The decline in gold prices continued today, with the scale of the correction now surpassing the pullbacks seen in April and May this year. The current correction level is comparable to the 2022 decline, though that downward move was stretched over many months. The current sell-off, by contrast, has lasted exactly seven days.

Losses since the correction began have now exceeded 11%, while the gain achieved in October has been severely reduced from 13% to just 1.5%. This means that October could become the first losing month since July if the correction extends to the $3,857 per ounce level. It is also worth noting that the sell-off in July was minimal, amounting to less than half a percent. A more significant correction took place between November and December 2024, when gold cumulatively retraced by over 4%.

Gold has sharply curtailed its gains this month. Previously, October was potentially the strongest month in over 10 years. Source: Bloomberg Finance LP

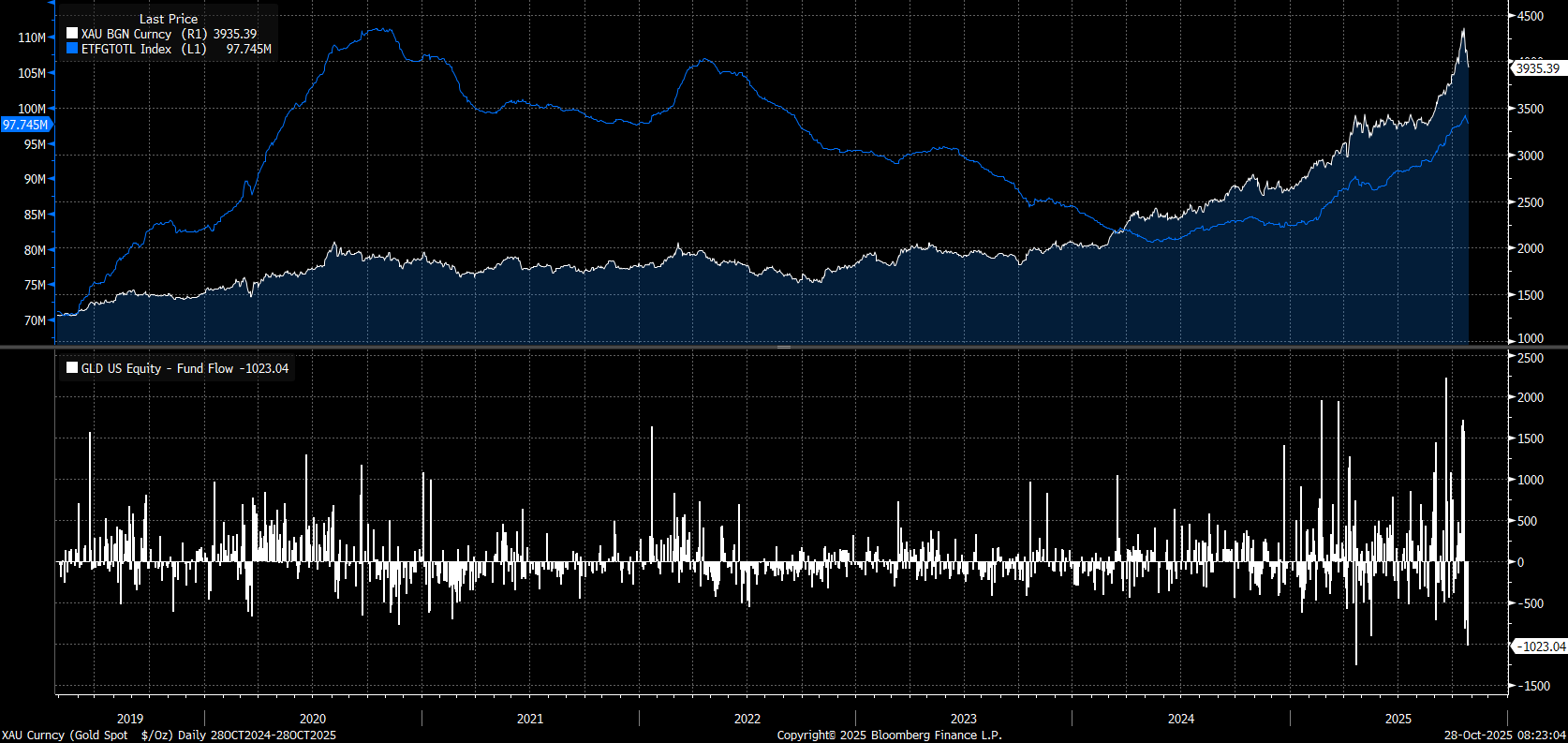

Gold has sharply curtailed its gains this month. Previously, October was potentially the strongest month in over 10 years. Source: Bloomberg Finance LPThe gold market sell-off is being motivated by improving market sentiment and profit-taking. COMEX recently raised the margin required to hold a position by approximately 5% for gold and 8% for silver. This move was mirrored by futures exchanges in Japan and India. It is evident that investors holding positions in ETFs have also decided to realize profits. Looking across all funds, ETFs are selling gold at the fastest pace since April and May. Simultaneously, the world’s largest gold ETF, the US-based SDPR Gold Shares (GLD.US), experienced its largest daily outflow since April, marking one of the largest single-day outflows in years. GLD is now experiencing its fourth consecutive day of outflows.

ETFs are selling gold in anticipation of a US-China trade deal. The Fed's decision may also be significant. If the Fed is cautious in communicating further rate cuts, it could push gold to even lower levels. Source: Bloomberg Finance LP

ETFs are selling gold in anticipation of a US-China trade deal. The Fed's decision may also be significant. If the Fed is cautious in communicating further rate cuts, it could push gold to even lower levels. Source: Bloomberg Finance LPGold temporarily retreated below $3,900 per ounce today, breaching the 38.2% Fibonacci retracement and approaching support at the 50.0% retracement of the last major uptrend. The scale of the correction exceeds what we observed in April and May.

Gold today temporarily falls below $3,900 per ounce, breaking the 38.2% retracement and approaching support at the 50.0% retracement of the latest upward wave. The scale of the correction exceeds what was observed in April and May. Source: xStation5

Gold today temporarily falls below $3,900 per ounce, breaking the 38.2% retracement and approaching support at the 50.0% retracement of the latest upward wave. The scale of the correction exceeds what was observed in April and May. Source: xStation5Looking at the price decline on the monthly chart, we could potentially see a massive 'wick' forming on the October monthly candle. The previous large candle wick occurred in April, which ultimately led to several months of consolidation.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.