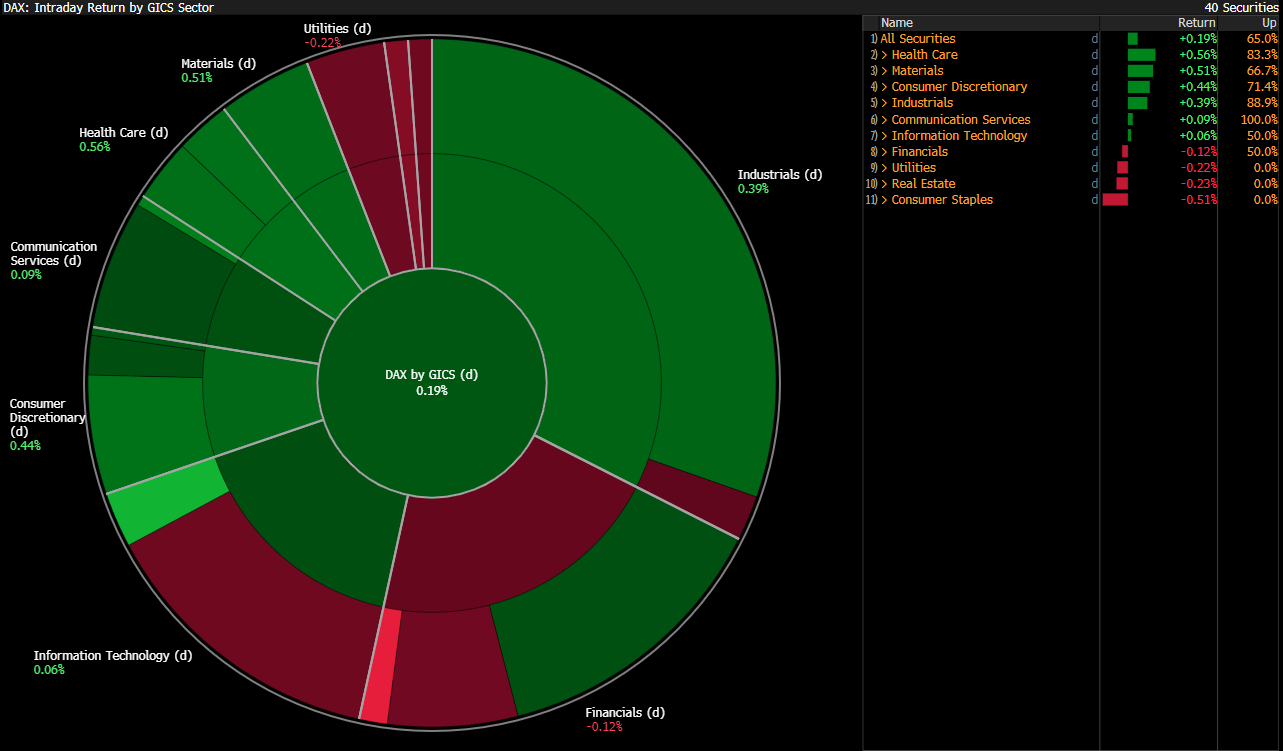

Today's stock market session in Europe is unfolding in moderately positive moods – most major indices are recording gains, and investors are benefiting from improved sentiment in global markets. The German DAX is following this trend, recording increases and aligning with the general direction of European exchanges.

Source: Bloomberg Finance LP

German indices are primarily driven upwards by companies in the medical, mining, renewable energy, and IT sectors. On the other hand, banks and retailers are exerting pressure on quotations – these segments remain in retreat due to concerns about declining consumption and potential regulatory challenges in the financial sector.

Macroeconomic Data:

Spanish Retail Sales:

- Actual: 4.5% YoY

- Previous: 4.7% YoY

Spanish Consumer Price Index (CPI):

- Actual: -0.4% MoM

- Forecast: -0.2% MoM

- Previous: 0.0% MoM

In Spain, today's inflation reading attracted attention, which turned out to be negative and worse than forecasts, raising concerns about the condition of the local economy and the risk of deepening deflation. On the other hand, retail sales data stood out positively, indicating an improvement in consumer demand, partially offsetting the pessimistic inflation picture.

Eurozone Economic Sentiment (September):

-

Economic Sentiment: 95.5 (Expected: 95.2. Previous: 95.2)

-

Consumer Sentiment: -14.9 (Expected: -14.9. Previous: -15.5)

-

Industrial Sentiment: -10.3 (Expected: -10.9. Previous: -10.3)

-

Services Sentiment: 3.6 (Expected: 3.7. Previous: 3.6)

Data from the eurozone had a moderately positive tone. In most segments of the economy, results turned out better than expected, supporting the image of economic stabilization. However, it is worth remembering that the trend in the data is still negative. Particular concerns are raised by the sector and consumers. Indicators fell below forecasts, suggesting that pressure to slow down activity in this area is still evident.

The further course of the session may also be influenced by statements from FOMC and ECB representatives, which will be carefully analyzed for clues regarding the direction of monetary policy.

DE40 (D1)

Source:xStation5

After bouncing off strong support at the FIBO 38.2 level, where EMA100 also runs, the price is heading towards the upper limit of consolidation at around 24,000 points, where the FIBO 23.6 level is also located. Breaking this level may signal further increases. However, returning to levels around 23,650 and breaking EMA100 may herald an attempt to test the lower boundary running at 23,300 points, where FIBO 50 is additionally located.

Company News:

Lufthansa (LHA.DE) - The airline announced the layoff of 4,000 employees to protect margins. The stock price is rising by about 1.6%.

Kloeckner (KCO.DE) - The steel producer announced it will sell its plants in the USA. The company gains over 3.5%.

Another day of growth for defense companies - Rolls-Royce (RR.UK), Rheinmetall (RHM.DE), and Hensoldt (HAD.DE) are rising by over 1% amid increasing orders and geopolitical tensions.

NIBE Industrier (NIBEB.SE) - The renewable energy company received a series of recommendations from investment banks. The stock price is rising by 6%.

UCB (UCB.BE) - The Belgian biotech company is rising by over 15% after announcing very promising research results regarding their new therapy.

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.