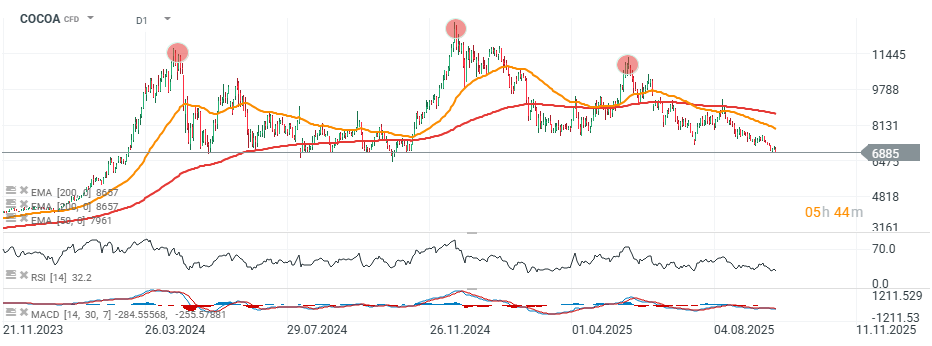

Cocoa prices have fallen more than 40% since peaking at nearly $13,000/tonne in 2024, now trading below the key, psychological and technical zone $7,000/tonne.

-

The drop comes as supply expectations improve and demand weakens, reversing last year’s rally fueled by drought, crop disease, and poor harvests in West Africa.

-

Higher rainfall and tree blossoming in the Ivory Coast and Ghana are boosting production forecasts, easing fears of shortages.

-

West Africa, responsible for 70% of global cocoa output, is expected to see rebounding harvests after last year’s severe weather and disease-driven slump.

-

High cocoa prices combined with U.S. tariffs on chocolate risk further dampening consumer demand.

-

Analysts see this as an additional headwind for prices heading into 2025.

-

Rising production this year will significantly increase supply, helping correct the imbalance that drove prices higher in 2024.

-

Rabobank expects a significant surplus in the 2025/26 season, with production gains across Ecuador, Brazil, Peru, Nigeria, and Cameroon, alongside recovery in West Africa.

-

Cocoa prices are projected to trend gradually lower in the short and medium term, despite the potential for short-lived rebounds.

-

Limited supply risks in the Ivory Coast and Ghana should keep prices above $3,000/tonne, even in a bearish scenario.

Looking at the cocoa chart, we can see the head and shoulders pattern, with futures prices now in line with the potential 'neckline' in the formation.

Source: xStation5

Source: xStation5

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.