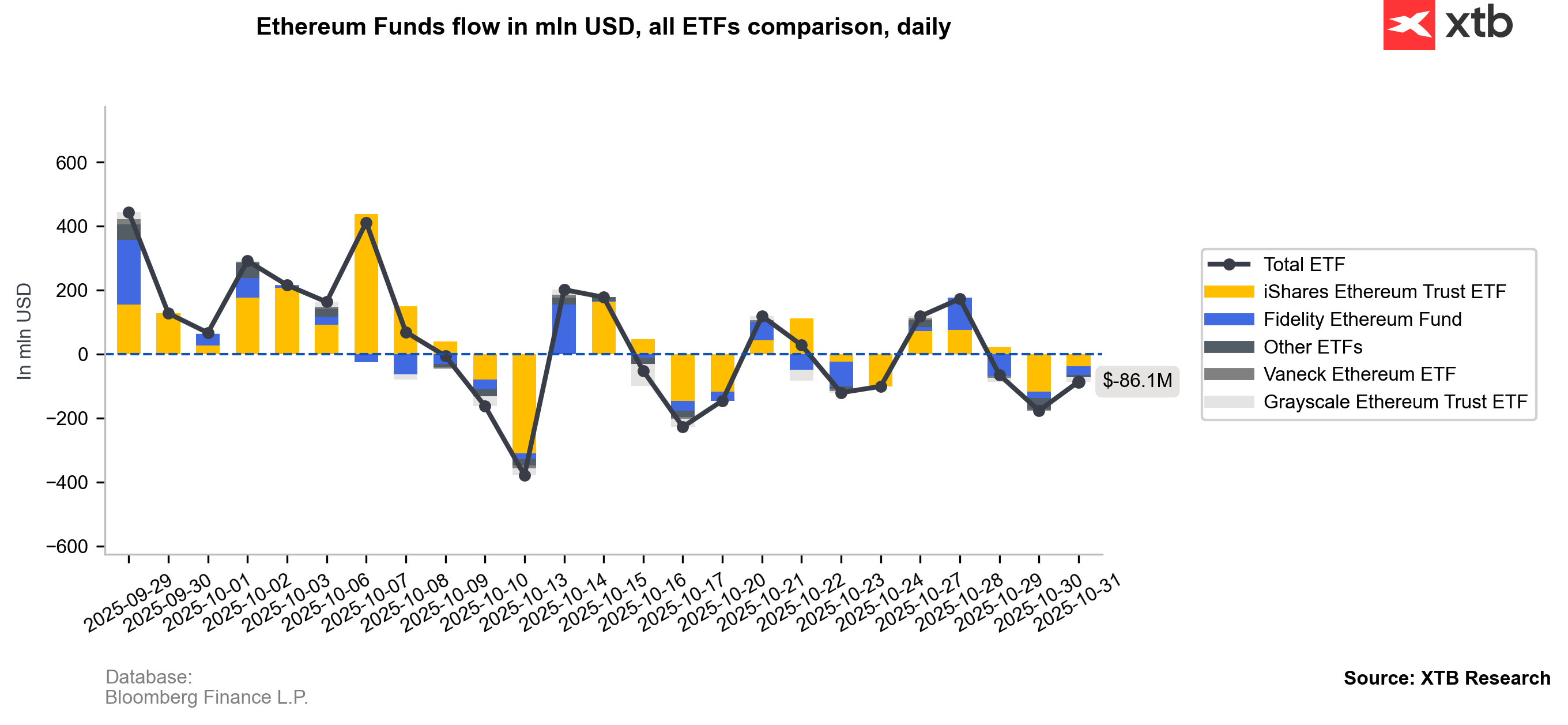

Cryptocurrencies remain largely dependent on stock market sentiment. According to Goldman Sachs data, the put-call skew in the Mag7 group (the seven largest tech companies) inverted for the first time since December 2024, meaning that the implied volatility of call options (betting on price increases) has exceeded that of puts (betting on declines). This phenomenon is rare and may signal that investors are potentially over-positioned for further equity market gains.However, weak technical conditions (also visible in Ethereum) and declining interest in U.S. spot ETF inflows are, to some extent, undermining the narrative of a strong autumn rally in the crypto market. As a result, the market may increasingly mirror the 2021 scenario, when the first half of November brought sharp declines in cryptocurrencies, triggering a bear market that lasted until around December 2022.

Bitcoin and Ethereum

Bitcoin (BTC)

Key support levels for BTC remain the psychological $100,000 area and $94,000 (the retracement of this year’s entire advance). Should both levels be broken, we may cautiously assume that Bitcoin’s uptrend has ended. The current price is about 6% below the average cost basis for short-term holders, which indicates stress and potential loss realization within this group. Based on realized price metrics across all investor cohorts, a potential bear-market bottom would likely form in the $50,000–$55,000 range. Conversely, if Bitcoin finds solid support and resumes its rally, a breakout above $110,000 could open the way toward new all-time highs above $126,000.

Source: xStation5

Ethereum (ETH)

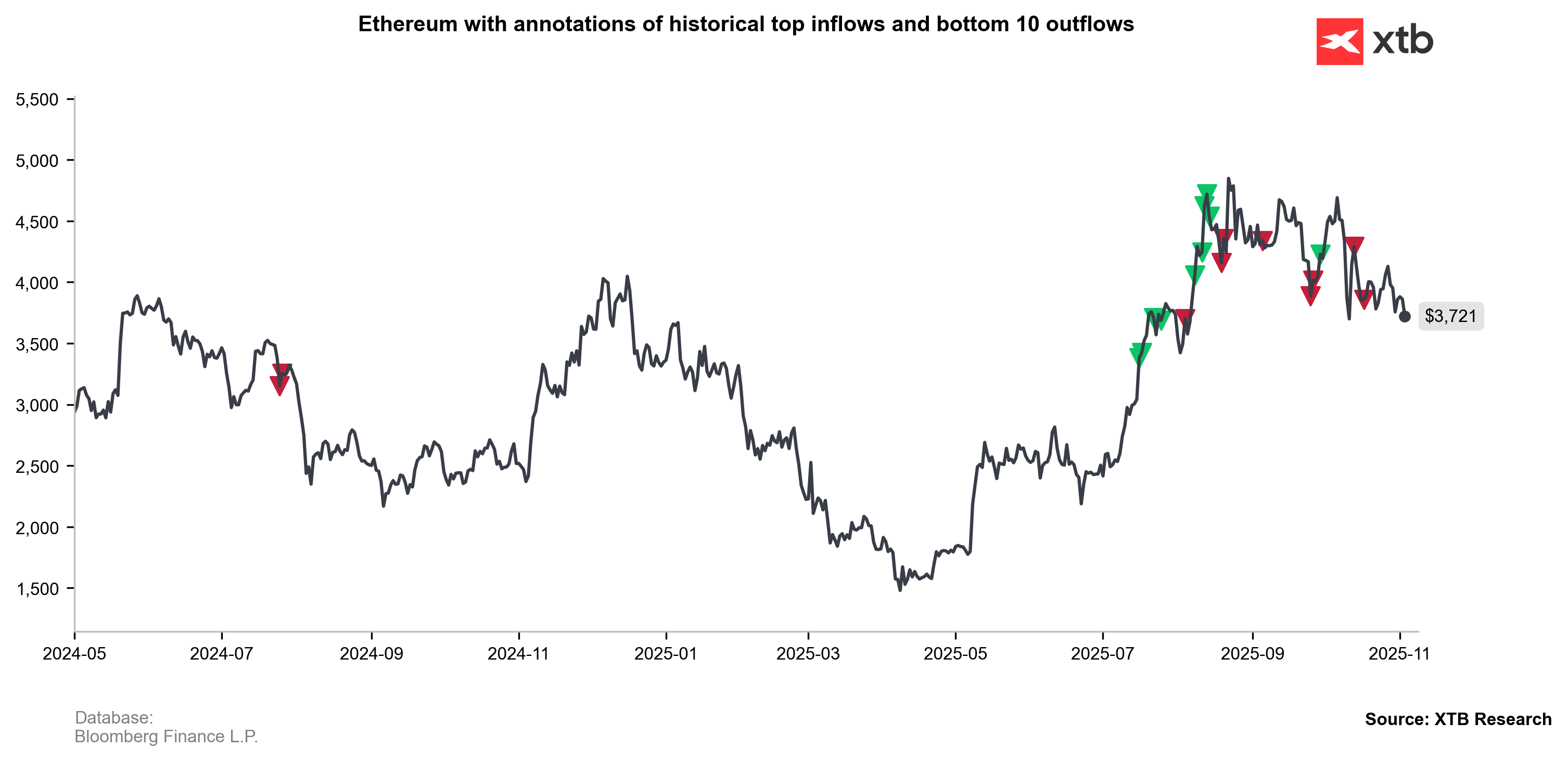

Ethereum is currently under pressure, but based on historical price impulses, we can cautiously assume that market geometry supports at least a consolidation phase after the recent decline. Historically, however, drops below the 200-day EMA have almost always led to deeper sell-offs for ETH than the current one. To maintain a bullish trend, a quick rebound above $3,700 would be necessary. Otherwise, renewed pressure could push the price back toward $2,500, erasing this summer’s upward move.

Sources: xStation5

Source: xStation5

Bloomberg Finance L.P. , XTB Research

Bloomberg Finance L.P. , XTB Research

Source: Bloomberg Finane L.P. , XTB Research

AMD Q3 Preview — What can we expect?

DE40: European indices in the shadow of risk-off sentiment

Economic calendar: Speeches by central bankers; quarterly results from Ferrari, AMD, and Pfizer (04.11.2025)

Morning Wrap (04.11.2025)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.