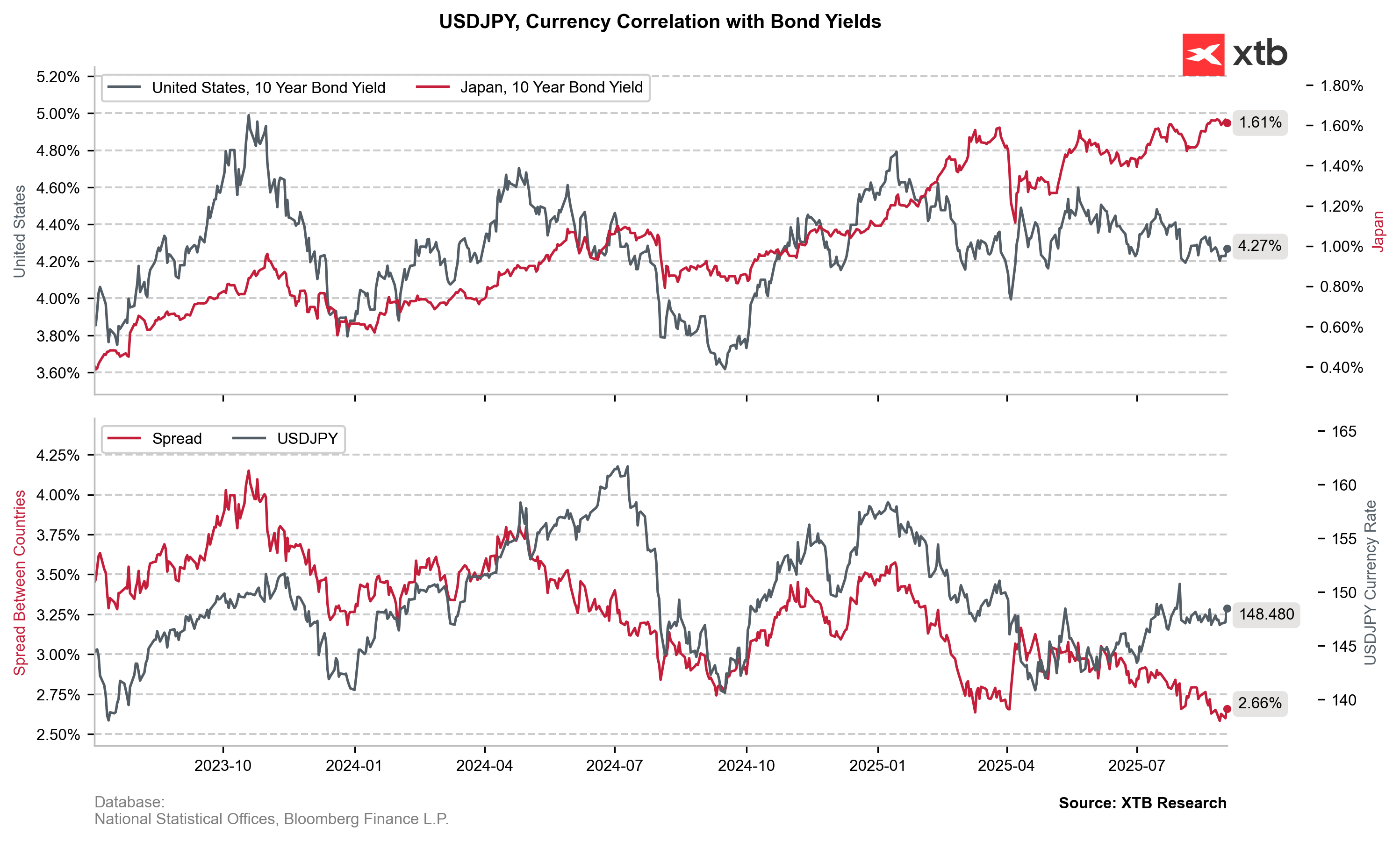

The Japanese yen is today the second-weakest G10 currency (just after the pound), losing about 0.9% against the dollar. The weakness stems both from the broad rebound in the USD and from recent comments by a Bank of Japan member, which reduced market expectations for future rate hikes in Japan. A clear reaction is also visible in the bond market, where Japanese 10-year notes saw the strongest demand since 2023.

USDJPY has bullishly broken above the 30-day exponential moving average, ending a series of sessions with muted volatility. The pair stalled at the upper boundary of the current consolidation (the 100% Fibonacci retracement level), and a potential correction could occur if the ISM report comes in worse than expected, particularly the employment sub-index. Source: xStation5

USDJPY has bullishly broken above the 30-day exponential moving average, ending a series of sessions with muted volatility. The pair stalled at the upper boundary of the current consolidation (the 100% Fibonacci retracement level), and a potential correction could occur if the ISM report comes in worse than expected, particularly the employment sub-index. Source: xStation5

What is shaping USDJPY today?

-

Bank of Japan Governor Ryozo Himino emphasized that the BOJ will continue raising interest rates as economic activity improves and inflation gradually returns to the 2% target. He did not specify which meeting might include a rate hike discussion but noted that the absence of a clear slowdown in response to tariffs should support monetary tightening.

-

In the absence of clearly hawkish comments, the market reduced its expectations for a 25 bp rate hike in 2025 from 70% to around 63%.

-

The latest 10-year Japanese government bond auction saw the strongest demand since October 2023, pushing yields down from local highs to 1.60% (-2 bp).

-

Japan’s top trade negotiator Ryosei Akazawa canceled his trip to Washington amid frictions over rice and auto tariffs, emphasizing that agriculture was not part of the July trade deal. Japan will, however, meet U.S. rice import requests within its current duty-free quota without lowering tariffs on other farm products, while pressing the U.S. to honor commitments on auto tariff reductions in exchange for the promised $550 billion investment initiative.

10-year yields fell from their recent peak following neutral comments from the BOJ governor, which boosted demand during today’s auction. Source: XTB Research

10-year yields fell from their recent peak following neutral comments from the BOJ governor, which boosted demand during today’s auction. Source: XTB Research

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.