The yen has been the strongest G10 currency for the third straight day, gaining 0.5% against the dollar and 0.35% against the euro. The Japanese currency is supported both by hawkish signals from the BOJ and by global dollar weakness amid the US government shutdown.

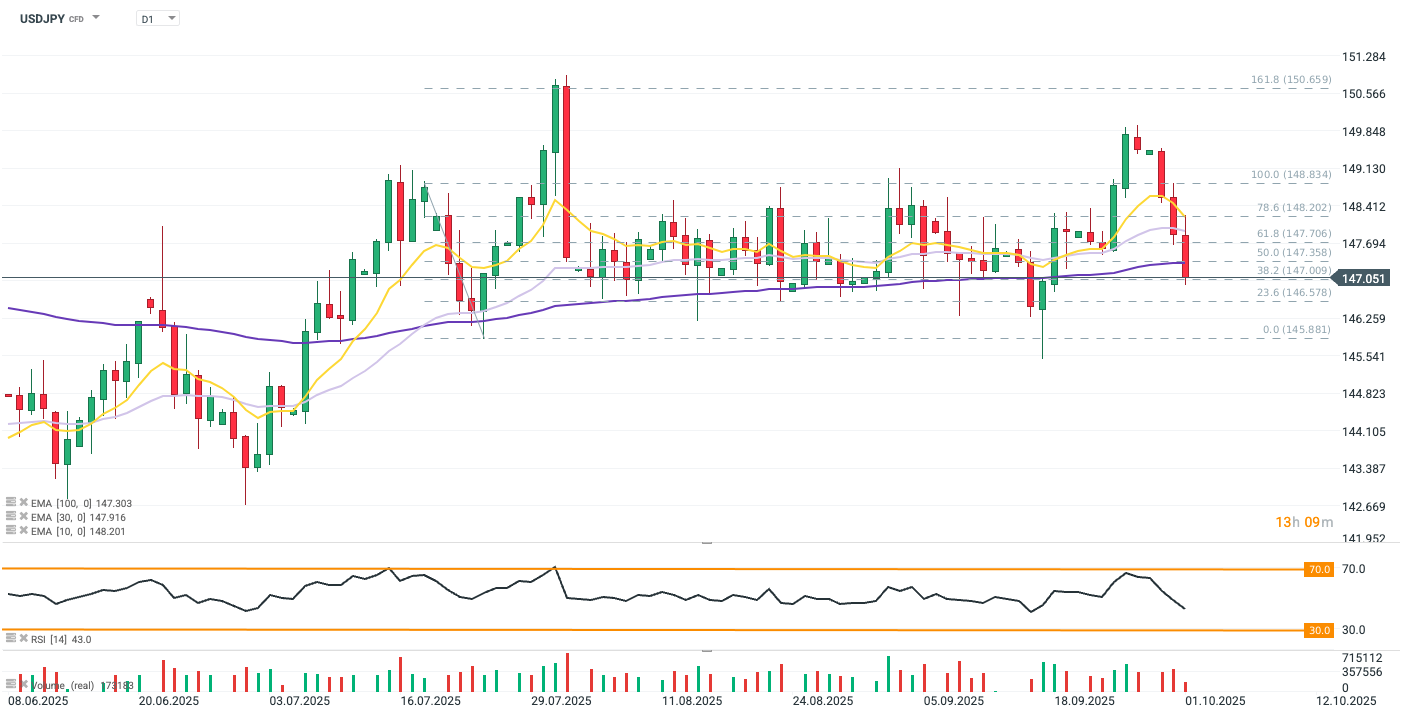

USDJPY plunged today below the 100-day exponential moving average (EMA100, dark purple), halting just above the psychological 147.000 level, which coincides with the 38.2% Fibonacci retracement of the consolidation since August. A move below 146.600 could open the door to a new downtrend, in line with the emerging policy divergence between Japan and the US. Source: xStation5

What is shaping USDJPY today?

-

The US government shutdown is reviving the yen’s appeal as a safe-haven currency. Congress failed to pass the spending bill before midnight, leaving the federal government without a budget for the new fiscal year.

-

The lack of agreement has resulted in the first shutdown since 2018, suspending operations of most federal agencies, blocking public services, and leading to upcoming layoffs (temporary or permanent). On one hand, the market sees this as part of political games ahead of the 2026 Congressional elections, but the current paralysis could last longer due to deep divisions between Democrats and Republicans over healthcare spending.

-

Japan’s manufacturing PMI came in slightly above expectations (48.5 vs. Bloomberg consensus 48.4, previous 49.7), but still pointed to the sharpest production decline in six months.

-

Meanwhile, the Bank of Japan’s “Tankan” survey showed improved sentiment among manufacturers for the second consecutive quarter, especially in the ceramics and shipbuilding sectors. This greater optimism could mark the start of a rebound once global trade stabilizes, and the data was interpreted as a fresh argument for rate hikes in Japan.

-

In addition, minutes from yesterday’s BOJ meeting revealed increasingly hawkish tones among policymakers. The return of rate hikes was widely debated at the September meeting, with the overall message suggesting it is closer than further away. The minutes, combined with recent data, prompted markets to raise the implied probability of a 25bp hike in October to 62%.

Daily Summary: Strong Russel and metals, ATH in UK

Bitcoin surges 2% approaching ATH levels 📈

Copper on the raise, close to ATH again! 📈🏗️

Emission contracts surge upwards! 📈🏭

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.