-

ECB Stands Pat: The central bank maintains a neutral stance, signaling an end to the rate-cut cycle as the inflation target has been met, with no immediate plans for policy changes.

-

French Fiscal Risks Weigh on Euro: High deficit/debt and political instability in France are now the primary sources of risk for the Eurozone, dragging the euro lower.

-

EURUSD Oversold Signal: Despite the dollar's strength, the EURUSD pair may be undervalued/oversold based on the yield spread, though it recently broke its technical uptrend.

-

ECB Stands Pat: The central bank maintains a neutral stance, signaling an end to the rate-cut cycle as the inflation target has been met, with no immediate plans for policy changes.

-

French Fiscal Risks Weigh on Euro: High deficit/debt and political instability in France are now the primary sources of risk for the Eurozone, dragging the euro lower.

-

EURUSD Oversold Signal: Despite the dollar's strength, the EURUSD pair may be undervalued/oversold based on the yield spread, though it recently broke its technical uptrend.

ECB is Not Gearing Up for Monetary Policy Changes

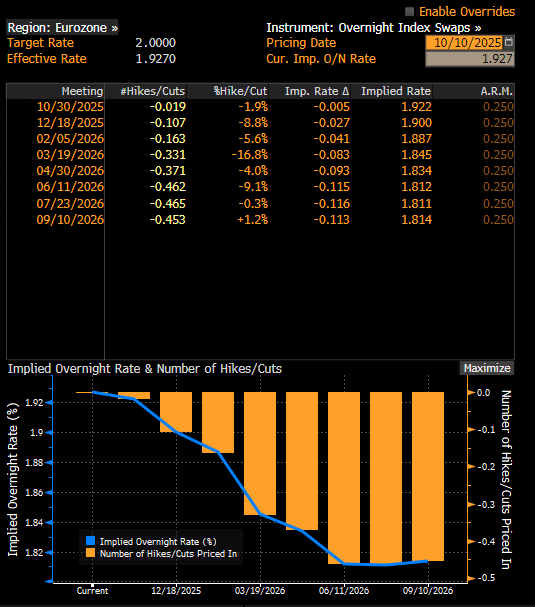

Members of the ECB maintained an unambiguously neutral tone in their statements today, suggesting that the cycle of interest rate cuts has ended, and they describe the current state of monetary policy as close to neutral. Both Mārtiņš Kazāks and José Luis Escrivá emphasized that the inflation target has been achieved, and current readings do not require any reaction from the central bank. At the same time, they cautioned that short-term deviations from 2% will not be treated as a reason to adjust rates.

Expectations indicate no prospects for interest rate cuts in the near term. Source: Bloomberg Finance LP

These statements align with the broader ECB's communication in recent weeks: the lack of inflationary pressure and the stabilization of expectations allow for a "wait and see" stance, especially since risks to economic growth have not materialized. Therefore, we can speak of a consolidation of monetary policy at the current level, with a low probability of both further cuts and a return to tightening.

Does France Remain a Problem for the Euro?

Against the backdrop of the region, the thread of France's fiscal situation, discussed by François Villeroy de Galhau, remains particularly interesting. Despite maintaining the GDP growth projection at 0.7% for 2025, the country faces serious budgetary challenges—the deficit is approaching 5.5% of GDP, and public debt is hovering around 116%. This is significantly above the EU limits (3% and 60%), increasing tensions in the context of future negotiations with the European Commission. Additionally, political instability could cost the economy up to 0.5 percentage points in GDP growth.

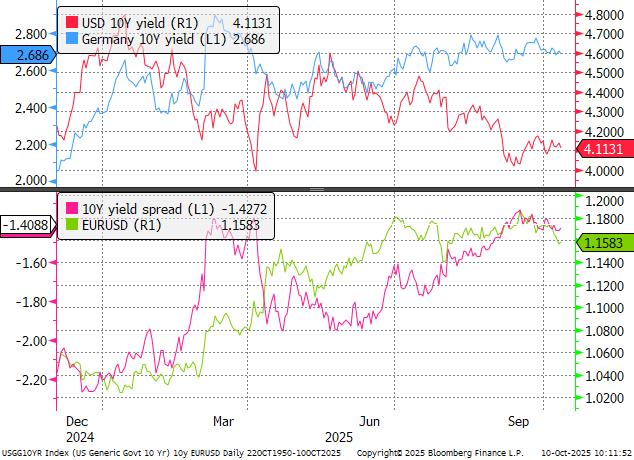

It was these negative reports concerning France that heavily dragged the euro down this week, although the strength of the US dollar itself was also a factor. While the European economy remains in a difficult position, as suggested by data from Germany this week, it seems that EURUSD may be somewhat too heavily oversold, a point also indicated by the yield spread.

The yield spread indicates excessive overselling in the EURUSD pair. Source: xStation5

In summary, the ECB signals a stabilization of monetary policy, while risks are shifting to the fiscal and political spheres, particularly in France. The bank sees no reason to react as long as inflation remains contained, but it is simultaneously observing the balance between slowing growth and maintaining fiscal credibility in the Eurozone.

Technical Analysis (EURUSD)

EURUSD saw a retracement below the 1.16 level and the 61.8% Fibonacci retracement yesterday, signifying a breakout from the uptrend. However, a new lower low in the downward sequence was potentially established yesterday, so an upward correction to the 1.16-1.1630 level cannot be ruled out. The 60.0% retracement remains the key resistance, where price reactions were observed previously.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.