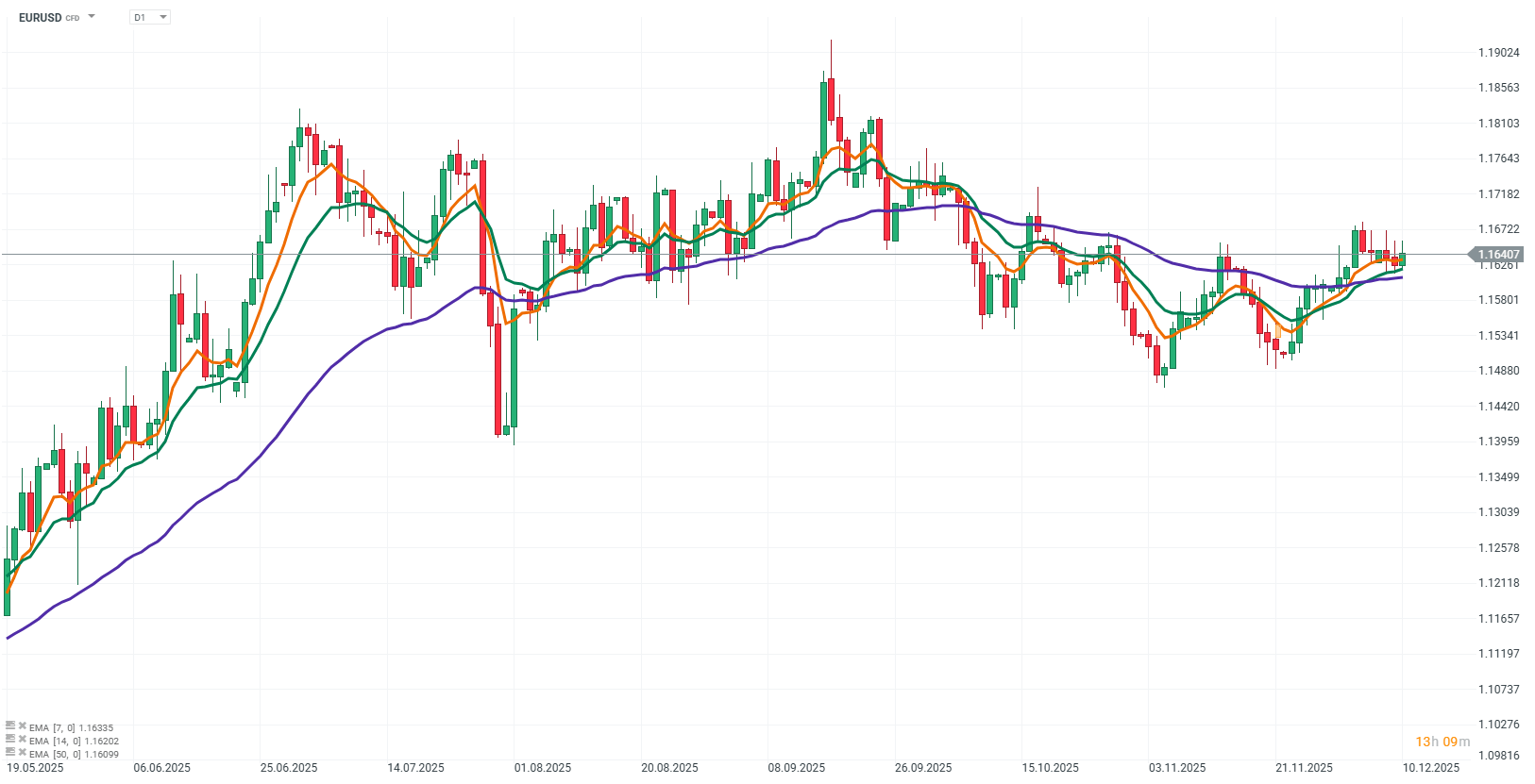

Today, the EUR/USD is trading near 1.164, moving within a relatively narrow range. Markets are holding back on larger positions ahead of the Fed's evening meeting. Slight pressure on the dollar, driven by expectations of possible rate cuts in the U.S., along with stable macro data from the Eurozone, provides moderate support for the euro. Nevertheless, the key factor remains the decision of the U.S. central bank and the accompanying press conference.

Source: xStation5

Factors shaping EUR/USD today

Expected Fed decision

The market is almost fully pricing in a 25 basis point rate cut, so the decision itself may have a limited impact on the currency pair. The most important aspect will be the tone of the statement and the rate projections for the coming year.

A dovish message could strengthen the euro against the dollar, pushing EUR/USD toward 1.1680–1.1730. Conversely, a more hawkish tone, emphasizing inflation risks and labor market stability, could support the dollar, causing the pair to fall toward 1.1615–1.1590 or lower. Markets will therefore closely monitor the nuances in Powell’s remarks.

Stable ECB guidance

The European Central Bank maintains a cautious and stable communication policy. ECB representatives, including Simkus, signal that there is no need for rapid changes in interest rates while inflation remains near target.

The absence of new stimuli from Frankfurt means that the euro is not receiving a clear boost from its own monetary policy. In practice, EUR/USD movements today are driven primarily by signals from the U.S., rather than local central bank statements.

Eurozone macro data

The lack of significant surprises provides moderate support for the euro, reinforcing the narrative of economic stabilization. However, these data do not create a strong trend-driving impulse for EUR/USD, and the main direction will remain dependent on the Fed’s decision and statement.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.