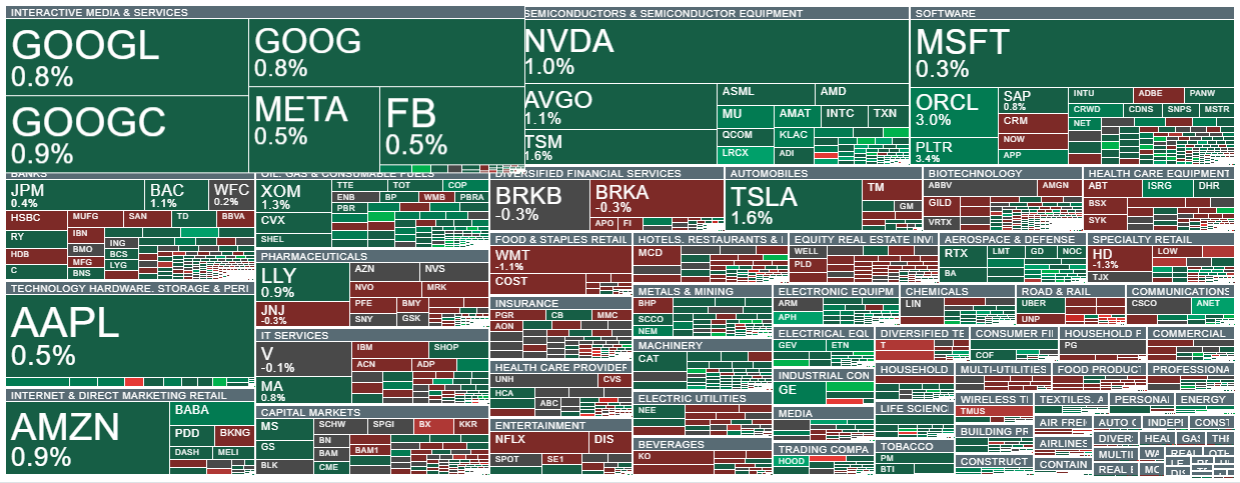

- U.S. equities moved higher again today, with the US100 (Nasdaq 100) gaining nearly 1%, driven by strength in semiconductor and Big Tech stocks.

-

U.S. macro data surprised to the upside: existing home sales matched forecasts, while the Kansas City Fed index came in significantly above expectations.

-

Gold recovered nearly 1%, rebounding from recent losses despite a stronger U.S. dollar index (USDIDX), which rose more than 0.15%.

-

J.P. Morgan analysts expect the Federal Reserve to end its quantitative tightening (QT) program next week, while markets are increasingly pricing in a 25 basis point rate cut.

-

The earnings season has been strong so far, with most companies beating profit and revenue estimates.

-

IBM shares are trading lower after results, while Honeywell is gaining on upbeat performance.

-

Crude oil prices are rising amid new U.S. sanctions on Russia, with Chinese refiners halting seaborne imports of Russian crude.

-

Vladimir Putin commented on the U.S. sanctions, expressing his willingness to continue dialogue and seek a diplomatic path toward peace in Ukraine with President Trump. He added that sanctions will not change the military situation on the front lines.

-

Eurozone consumer sentiment showed a slight improvement compared to the previous reading.

-

In Canada, August retail sales matched forecasts, although core sales (excluding autos) came in below expectations.

- U.S. equities moved higher again today, with the US100 (Nasdaq 100) gaining nearly 1%, driven by strength in semiconductor and Big Tech stocks.

-

U.S. macro data surprised to the upside: existing home sales matched forecasts, while the Kansas City Fed index came in significantly above expectations.

-

Gold recovered nearly 1%, rebounding from recent losses despite a stronger U.S. dollar index (USDIDX), which rose more than 0.15%.

-

J.P. Morgan analysts expect the Federal Reserve to end its quantitative tightening (QT) program next week, while markets are increasingly pricing in a 25 basis point rate cut.

-

The earnings season has been strong so far, with most companies beating profit and revenue estimates.

-

IBM shares are trading lower after results, while Honeywell is gaining on upbeat performance.

-

Crude oil prices are rising amid new U.S. sanctions on Russia, with Chinese refiners halting seaborne imports of Russian crude.

-

Vladimir Putin commented on the U.S. sanctions, expressing his willingness to continue dialogue and seek a diplomatic path toward peace in Ukraine with President Trump. He added that sanctions will not change the military situation on the front lines.

-

Eurozone consumer sentiment showed a slight improvement compared to the previous reading.

-

In Canada, August retail sales matched forecasts, although core sales (excluding autos) came in below expectations.

- European stocks advanced on Thursday. Germany’s DAX and France’s CAC40 each gained over 0.2%, while the UK’s FTSE 100 climbed more than 0.6%. London Stock Exchange Group shares jumped over 6% following strong Q3 results and the announcement of a new share buyback program. Unilever shares also rose after the company reported a nearly 4% year-over-year increase in sales, while Germany’s defense company MTU Aero gained on earnings.

- U.S. equities are trading higher today amid renewed optimism toward Big Tech, semiconductor stocks, and energy companies, which are benefiting from the recent rise in oil prices. As a result, the Nasdaq 100 is up over 0.9%, while the Dow Jones Industrial Average (DJIA) advances more than 0.3%.

- STMicroelectronics shares are the only major semiconductor stock declining, falling more than 14% after earnings. IBM is also under pressure after its growth pace disappointed investors. In contrast, Honeywell and Dow Inc. shares are gaining following stronger-than-expected results.

- The Kansas Fed Composite Index came in at 6 points, beating expectations of 2 and above the previous reading of 4. The Manufacturing benchmark rose sharply to 15 points from 4, signaling improving industrial activity.

- China’s state-owned refiners — PetroChina, Sinopec, CNOOC, and Zhenhua — have halted contracting new seaborne oil supplies from Russia. According to preliminary media reports, India is also reducing imports of Russian energy commodities.

- According to EIA data, natural gas inventories rose by 87 billion cubic feet (bcf) versus 84 bcf expected and 80 bcf previously. The report indicates rising production and a potential decline in demand, despite the start of the U.S. heating season.

- Vladimir Putin stated he still intends to meet with Donald Trump, emphasizing that Trump had not canceled but merely postponed the planned meeting with the Russian president. Putin warned that Ukrainian attacks deep inside Russia would lead to conflict escalation and trigger a strong, proportional response from Moscow.

- Shares of Argentine lender Banco Macro are up over 5%, extending gains after the U.S. Treasury Department reaffirmed its support for Argentina. Market optimism is also building ahead of the October 26 presidential election. A potential victory for Javier Milei could reinforce the positive sentiment in Argentine equities, which had recently declined following local election losses.

The energy and semiconductor sectors are today’s top performers in the U.S. market, while STMicroelectronics and Blackstone rank among the weakest large-cap stocks.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.