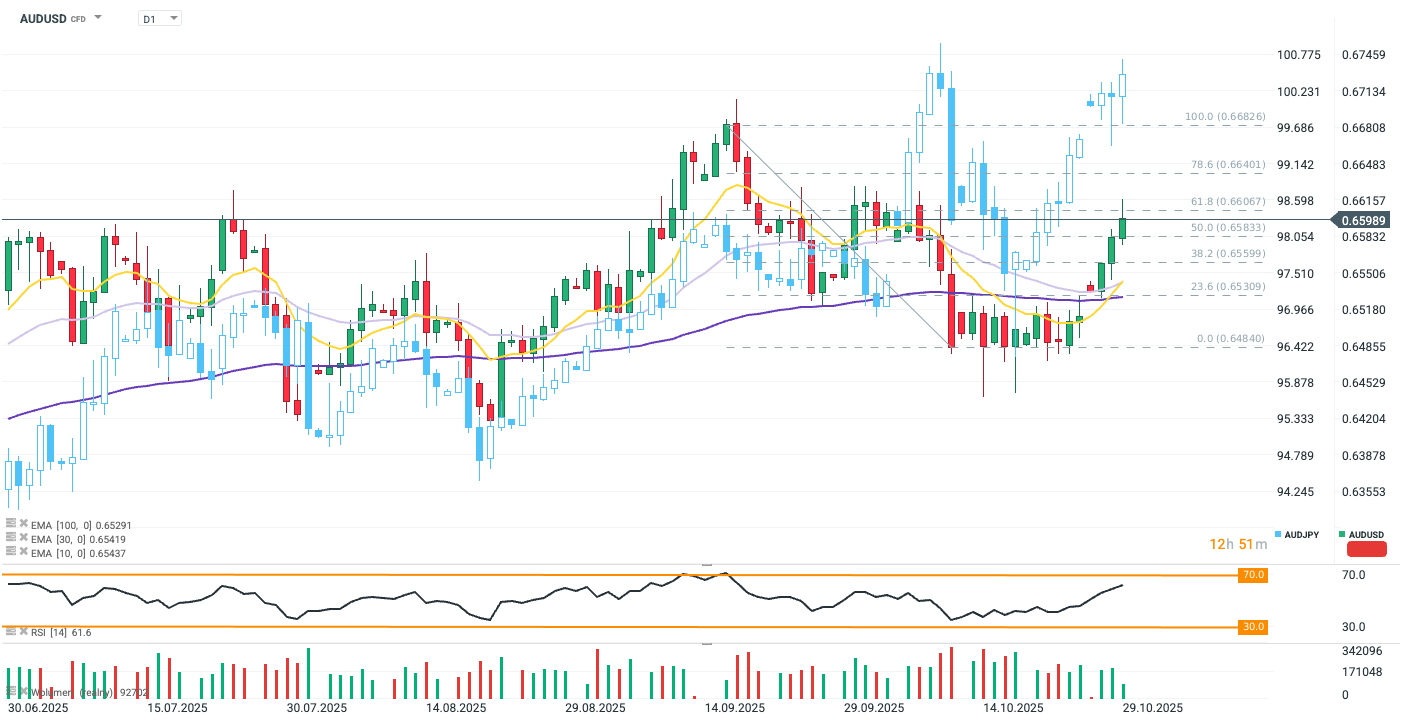

AUDUSD broke above the 50% Fibonacci retracement level of the latest downward wave but encountered resistance near recent highs around 0.66. Strong “risk-on” momentum is also visible on AUDJPY (in blue). Source: xStation5

What’s driving AUDUSD today?

-

Consumer inflation (CPI) rose in Q3 2025 to 3.2% (previous: 2.1%, consensus: 3%) — the highest since Q2 2024. Even more concerning for price stability, monthly data show core inflation accelerating to 3.7% in September. The main price pressures came from housing (+2.5% q/q), recreation and culture (+1.9%), and transport (+1.2%), while electricity prices surged 9%.

-

The higher-than-expected reading ties the RBA’s hands, after the central bank paused easing in September amid worrying monthly data (rates have remained at 3.6% since August). The RBA has emphasized its preference for less volatile quarterly figures, so this clear confirmation of persistent inflation significantly reduces the likelihood of further rate cuts. Moreover, the trimmed mean CPI — which excludes extreme price movements — exceeded the RBA’s forecast for the first time since 2022.

-

Still, the RBA faces a policy dilemma, balancing resurgent inflation against a slowing labor market. Unemployment rose to 4.5% last month, the highest in nearly four years, though Governor Michele Bullock maintained a hawkish tone, noting labor data volatility and that “unemployment hasn’t risen much above forecasts.”

-

As a result, the AUD strengthened broadly, extending this week’s bullish pivot against the U.S. dollar. The currency is also supported by global risk appetite, fueled by strong Wall Street earnings, progress in Trump’s trade talks with China and rising Australian bond yields.

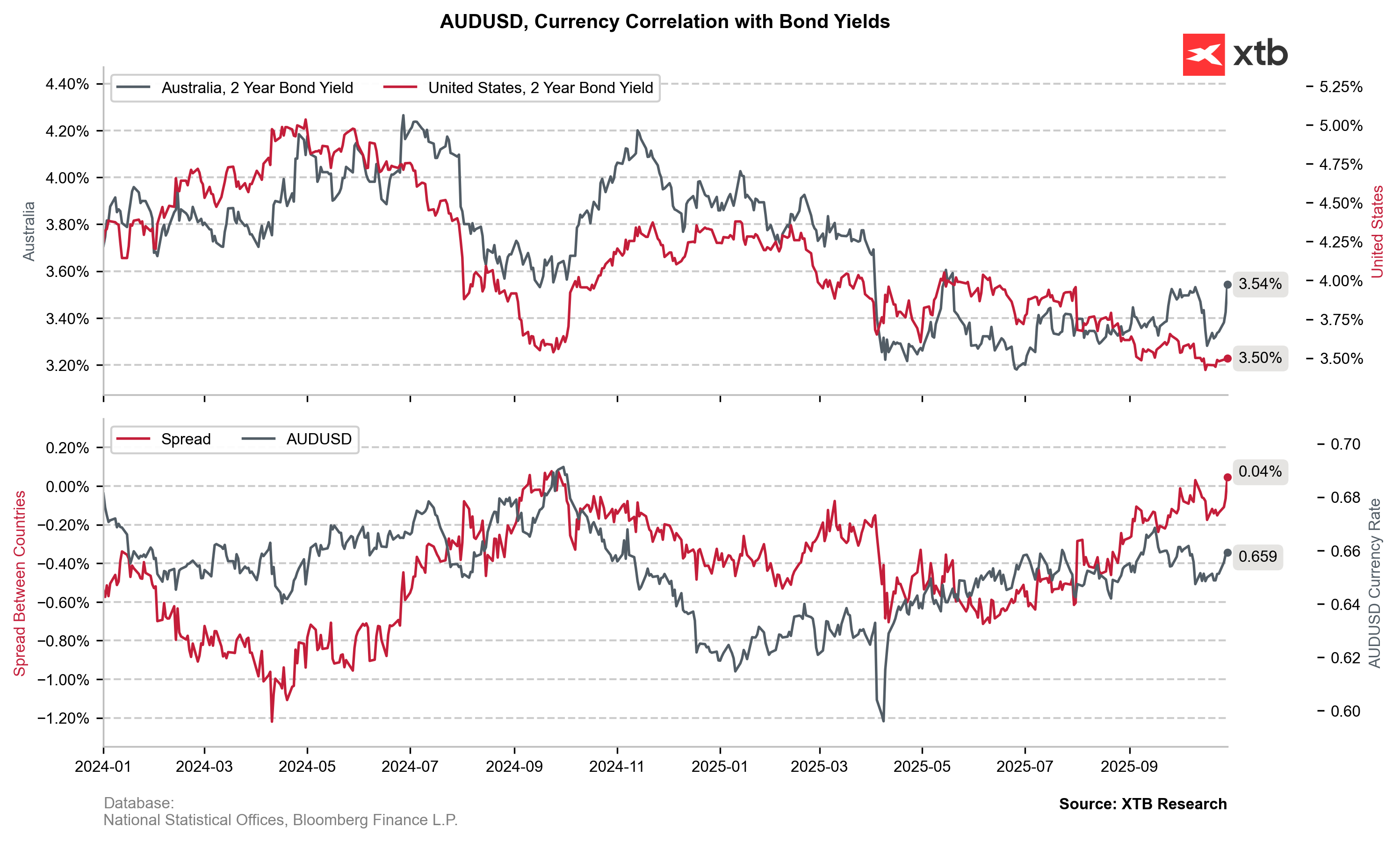

Australian 2-year yields have climbed roughly 20 bps since the start of the week to their highest level since May 2025, with AUDUSD closely tracking the yield spread after a brief period of stagnation. Source: XTB Research, Bloomberg data.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.