European session opens with distinctly negative sentiments. Major indices are experiencing broad sell-offs amid investor concerns about growth rates and trade tensions. Among futures contracts, the leaders of declines are W20 and NED25, with sell-offs exceeding 0.6%. FRA40, DE40, and UK100 are losing slightly less, depreciating by 0.4%. ITA40 is the only one rising around noon.

The market is still trying to discount a huge portion of macroeconomic data and the results of the world's largest companies. Market expectations regarding comments from central bankers, the meeting between Xi and Trump, and the results of technology companies may have been exaggerated, and investors are reassessing their hopes today, which is reflected in falling valuations.

Source: Bloomberg Finance Lp

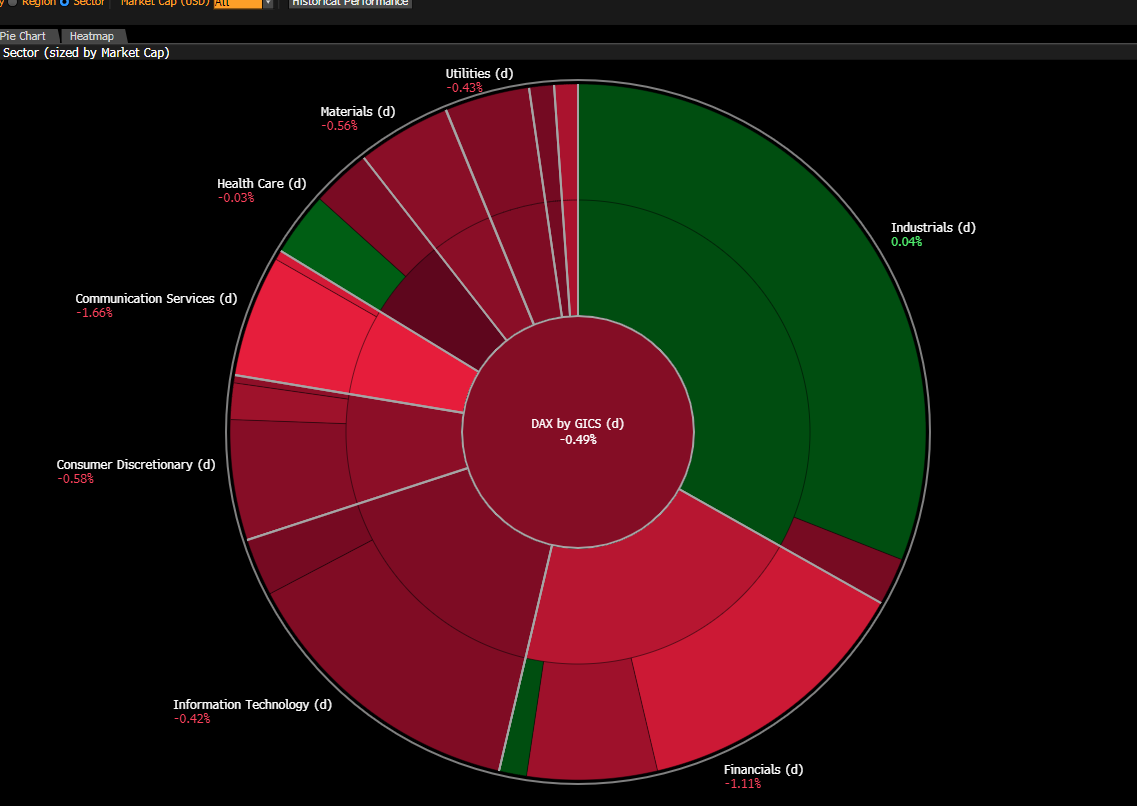

On the German index, we can observe a broad correction, indicating a general deterioration in sentiment. Communication services and banks are losing the most due to negative information from companies and concerns about sector results. The industry is doing better, supported by the still heated defense industry.

DE40 (D1)

Source: xStation5

The chart shows the continuation of the downward correction and the formation of a consolidation channel in the FIBO 23.6-50 range. The price broke the support at the level of 24,300 points and EMA50, indicating short-term weakness of buyers. To prevent an extended downward correction, buyers must maintain the support zone around 24,000. Sellers taking the initiative may bring the price down to around 23,900, where the FIBO 61.8 level and EMA100 are located.

Company news:

Fuchs (FPE.DE) — The German lubricant manufacturer is up over 7% after publishing results that significantly exceeded key investor expectations, and the company's management expressed optimism about future quarters' results. Investment analysts spoke positively about the results, praising the company for good cost management and sales growth in Asia.

Deutsche Telekom (DTE.DE) — The company is losing about 1.5% after a series of credible comments emerged in the public space suggesting that the company would replace equipment and infrastructure provided by Chinese Huawei at the expense of the German taxpayer. This decision is said to be driven by security concerns and fears of espionage from China.

Kongsberg Gruppen (KOG.NO) — The company is up over 4% at the session's opening after publishing good results. The company managed to increase revenues by 12%, and in the defense sector, the company grew by 38% year-on-year. Margins also improved.

Saint-Gobain (SGO.FR) — The centuries-old construction-industrial company disappointed investors. Despite sales growth, turnover in the USA clearly fell, prompting investors to depreciate the company by 3%.

Renk Group (R3NK.DE) — The German company engaged in the production of advanced drive systems, mainly for the defense industry, received recommendations from an investment bank. The stock price is up 2%.

Daily summary: Sentiments on Wall Street despite Fed rate cut and deal-done with China🗽US Dollar gains

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

Fed's Bostic and Hammack comment the US monetary policy 🔍Divided Fed?

Scott Bessent sums up the US trade deal with China🗽What will change?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.