Friday, 14 November, turns out to be a day of profound reckoning on global financial markets. With investor sentiment deteriorating, we are seeing a massive sell-off of virtually all asset classes, from equities to commodities and cryptocurrencies, signalling a significant shift in investors' approach to risk.

Market sentiment stands on a knife's edge as US markets prepare to open after a bloodbath across European and Asian bourses. The critical question investors face is whether the session opening on Wall Street will mark a capitulation point—where panic selling exhausts itself and oversold conditions trigger reversal buying—or whether the momentum of weakness carries through and deepens the rout. Source: xStation

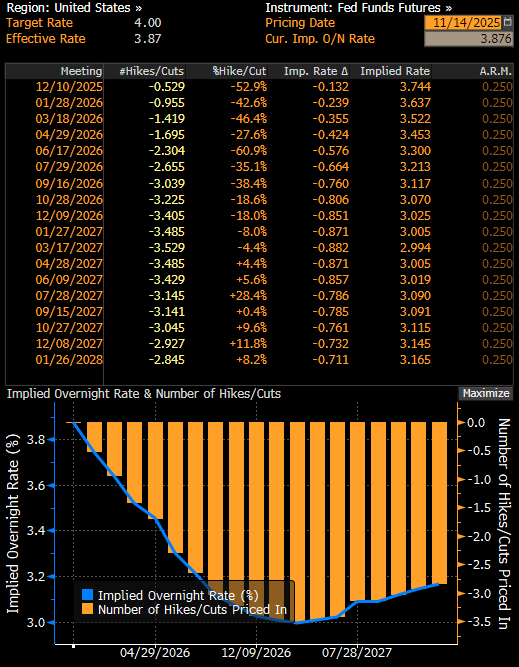

The stock market is experiencing one of its strongest sell-offs since April, when investors faced Donald Trump's tariff panic. The declines in S&P 500 and NASDAQ 100 futures are due to overlapping fundamental and macroeconomic factors. Firstly, the technology and artificial intelligence sector remains in the spotlight – growing doubts about company valuations and real returns on billion-pound investments in AI are creating selling pressure, particularly among companies such as Nvidia, Broadcom and AMD. Secondly, declining expectations for Fed rate cuts – the chance of a December decision has fallen from 95% to around 50% – combined with the central bank's hawkish tone are increasing risk aversion.

Source: Bloomberg Financial LP

In addition, the market is reacting to political and macroeconomic uncertainty. The historically long government shutdown in the US has caused delays in the publication of key data, making it difficult to assess the state of the economy, while in the UK, uncertainty over how to finance the fiscal gap is weakening the pound. Weaker data from China – factory output rose by only 4.9% year-on-year, the slowest pace in 14 months – is adding to global concerns.

The current sell-off is resulting in a rising VIX volatility index and a rotation of capital from growth stocks to more defensive assets. In the short term, markets remain cautious. Further declines are possible if new negative macro signals emerge or the Fed maintains its hawkish stance.

Today's session is not so normal, as the usual "safe havens" such as gold are not doing any better. The precious metal is currently down 2% and has fallen below USD 4,100 per ounce.

Another issue is Bitcoin, which is down 5% today alone and has fallen below 95,000 USD. This is the deepest decline for this cryptocurrency since the beginning of the year, when it lost 33% from its previous peak. At the moment, BTC has already lost 25% from its peak in early October.

The latest series of sell-offs seems to be particularly affecting Bitcoin, which has almost wiped out all of this year's gains. Source: Bloomberg Financial LP

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.