- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

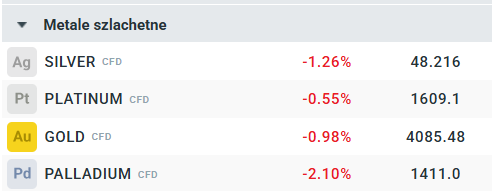

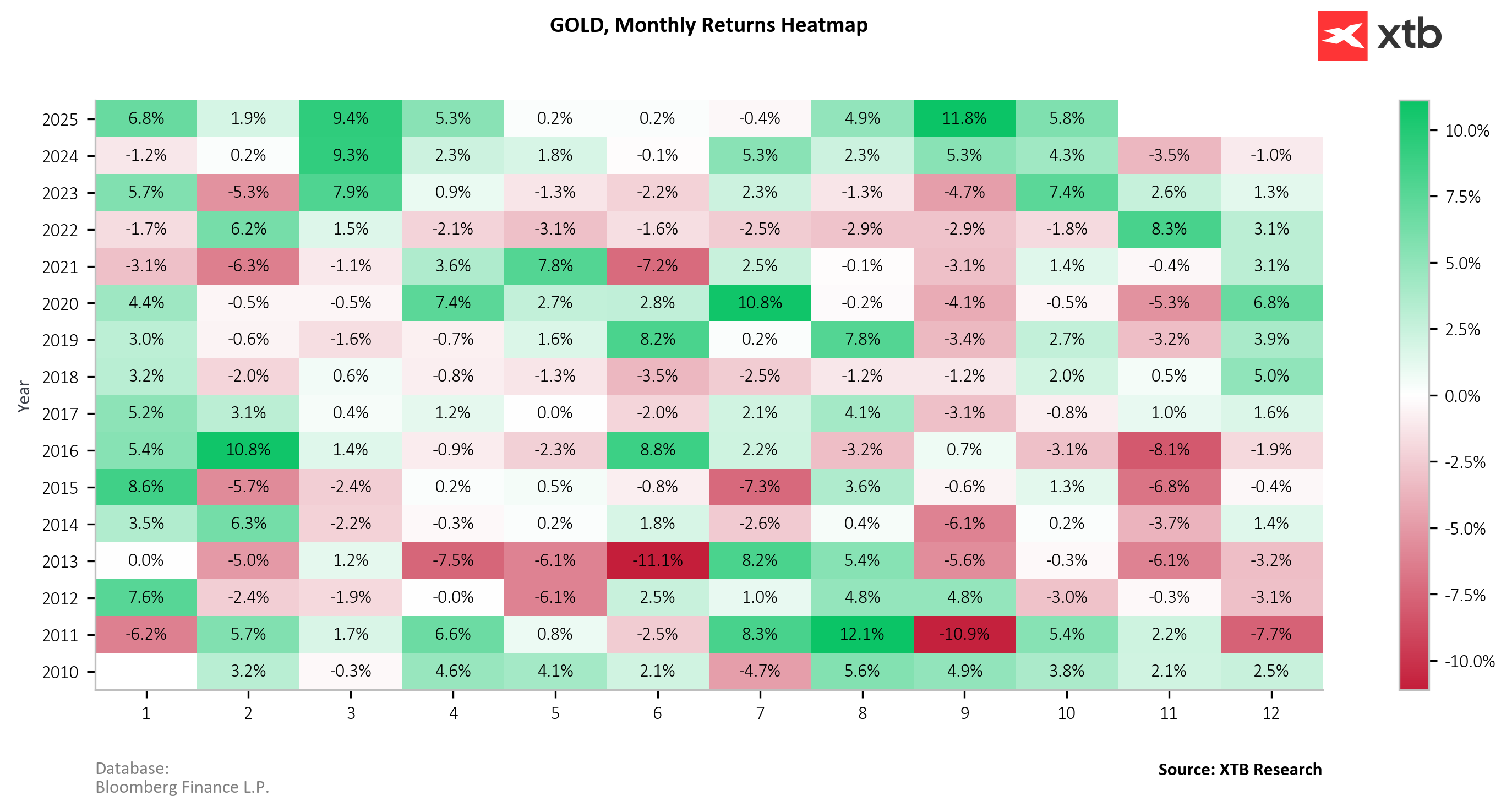

Precious metals extend their deepest correction in months. As of publication time today, gold is down another 1.00% to $4,085, silver falls 1.26% to $48.20, platinum declines 0.55% to $1,609, and palladium drops the most — 2.10% to $1,411. During the current correction, gold has lost a total of 6.50%, while silver is down 11.60%. Nevertheless, recent gains were so significant that on a monthly basis gold remains up 5.8%. Before the correction began, gold recorded two consecutive months of double-digit gains, a rare occurrence over the past 15 years of data.

The closest historical parallel to the current situation was July–August 2011, when gold rose 8.3% and then 12.1% month-over-month. In the following month — September — gold dropped 10.9%. The current setup is even more extreme, as gold has not only rallied sharply in the past two months but has also posted strong year-to-date gains. However, the macroeconomic and geopolitical environment is now substantially different.

Still, at levels above $4,300 per ounce, we observed a surge in retail buying, which may act as a contrarian signal. While long-term fundamentals remain supportive, seasonality and technical analysis point to a possible local top and a flat year-end performance. Meanwhile, ETF funds continue to accumulate, but on the Shanghai exchange, there has been a sharp reduction in long positions and a decline in silver inventories, which may suggest profit-taking.

⏫US100 rallies more than 1%

US Open: Wall Street Ends the Week on a Strong Note

Economic calendar: Retail sales from Canada; UoM data from the US

BREAKING: UK retail sales below expectations; GBPUSD ticks lower

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.