- EURUSD is down around 0.3% amid broad dollar strength.

- According to French media, Emmanuel Macron is consulting on a potential parliamentary dissolution.

- Fiscal and political jitters are boosting demand for traditional safe-haven assets.

- EURUSD is down around 0.3% amid broad dollar strength.

- According to French media, Emmanuel Macron is consulting on a potential parliamentary dissolution.

- Fiscal and political jitters are boosting demand for traditional safe-haven assets.

EURUSD is down 0.3% to around 1.162 amid a global dollar rally, sliding below key support near 1.165. Since the start of the week, the world’s most traded currency pair has fallen nearly 1%, as political turmoil in France and Japan has boosted demand for classic “safe havens” such as the dollar and gold.

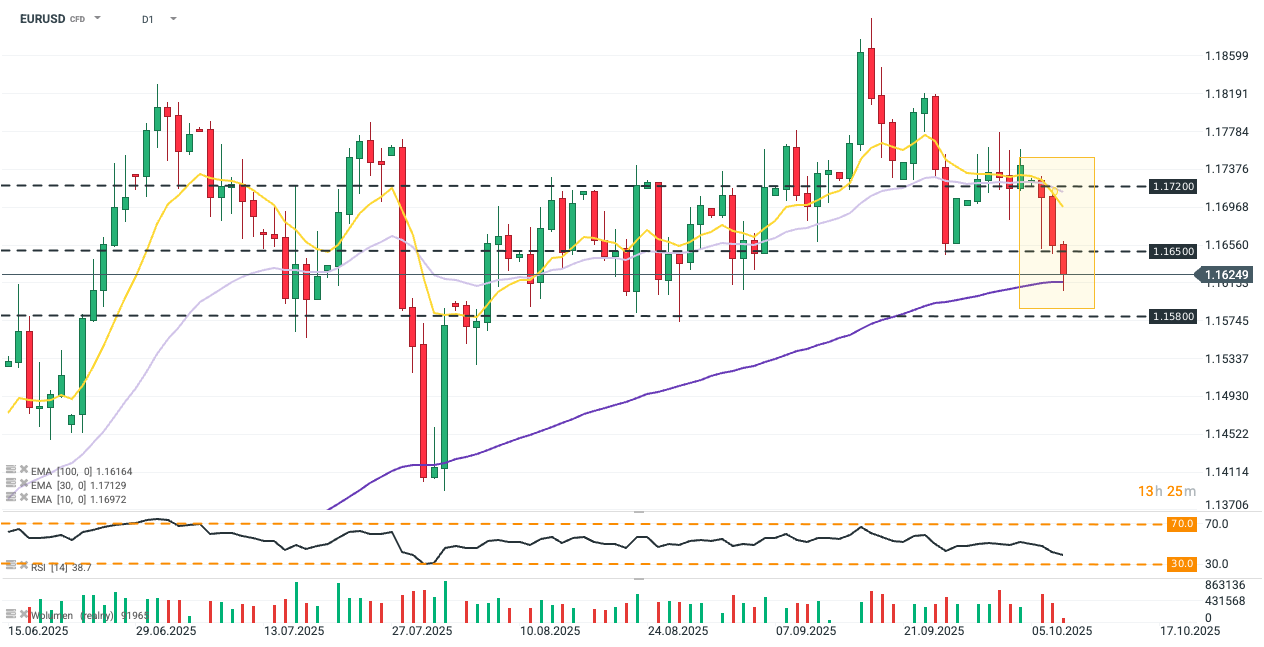

This week, EURUSD entered a sharp correction after last week’s break above 1.172, reaching a near six-week low today. The pair found support at the 100-day exponential moving average (EMA100, dark purple). Source: xStation5

What is shaping EURUSD today?

-

The dollar is strengthening against all G10 currencies as political uncertainty in France and Japan overshadows domestic U.S. concerns, i.e. the ongoing government shutdown. The Dollar Index (USDIDX) is up 0.2% today, hitting a two-week high.

-

Budget and political stability concerns in major economies have increased investor optimism toward the dollar and the overall U.S. economic outlook. The shutdown and the lack of most macro data create some uncertainty about the next Fed decision, but the effect is too small to alter market-implied expectations for an October rate cut in the U.S.

-

President Emmanuel Macron met yesterday with the presidents of France’s National Assembly and Senate to consult ahead of a potential parliamentary dissolution. French media also reported that prefectures were advised to prepare for possible elections between November 16 and 23. Political pressure is mounting on Macron to step down, complicating the outlook for the EU’s second-largest economy—especially as Prime Minister Lecornu’s resignation has dashed hopes for a timely budget approval.

-

On the other hand, there is no additional pressure on key Eurozone bonds. French 10-year yields fell about 5 bps, though they remain near historic highs, above levels seen during the last parliamentary dissolution in 2024. German 10-year Bund yields are down roughly 2.5 bps.

-

It is worth noting that a weaker euro could support the EU economy by boosting export competitiveness, provided that the French political crisis does not turn into a prolonged impasse or fiscal crisis. ECB President Christine Lagarde highlighted euro appreciation this week as a potential risk to EU growth, so a sustained EURUSD pullback from recent highs could ease the slowdown in business activity observed last month.

-

The Japanese yen did not benefit from the safe-haven flow, weighed down by Sanae Takaichi’s nomination as a prime minister candidate. Takaichi has repeatedly supported expansive fiscal policies while criticizing further interest rate hikes. Potential increases in public spending could be inflationary, and combined with yen depreciation, may accelerate a return to rate hikes by the Bank of Japan.

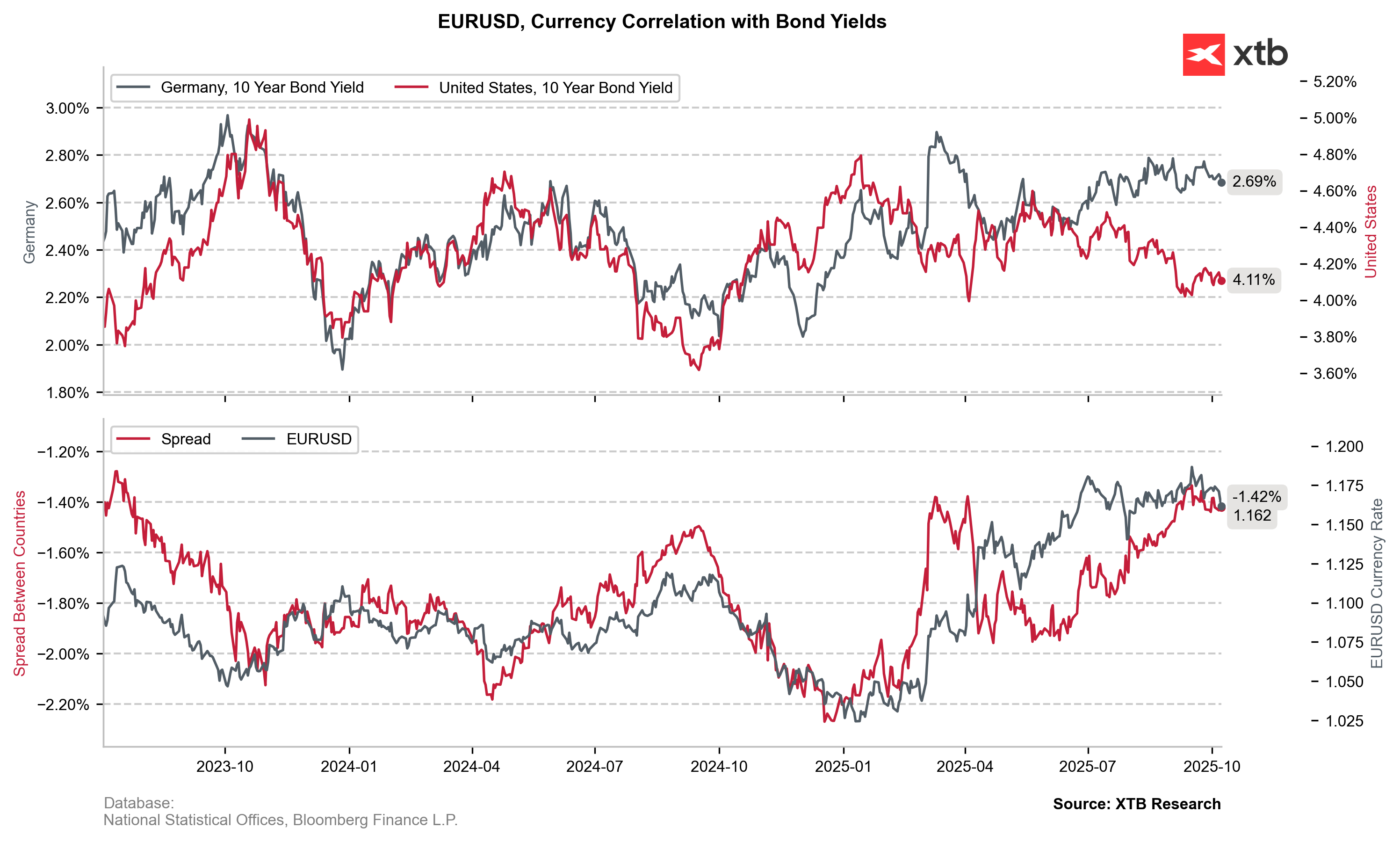

EURUSD is now reacting to the yield spread between German and U.S. 10-year bonds. Source: XTB Research

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.