Geopolitical tensions and earnings season are commanding nearly all investor attention, yet macroeconomic data will still be plentiful during Thursday’s session.

UK GDP came in above expectations, but the significant impact of a strong car production at Jaguar Land Rover suggests the improvement may be largely on paper. The absence of more structural signals of a recovery in the UK’s economic potential translated into a muted reaction in the pound (GBPUSD: -0.05%).

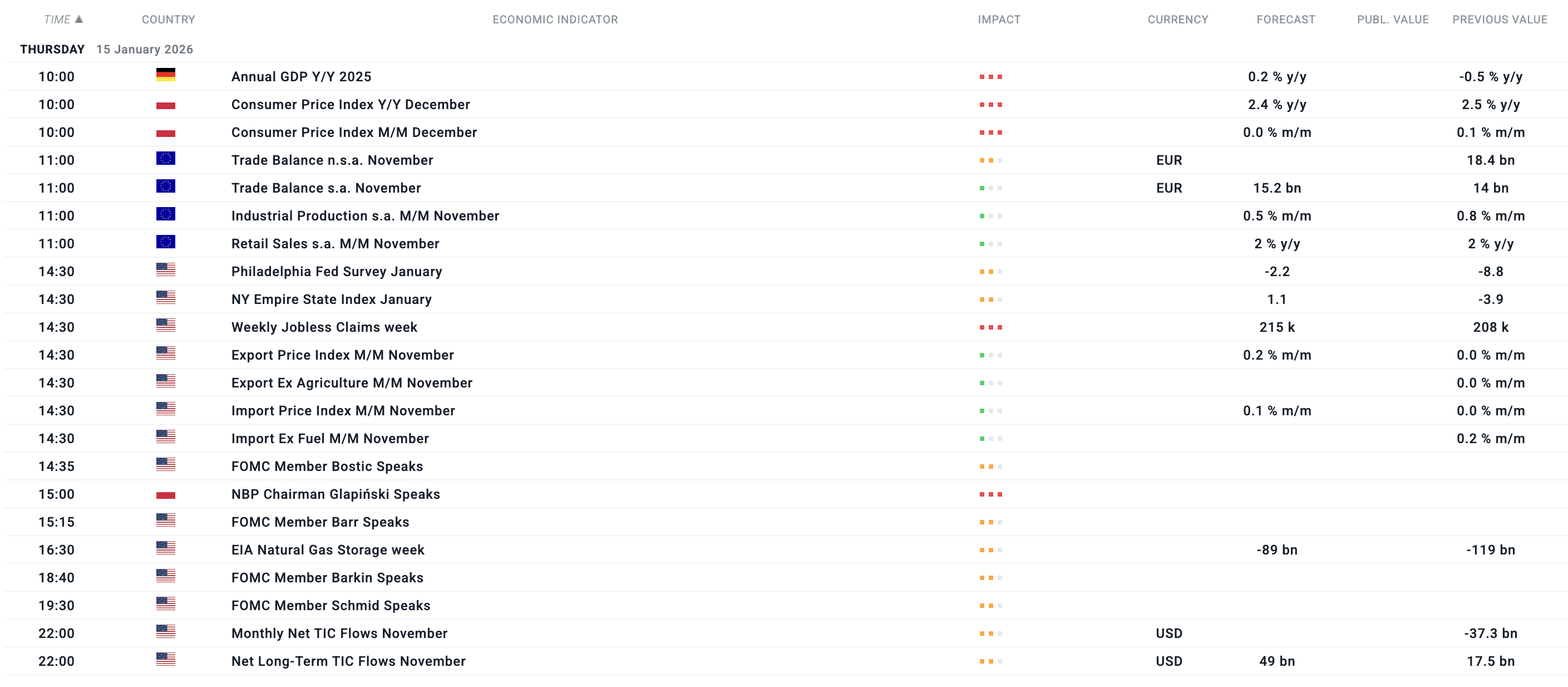

Alongside UK data and several Eurozone inflation readings, the highlight in Europe will be Germany’s GDP estimate for 2025, which has hovered dangerously close to zero quarter-on-quarter in recent quarters.

In Poland, the most important release will be the final December inflation reading, which, together with the National Bank of Poland governor’s conference, is expected to increase volatility in the PLN.

EURUSD may also react to Eurozone trade and industrial production data, potentially providing investors with fresh reference points for the ECB’s recently neutral stance.

In the U.S., trade data, initial jobless claims, and multiple FOMC member speeches are scheduled.

Earnings releases today includeL Goldman Sachs, Morgan Stanley, and BlackRock.

All times CET. Source: xStation5

All times CET. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.