- Cocoa Prices Plunge: The commodity is down over 10% this week and nearly 30% in three months, reverting prices to early 2024 levels.

- Supply Outlook Improves: The sharp correction is driven by better-than-expected port arrivals and producer plans to raise farmer prices, signaling higher future output.

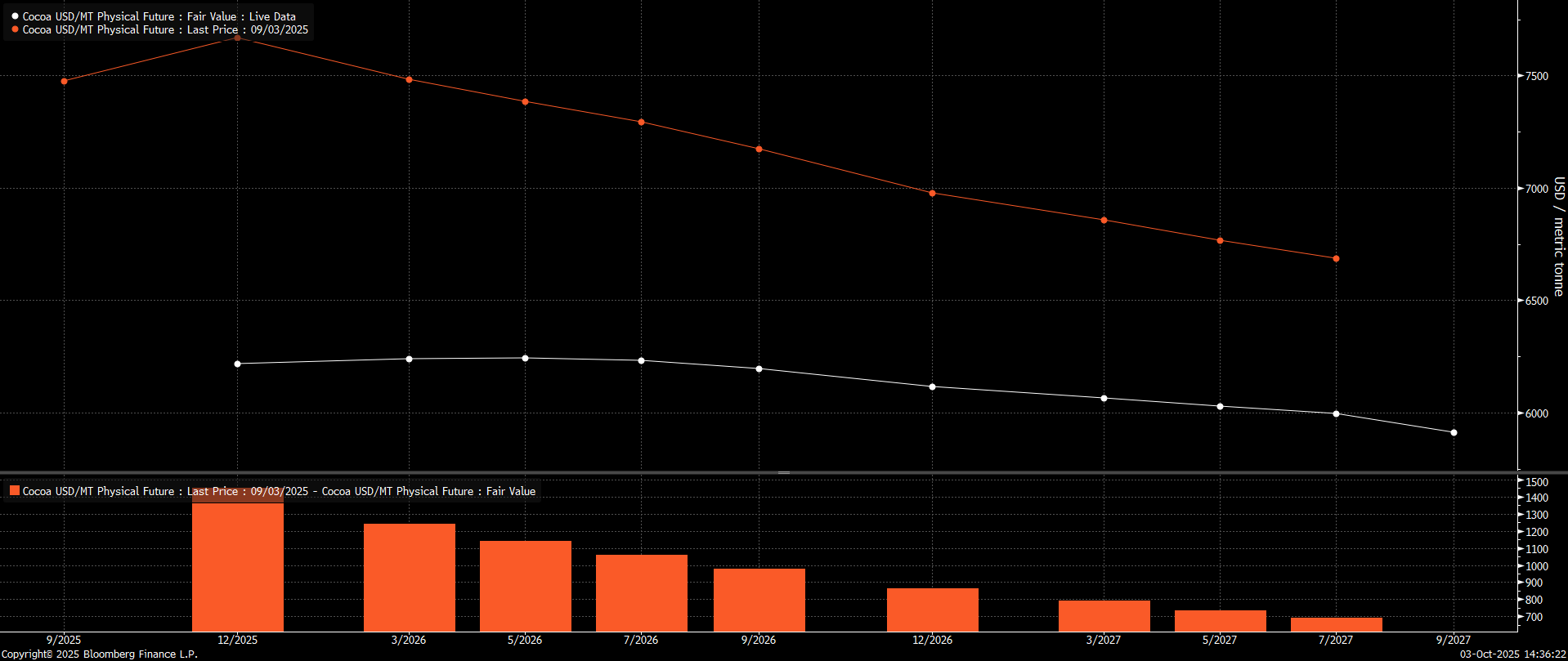

- Forward Curve Flattens: The near-flat forward curve indicates increased market confidence in supply continuity, despite the price appearing technically undervalued.

- Cocoa Prices Plunge: The commodity is down over 10% this week and nearly 30% in three months, reverting prices to early 2024 levels.

- Supply Outlook Improves: The sharp correction is driven by better-than-expected port arrivals and producer plans to raise farmer prices, signaling higher future output.

- Forward Curve Flattens: The near-flat forward curve indicates increased market confidence in supply continuity, despite the price appearing technically undervalued.

Cocoa prices are down more than 4% today, marking the third day of the month and simultaneously the third day of the official 2025/2026 main season. Since the start of this week, the decline has exceeded 10%. Over the last three months (excluding rolling costs), prices have plummeted by almost 30%, establishing cocoa as the worst-performing commodity globally in the recent period. Prices have reverted to levels last seen at the beginning of 2024, and the forward curve is near flat, signaling increased market certainty regarding supply.

Cocoa is the worst-performing commodity over the last 3 months. Source: Bloomberg Finance LP

The first crucial port arrival data for Côte d'Ivoire is expected on Monday, and early reports suggest these figures will be significantly better than initially anticipated. Furthermore, arrivals in recent weeks have been several times higher than a year ago, underscoring a marked improvement in the cocoa market's supply dynamics. Moreover, both Ghana and Côte d'Ivoire are expected to raise the prices paid to farmers. This will not only improve future production prospects due to potential investments but may also encourage growers to favor official sales channels over illegal ones to secure higher prices.

The price of cocoa is already two standard deviations below the 1-year mean, indicating significant undervaluation. Nevertheless, historical data shows that in 2017, when the rate of decline was similar, the price deviated up to three times from the mean. Source: Bloomberg Finance LP, XTB

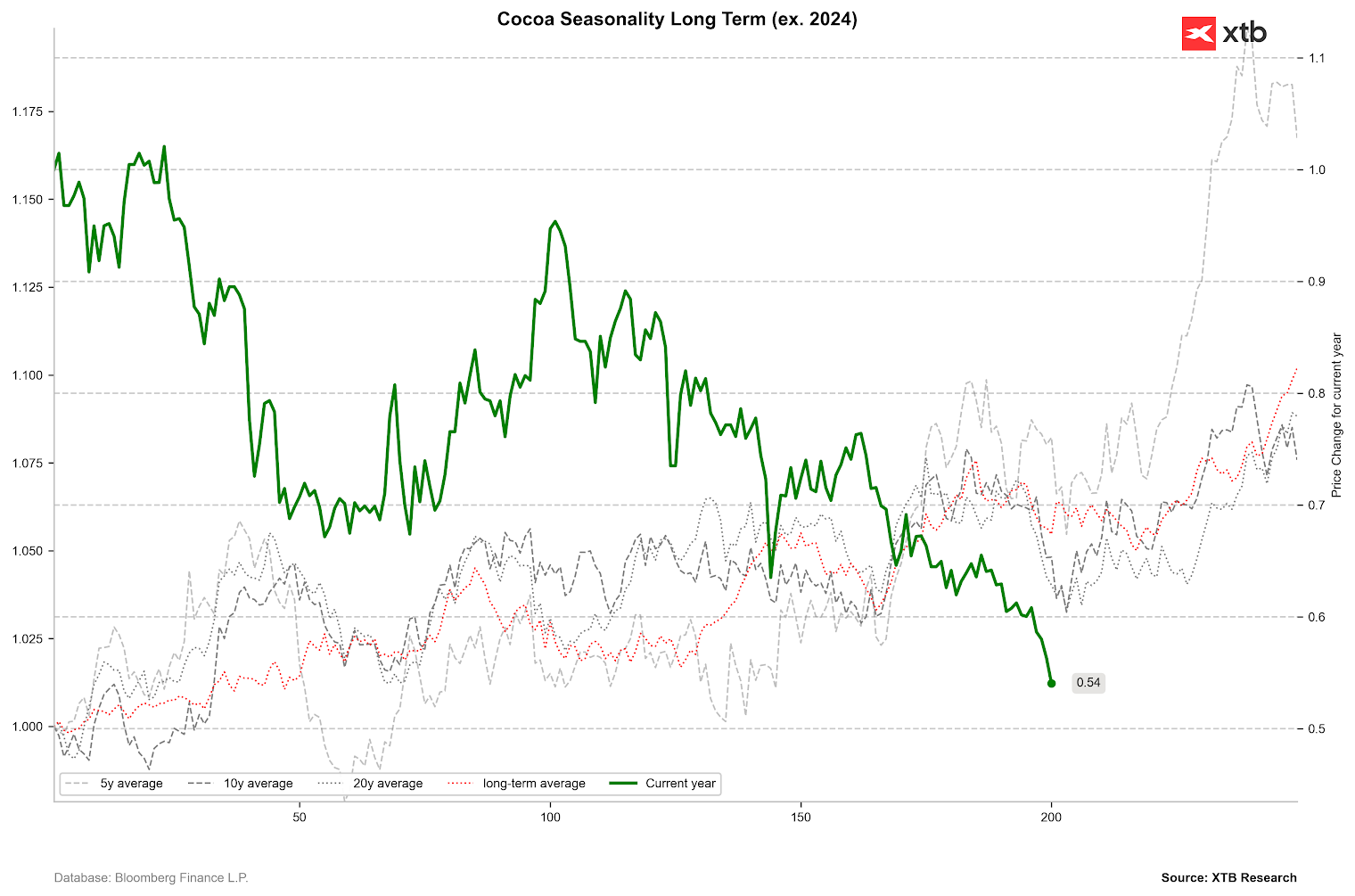

Seasonality suggests that cocoa prices typically declined around September and October, yet a subsequent rebound was frequently observed. However, if the harvest season proves robust, prices may not necessarily rise in line with historical averages.

Seasonality in cocoa price change. Source: Bloomberg Finance LP, XTB

The cocoa forward curve is nearly flat compared to its shape just a month ago. This signifies substantial investor confidence regarding supply continuity. Concurrently, liquidity in the futures market remains extremely low.

Cocoa forward curve is nearly flat. Source: Bloomberg Finance LP

Cocoa forward curve is nearly flat. Source: Bloomberg Finance LPCocoa prices were testing $7,000 per tonne at the start of the week but are now approaching the $6,000 level.

Cocoa prices are approaching the $6,000 per tonne level. Source: xStation5

Cocoa prices are approaching the $6,000 per tonne level. Source: xStation5Daily Summary: US2000 leads on Wall Street📈Crypto and metals up, US dollar down

Bitcoin surges 2% approaching ATH levels 📈

Copper on the raise, close to ATH again! 📈🏗️

Emission contracts surge upwards! 📈🏭

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.