Cryptocurrencies rebounded sharply last Friday after record sell-offs that pushed Bitcoin down to $60k and triggered a record wave of liquidations of long positions across the altcoin market as well. Over the weekend, volatility was muted after the strong rally, and on Monday we are seeing Bitcoin slide back below $70k. Ethereum is trying to hold above $2,000.

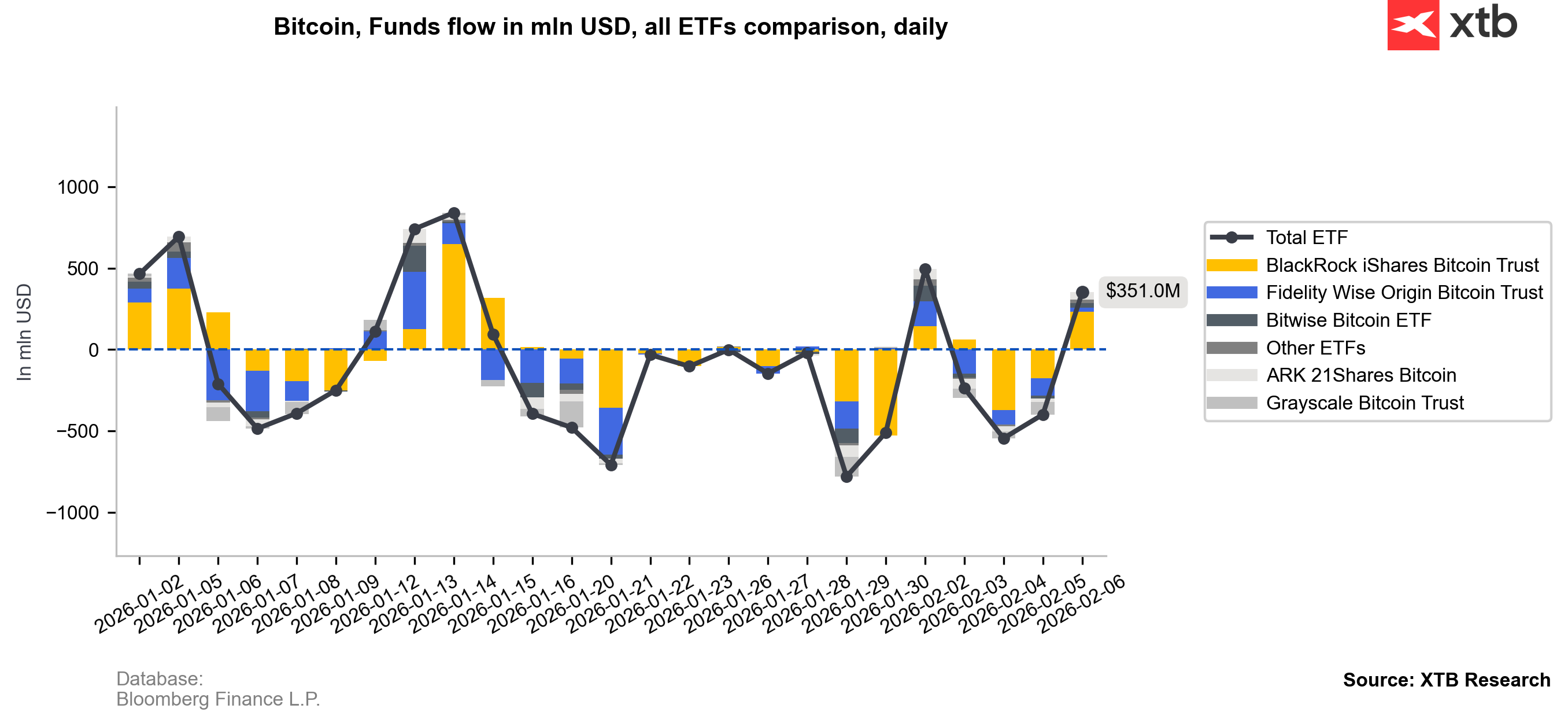

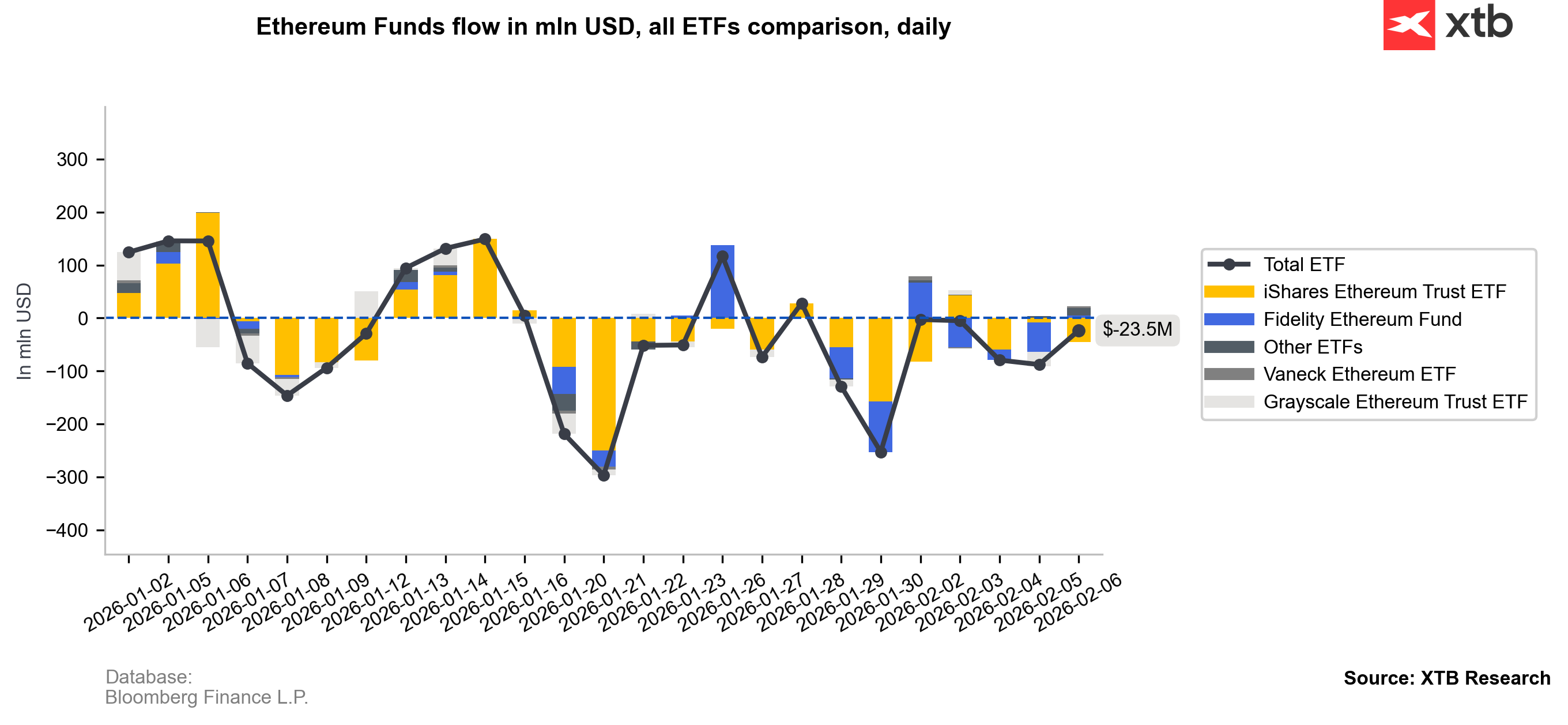

- Inflows into ETF funds remain very limited, while options market activity points to demand for hedging and potentially restraining strong price upside. On Friday, BTC ETFs recorded more than $350m of net inflows, while ETH saw net outflows of more than $20m. Historically, during bear markets Ethereum has underperformed Bitcoin, and it appears that the largest cryptocurrency is drawing the most interest when it comes to “buying the dip.”

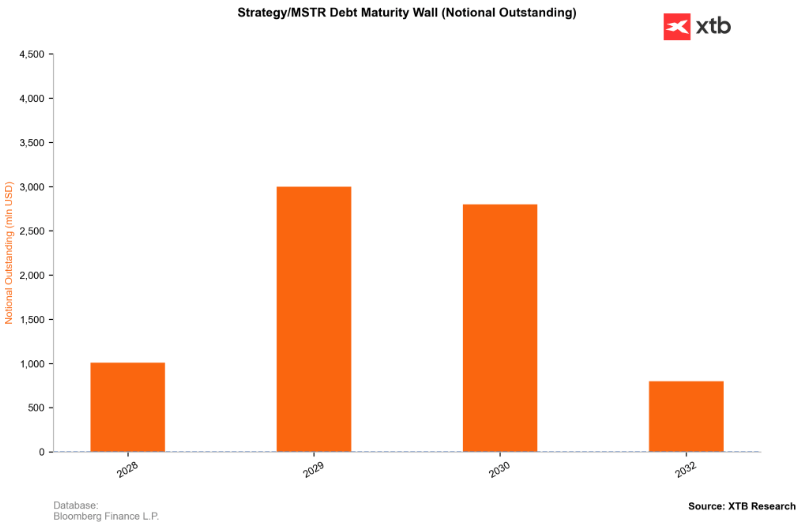

- Michael Saylor from Strategy (MSTR.US) once again used social media to signal to markets that any time is a good time to buy BTC. However, the market is approaching Strategy exposure very cautiously: the company holds around 700k BTC and is currently sitting on roughly a 10% average loss on that position.

- The market is also watching the situation at South Korea’s Bithumb exchange. On February 6, due to an error, it transferred 620k BTC to users while holding reserves of around 175 BTC. The issue was fixed and nearly 100% was recovered, but questions remain about the mechanism that made such a scenario possible.

Bitcoin and Ethereum chart (D1)

Bitcoin’s price is around 43% below the October peak, and on the daily timeframe—despite Friday’s rebound—it is still trading with the RSI close to oversold levels.

Source: xStation5

Source: xStation5

US BTC and ETH ETF flows

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

In 2028, Strategy’s maturing debt will total roughly $1bn, rising to around $3bn in 2029. In theory, the company currently has enough cash to cover the 2028 obligations and about 30% of the 2029 amount—however, even assuming a steep drop in annual operating costs, these could materially weaken its liquidity. In 2030, the company will need to repay an additional $2.8bn, and by 2032 another $800m. These figures do not appear extreme—provided the Bitcoin bull market returns.

Source: XTB Research, Strategy.com, Bloomberg Finance L.P.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.