Platinum Slides 5% After Hitting All-Time High at $2,472 Amid Broad Precious Metals Sell-Off.

After breaking the all-time high at $2,472, the PLATINUM contract moved sharply into defensive territory. The decline found support at the 23.6% Fibonacci retracement level and is currently trading around the close on December 23. Source: xStation5Source: xStation5

From early December to mid-Asian session today, platinum futures surged a record 50%. The RSI indicator was already near overbought territory (70<) at the start of the last steep rally, when prices were flirting with the then-ATH near $1,700 (yellow zone). Concerns about overvaluation did not prevent further euphoria. Platinum gains were initially driven by broad bullishness in precious metals, fueled by expectations of further monetary easing. Lower interest rates would increase market liquidity, boosting broad demand and reducing the opportunity cost of holding commodities versus interest-bearing deposits or bonds. For platinum specifically, shortages played a key role, highlighted by strong industrial demand (particularly for automotive catalytic converters) and jewelry.

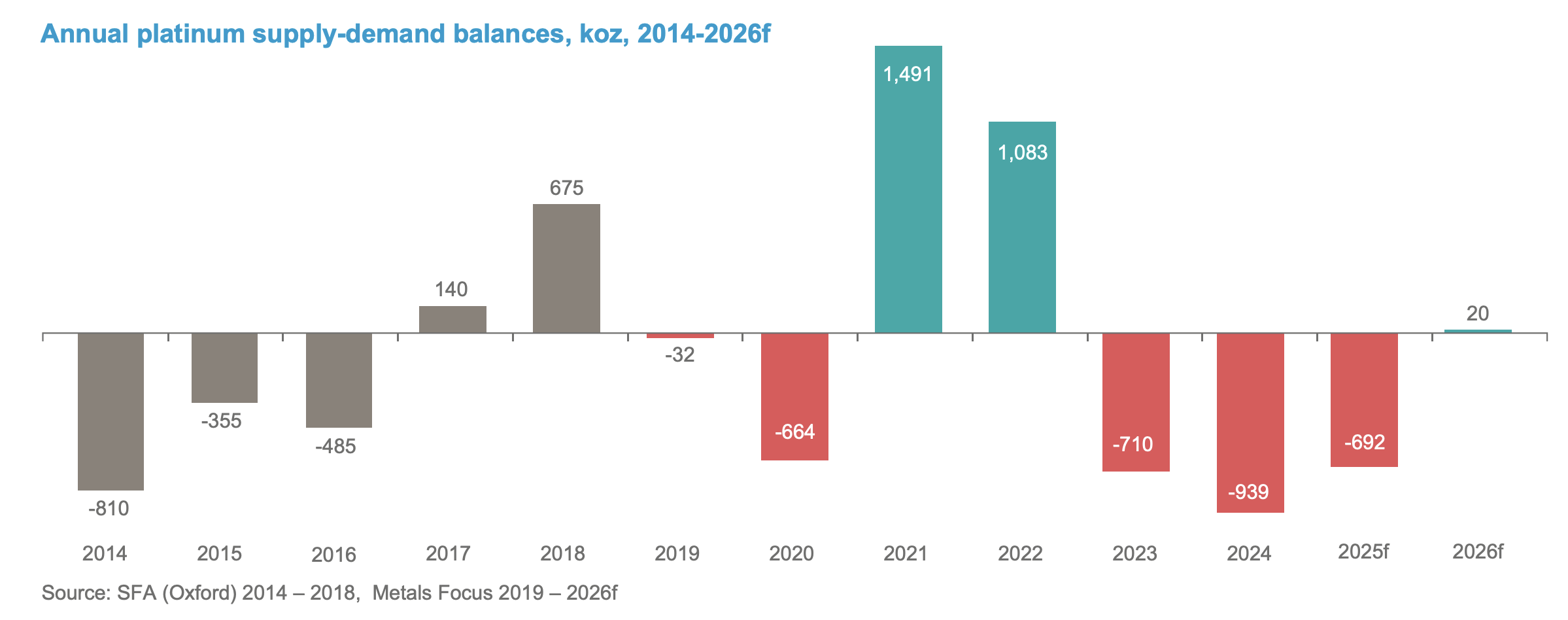

Platinum’s chronic deficit is expected to ease in 2026. Source: World Platinum Investment Council Q3 2025 Report

However, the safe-haven appeal failed to support precious metals at year-end. While the Trump-Zelensky talks produced no concrete peace breakthroughs on paper, hopeful narratives about the “war nearing its end” and “90% agreement on the peace plan” were enough for investors to take profits in overbought markets. Alongside platinum, GOLD (-1.4%), SILVER (-4%), and PALLADIUM (-12%) also declined.

The sell-off in precious metals was further supported by stabilizing expectations around the Fed’s January move (swap markets price an ~80% chance of rates remaining unchanged) and caution ahead of tomorrow’s FOMC minutes release. Platinum, however, faces supply-side pressures that are expected to normalize after years of deficits in 2026. The WPIC November report noted slightly lower industrial consumption in key sectors (catalysts and jewelry), and steeper declines in palladium may further encourage manufacturers to substitute platinum with a cheaper alternative.

Chart of the day: CHN.cash (30.12.2025)

Silver jumps 3% as buyers step in after the crash 📈

Economic calendar: All eyes on FOMC minutes (30.12.2025)

BREAKING: Spanish CPI higher than expected 📈 🇪🇸 SPA35 ticks up

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.