The German equity benchmark opened Tuesday’s session with cautious gains, although the upside remains limited due to investor caution in the United States, where equity futures are posting slight declines. Today’s macro calendar is nearly empty, with the main reading from Europe being the preliminary Eurozone CPI inflation for November.

In Germany, headlines are dominated by Bayer, which may benefit from support from the U.S. administration after it proposed exempting the company from multi-billion-dollar penalties related to glyphosate litigation. Shares of Hypoport were upgraded to “Overweight”, with a price target of 210 EUR at BNPP Exane.

Eurozone inflation data (November):

-

Headline CPI (y/y): 2.2 percent (forecast 2.1 percent; previous 2.1 percent)

-

Core CPI (y/y): 2.4 percent (forecast 2.4 percent; previous 2.4 percent)

-

CPI (m/m): minus 0.3 percent (forecast minus 0.3 percent; previous 0.2 percent)

-

Eurozone unemployment rate (October): 6.4 percent (forecast 6.3 percent; previous 6.3 percent; revised to 6.4 percent)

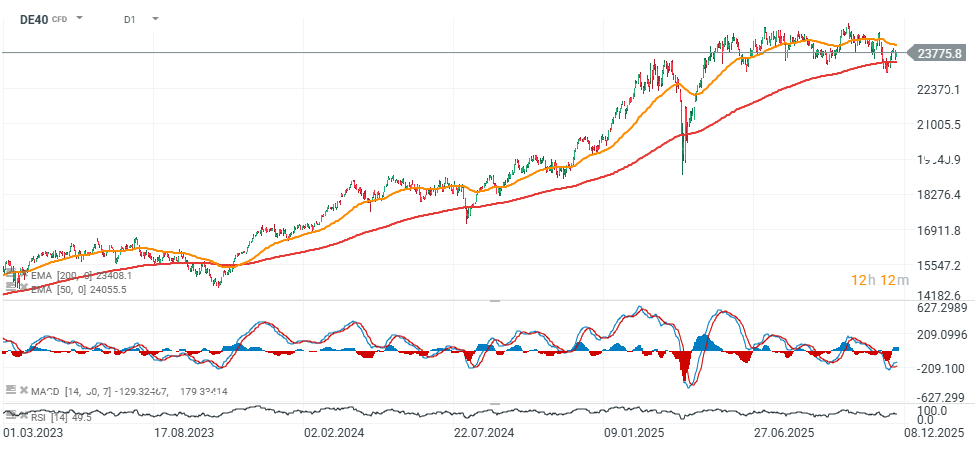

DE40 (D1 interval)

Source: xStation5

Bayer is leading gains on the German market, while Siemens and the financial sector are also performing strongly, including Deutsche Boerse, Deutsche Bank and Commerzbank. Rheinmetall is attempting to rebound after its recent decline. Source: Bloomberg Finance L.P.

Will Bayer benefit from Trump support?

Support from the Trump administration significantly improves Bayer’s legal position in the U.S., increasing the likelihood of limiting litigation risk related to glyphosate (Roundup). The Solicitor General’s recommendation signals that Washington is leaning toward an interpretation favoring federal EPA oversight over state-level regulations. This could represent a turning point in the years-long legal battle. The market is reacting immediately, with the rally in Bayer shares suggesting a sharp reduction in the litigation risk premium.

- A potential Supreme Court ruling could lead to a reduction in litigation reserves, which currently amount to 7.6 billion USD. This would likely unlock meaningful shareholder value.

- A favorable outcome for Bayer could improve cash flow, credit ratings and dividend prospects, while also easing management and communication pressures.

- However, the case remains politically sensitive. Support from the Trump administration does not guarantee a Supreme Court decision.

- Even a positive ruling would not fully eliminate future lawsuits unless the Supreme Court provides a broad clarification on the extent of federal preemption.

- Reputation risk for Bayer remains elevated, particularly if health advocacy groups intensify public pressure.

- If the Supreme Court agrees to hear the case in 2025–2026, the market may continue to price in lower legal risk, potentially supporting further appreciation of the shares.

- Bayer nonetheless remains in a situation where legal dynamics dominate valuation more than operating fundamentals.

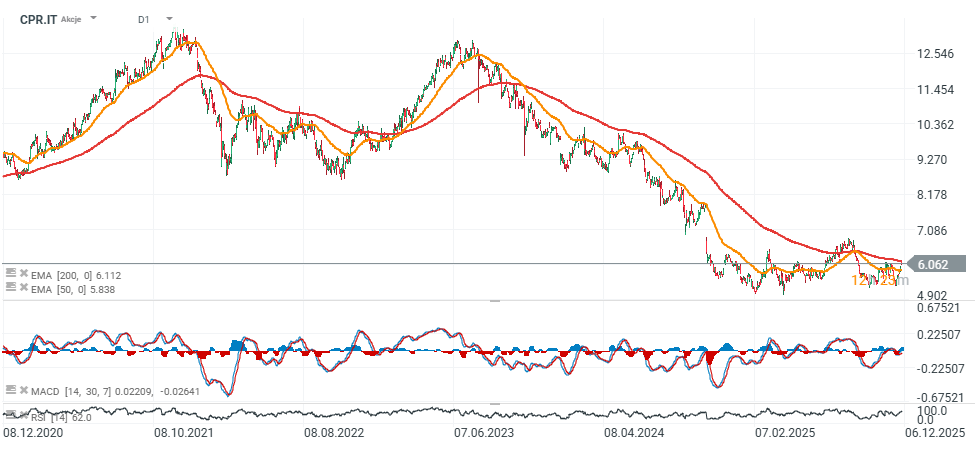

Bayer shares, BAYN.DE (D1 interval)

Source: xStation5

JP Morgan analysts upgraded Campari to “Outperform” with a price target of 7.9 EUR per share. The stock is trading near its 200-day EMA (red line).

Source: xStation5

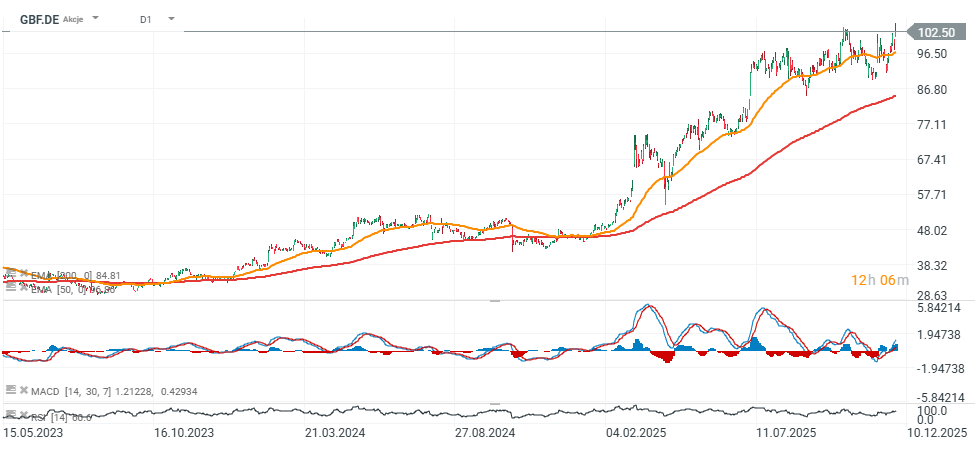

Bilfinger expects margins to rise to approximately 8–9 percent by 2030. Shares reached new all-time highs today following the company’s optimistic outlook but pulled back amid profit-taking.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.