Precious metals are benefiting from a broader destabilization in global financial markets, which is weighing on the US dollar and potentially on demand for US Treasuries. The diversification trend away from Treasuries appears strategic and long-term in nature, supporting the fundamental backdrop for gold in particular. Goldman Sachs has raised its 2026 gold price target to $5,400 per ounce, up from $4,900 previously.

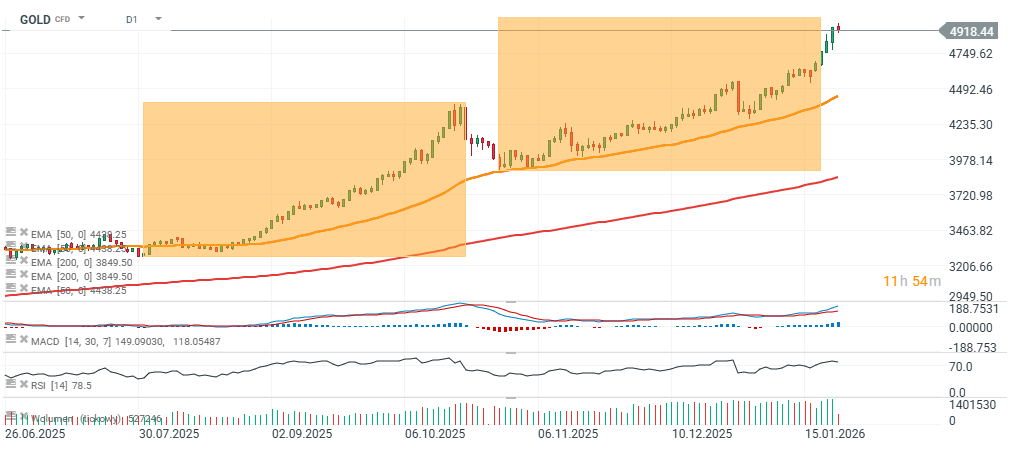

- If we assume the next leg in gold follows a 1:1 pattern similar to the two prior impulses—and that the corrective phases also respect a 1:1 structure—this would imply a potential pullback toward $4,400 before a new upside impulse. In that scenario, the next move could be roughly $1,000 higher, taking gold toward $5,400 per ounce, broadly in line with Goldman’s projection.

- The two previous upward impulses (July–October, and mid-October–January 2026) each delivered gains of around $1,000 per ounce. If the corrections were to be comparable as well, a pullback of roughly $500 would be consistent—pointing to a potential test of the $4,400 area. That said, there is no certainty that gold will continue to follow this pattern, or that a 1:1 correction must occur at this stage.

The biggest risk for gold and the broader metals complex appears to be Jerome Powell remaining in charge of the Fed—an outcome that would likely reduce the chances of implementing a “Trump model,” in which the Federal Reserve cuts rates aggressively while tolerating inflation near target. Even so, such a scenario would not necessarily prevent foreign central banks and large funds from deciding to reduce exposure to Treasuries. Against the backdrop of escalating tensions around Greenland, this is a debate that could increasingly matter for Nordic countries and pension funds in Northern Europe, not only for BRICS nations.

GOLD (D1 timeframe)

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.