- What’s particularly notable is new information from the Dutch pension fund Stichting Pensioenfonds ABP, indicating the fund has reduced its U.S. Treasury holdings by about 30% and sold roughly $10 billion of U.S. government bonds over a six-month period (through September 2025).

- ABP still holds around $19 billion in Treasuries, but the shift adds weight to the narrative that some large investors are gradually trimming exposure to U.S. debt. Even if the scale remains limited for now, it can still be enough to pressure the dollar and support gold.

- Strong demand from gold ETFs is also helping the upside. Volatility may pick up later today ahead of the U.S. NFP labor market report (14:30 CET). Recent U.S. employment data have been largely disappointing, which has provided additional support for precious metals.

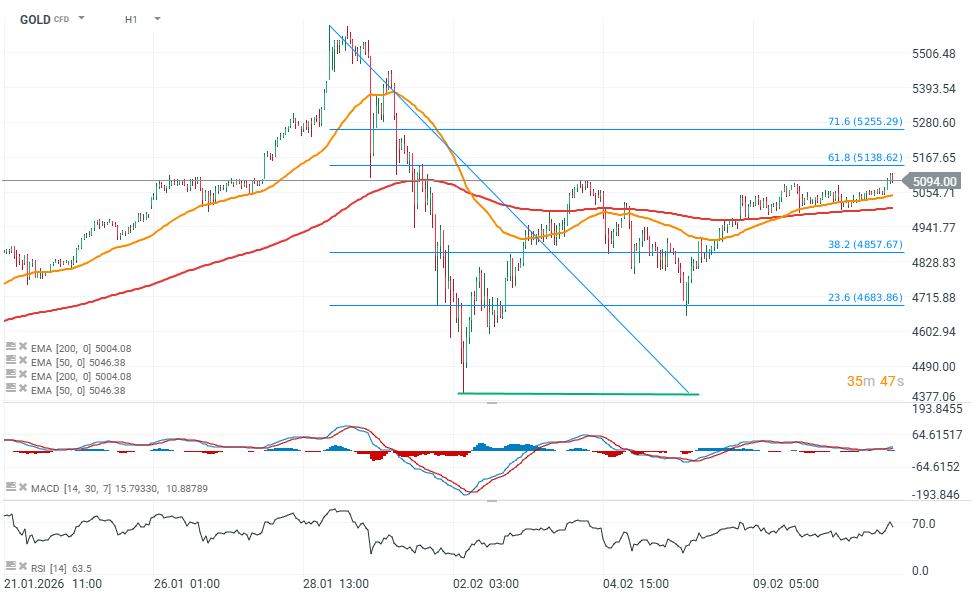

From a technical perspective, the hourly gold chart suggests an important resistance zone near the 61.8% and 71.6% Fibonacci retracements of the latest downswing. A break above $5,260 could open the way toward fresh all-time highs. Price remains above both the EMA50 and EMA200, pointing to strong bullish momentum.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.