- Struggling European economy looks towards Germany for direction

- Germany economic often ends up being more of a gamble and less of a strategy

- Will military spending re-ignite industry and growth?

- Regardless of scenario, German defense industry will benefit

- Struggling European economy looks towards Germany for direction

- Germany economic often ends up being more of a gamble and less of a strategy

- Will military spending re-ignite industry and growth?

- Regardless of scenario, German defense industry will benefit

The German economy is trapped in a phase of economic slowdown resulting from a series of structural problems. High energy costs combined with increasing government spending and low economic growth limit the government's maneuverability and investor optimism. Europe's economic giant is struggling more and more.

Germany has a problem, and no one is avoiding the topic anymore, not even the Germans. Unfortunately, what Germany is avoiding is correctly identifying the source of the problems and addressing them. This is not the first such case in the recent history of the Federal Republic of Germany.

In the 21st century, the German state has shown a tendency towards radical, risky, and poorly thought-out economic strategies. The attempt to base a radical restructuring of a significant part of the Union's economy on Russian resources — mainly gas — ended in a sudden energy crisis and an explosion of inflation that shook the entire community.

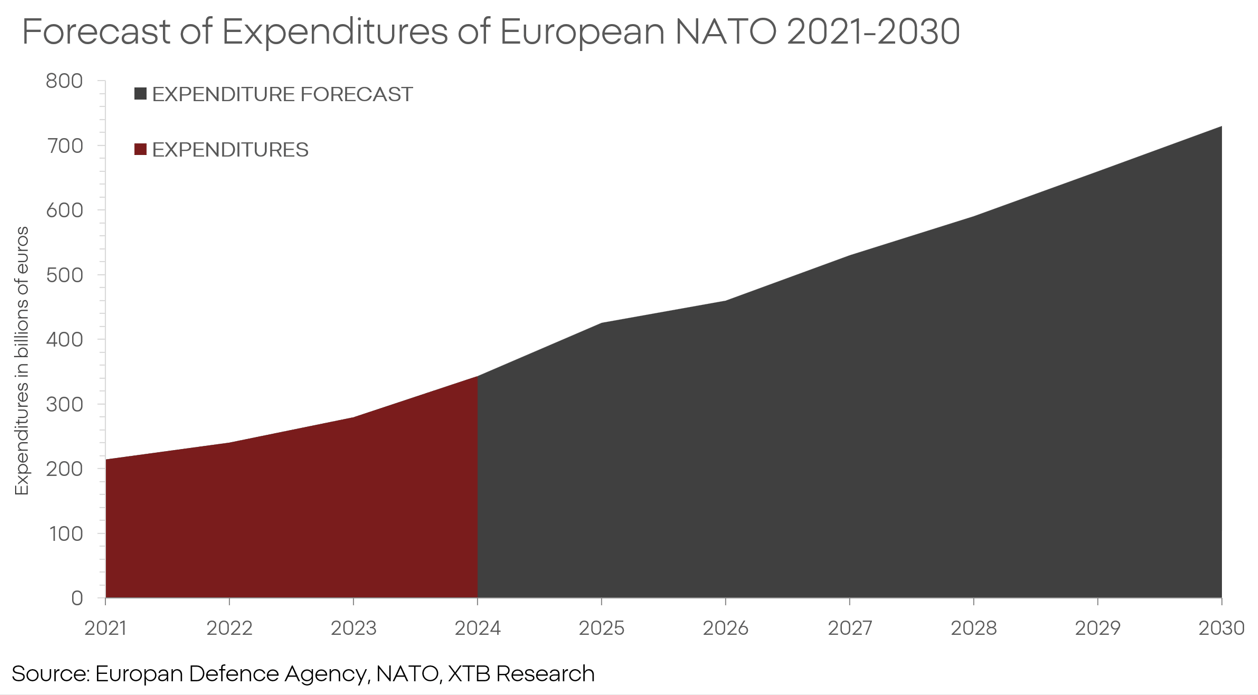

The Bundestag's next poker move is to transform current threats into opportunities through massive investments in the defense industry and infrastructure. The German government believes that expanding military capabilities will stimulate the economy, and new technologies developed for the army will eventually reach the civilian sector. This strategy is supposed to allow them to attract capital, skilled workers, and orders from other European countries.

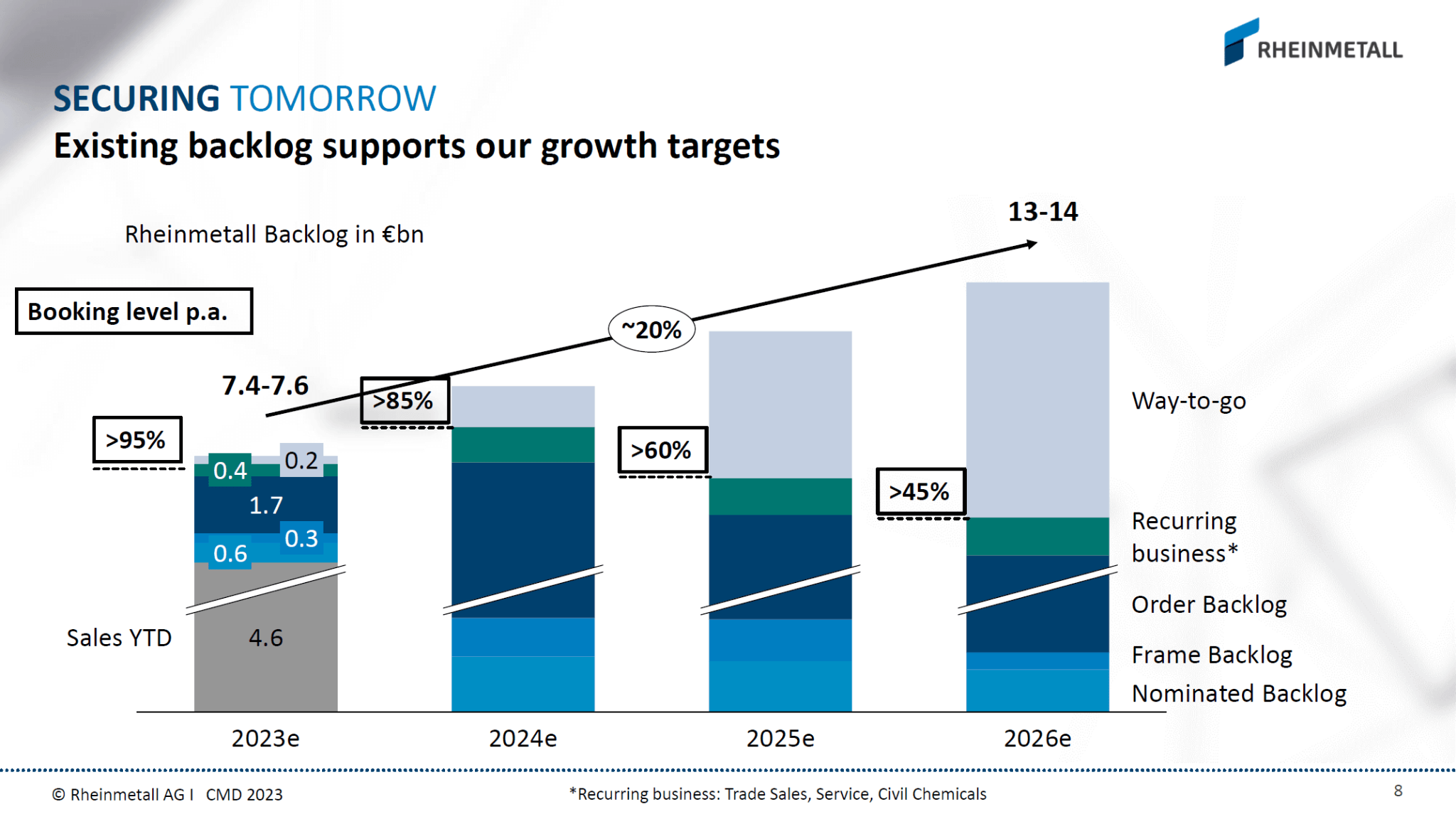

Source: Rheinmetall

Germany still has relatively low and stable public debt, and its industrial base remains strong. The Russian threat is real and long-term, which is expected to provide a lasting and stable demand for armaments throughout Europe. If the process of re-industrialization and militarization were successfully carried out, it could pull the country out of economic stagnation and further strengthen Germany's role in the Union.

However, the key word here is "success." Shifting huge financial resources to the defense sector does not solve fundamental competitiveness problems. It may even deepen them. Labor and energy costs will rise, and capital will be directed where demand exists mainly due to government orders. Increasing debt financing in the long term will deprive Germany of one of its key assets, and growing budgetary pressure may force later cuts when the economy and budget are most vulnerable to them.

As a result, Germany is once again deciding to play "Va banque". After a series of unsuccessful decisions, their margin for error has clearly narrowed. The stakes are not only the restoration of their own competitiveness but also the stability of the entire Europe. Germany must tread very carefully and address the sources of the problems, not just their effects. If the next major economic-strategic maneuver turns out to be misguided, the cost will be borne not only by German taxpayers but also by economic and political partners dependent on the condition of the continent's largest economy.

RHM.DE (D1)

Source: xStation5

Macro Focus: A Fiscal Turning Point in the United Kingdom?

DE40: European tech and defence stocks sell-off

BREAKING: FOMC minutes - many against December cut!

Google's European troubles

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.