Today's session on European stock exchanges started on a positive note. Futures contracts on most major indices were in the green, indicating moderate optimism among investors. The German DAX also opened in positive territory, suggesting that the market is trying to maintain positive momentum despite recent geopolitical turmoil and corrections in the USA. Contract valuations are rising by about 0.1-0.2%. The leader of growth today is Spain, whose IBEX35 index is rising by about 0.6% on the wave of good macroeconomic data.

On the global stage, investors are analyzing the latest decisions of Donald Trump's administration. The former US president announced the introduction of additional tariffs, this time mainly affecting the pharmaceutical sector.

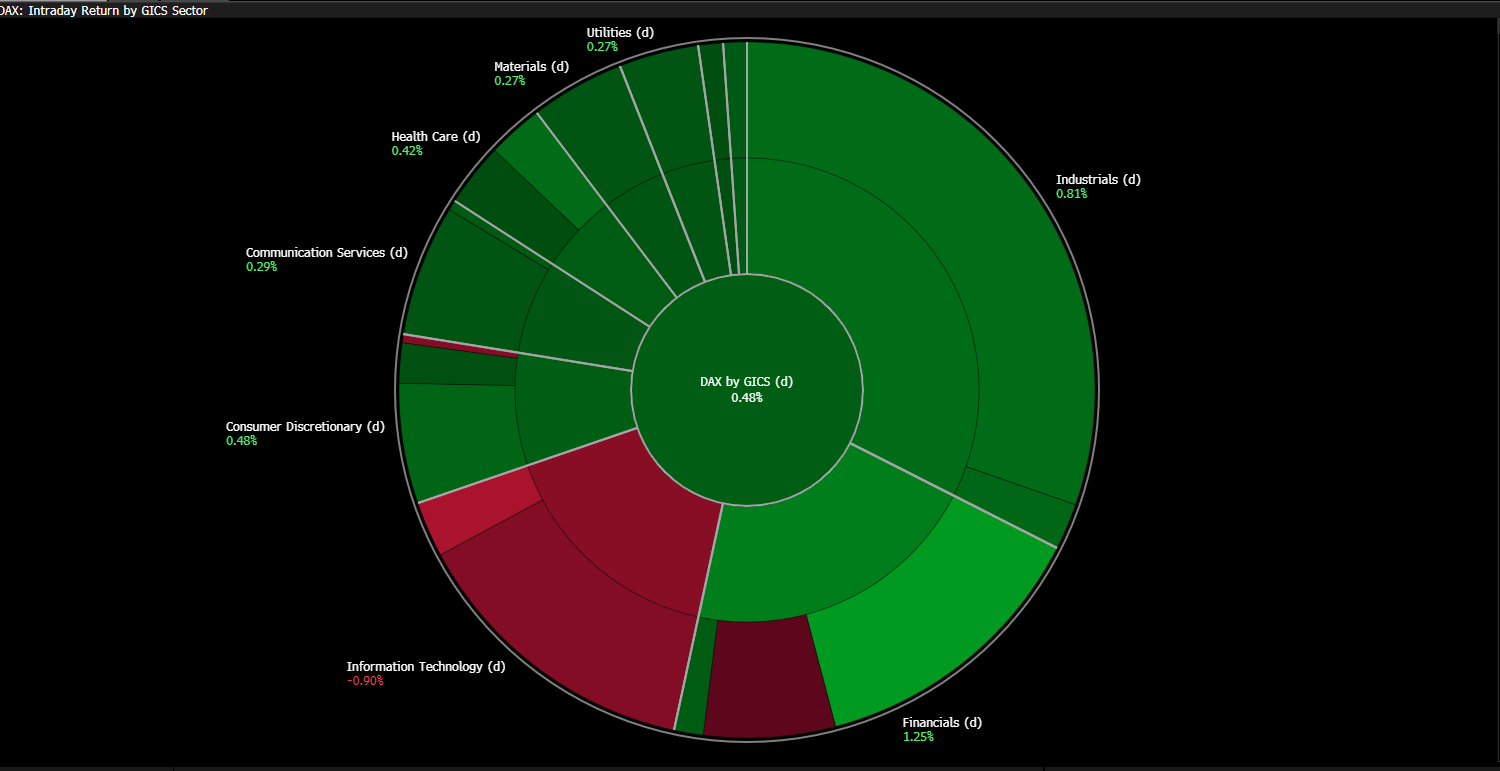

Source: Bloomberg Finance LP

In Germany itself, the DAX index is supported today primarily by the financial sector and industrial companies, which benefit from improved sentiment in the broader market. On the negative side, the technology sector stands out, weighing down the index and limiting its growth potential.

Macroeconomic data:

A positive highlight for European markets turned out to be the latest data from Spain. GDP for the last quarter grew more than economists had expected, supporting the narrative of the eurozone economy's resilience despite global trade tensions.

- GDP (q/q) (Q2): 0.8% (forecast 0.7%; previously 0.6%)

- GDP (y/y): 3.1% (forecast 2.8%; previously 2.8%)

However, investors remain cautious, waiting for afternoon publications from across the ocean. Key will be the PCE inflation data – the Federal Reserve's favorite measure. The reading may provide clues about the future path of interest rates. The market's attention will also be drawn to consumer sentiment readings and inflation expectations from the University of Michigan, which may confirm or undermine the strength of US domestic demand.

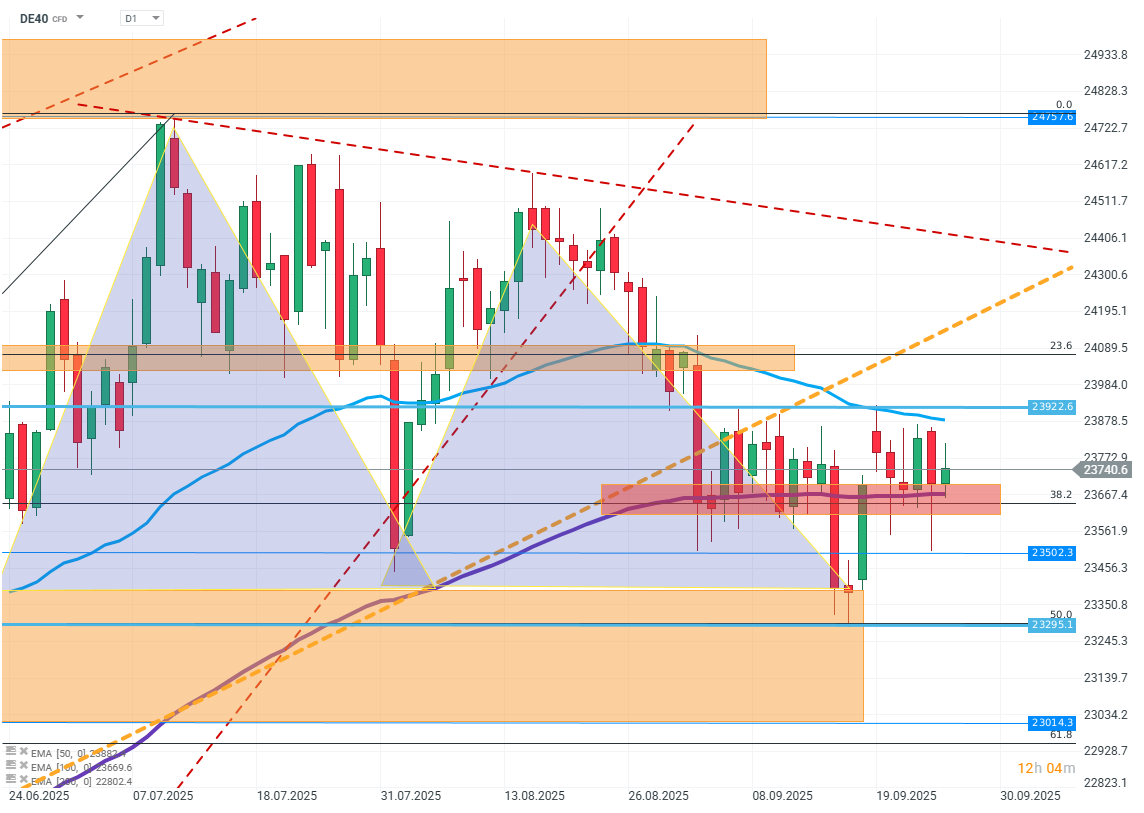

DE40(D1)

Source: xStation5

The chart shows that the realization of the RGR pattern is becoming increasingly unlikely. The price bounced off the neckline, which weakened the downward potential and halted further supply pressure. An additional technical support remains the EMA100 average, which stabilizes the quotations and strengthens the defensive barrier for buyers.

The baseline scenario for the next sessions seems to be entering a consolidation phase. Its probable range is determined by FIBO retracement levels from 23.6 to 50. Only breaking one of these limits may provide a stronger directional signal.

Company news:

Alten (ATE.FR) — The French company published results that exceeded expectations for operating profit. Shares are up 1.8% at the opening.

Volkswagen (VOW1.DE) — The German automotive giant is halting production at one of its electric car factories. The stock is down 2%.

Daimler (DTH.FE) — The truck manufacturer is down more than 5% following the announcement of new US tariffs affecting trucks.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.