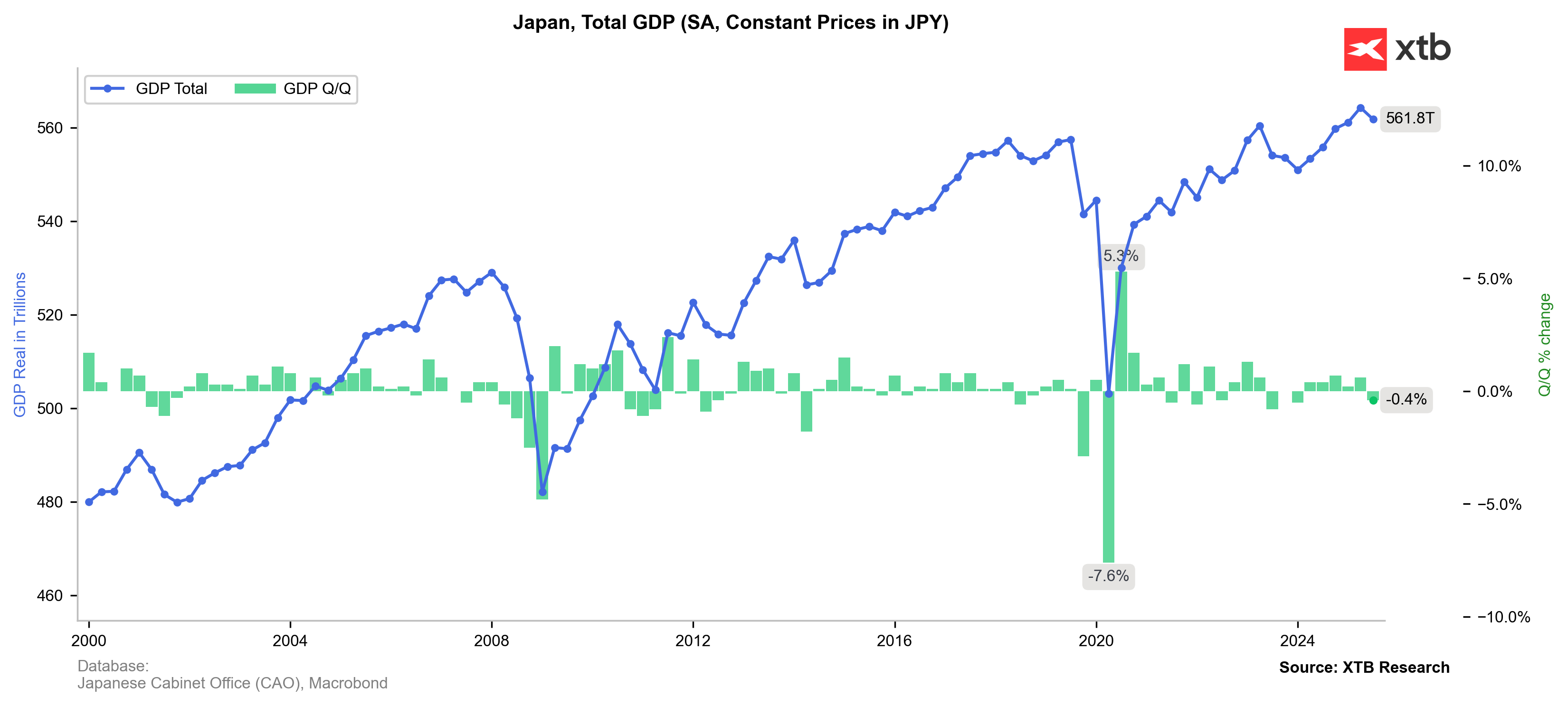

Japan’s economy contracted in Q3 for the first time in six quarters, falling 0.4% q/q (−1.8% annualized). The decline is a result of U.S. tariffs, which hit exports, while new housing regulations weakened demand for homes. Although the slowdown was milder than expected, it increased pressure on policymakers to implement a new fiscal package — potentially worth more than 17 trillion JPY, aimed at supporting households and key sectors.

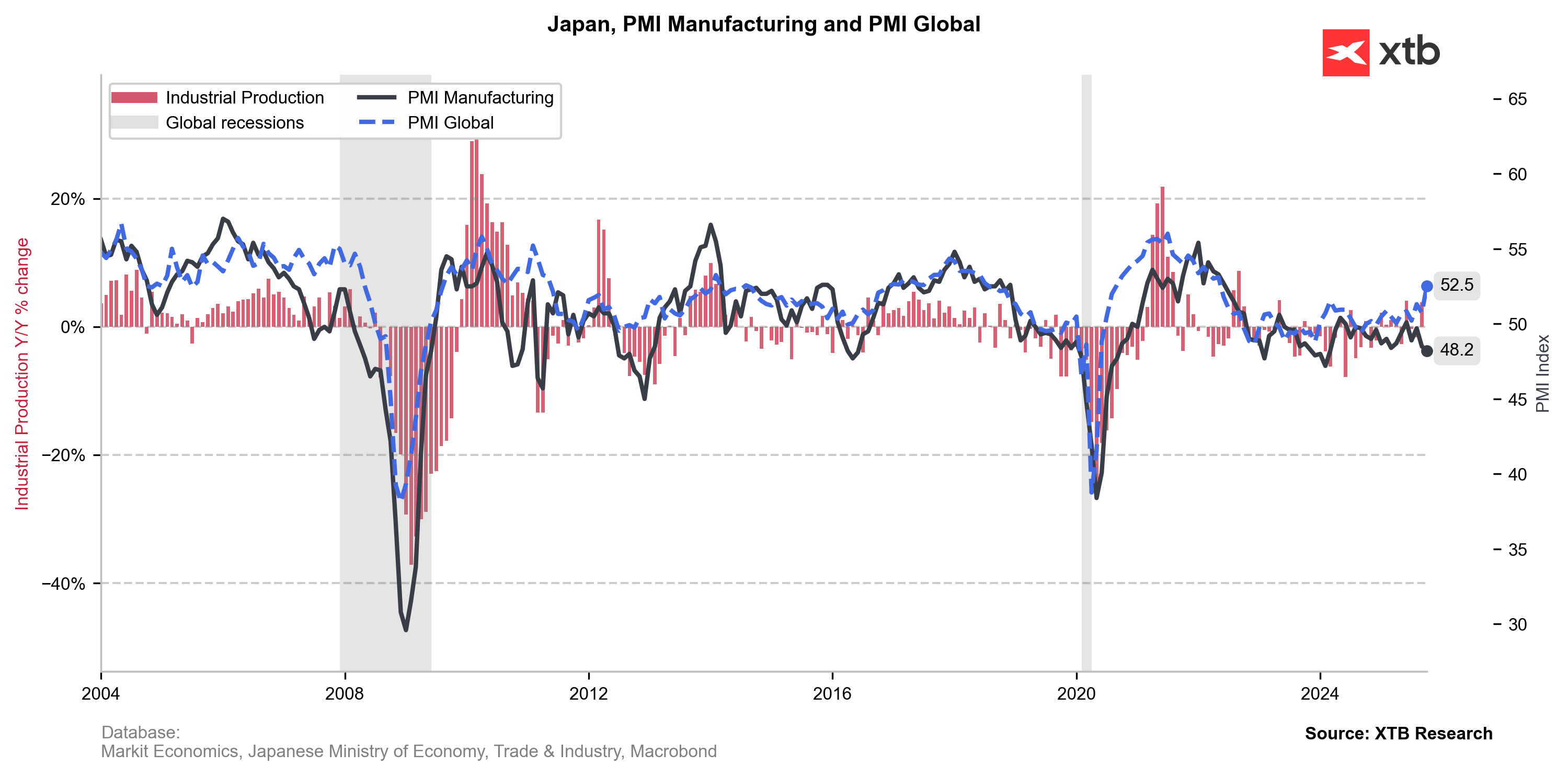

At the same time, September industrial production surprised to the upside, and capital investment remained resilient, suggesting that growth fundamentals are not collapsing. However, the drop in business sentiment within the industrial sector is noteworthy, as it diverges significantly from the global rebound seen in recent months.

The Bank of Japan remains cautious: core inflation is still below target, Governor Ueda emphasizes the need for patience, and several government advisers argue that rate hikes should be postponed until spring 2026.

Financial markets reacted much more strongly to fiscal concerns than to the GDP figure itself. Yields on long-term government bonds rose sharply — the yield on 20-year JGBs reached levels not seen since 1999, and the market has become more cautious regarding such a large debt issuance. Concerns about increased bond supply, rising fiscal risk premium, and the size of the stimulus package pushed long-term bond prices lower. At present, we do not see a significant reaction in the FX market: the yen is down only 0.00–0.10% against G10 currencies, while the JP225 index is falling moderately by 0.28%.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.