IBM is steadily strengthening its position as one of the leading innovators in advanced technologies, with a particular focus on the development of quantum computing and artificial intelligence. The company has been investing in research and development for a long time, creating advanced solutions that have the potential to dramatically transform data processing and decision-making across various sectors of the economy. Recently, IBM has drawn significant attention through its collaboration with HSBC Bank, which resulted in a major breakthrough in the practical application of quantum technology in business. Using its quantum processor, IBM Heron, the precision of forecasts in the corporate bond market improved by 34% compared to traditional analytical methods. The test, which involved the analysis of over one million queries across several thousand bonds, stands as one of the first concrete examples of quantum computers being used in the financial sector, demonstrating their real-world benefits in risk management and investment optimization.

As part of its long-term strategy, IBM is pursuing an ambitious roadmap for quantum computing, aiming to build a fully error-corrected quantum computer, known as "Starling", by 2029. This system is expected to deliver groundbreaking stability and computational power, enabling the execution of complex quantum operations while minimizing the impact of errors — a key challenge in the practical use of this technology to date. In the following stages, the company plans to launch the "Bluejay" system by 2033, equipped with around 2,000 logical qubits. This powerful quantum computer will enable the execution of an enormous number of quantum operations, opening up entirely new possibilities unattainable for classical technologies. Key to achieving these goals are IBM’s novel quantum processors, the modular Quantum System Two architecture, and advanced error-correction methods, all of which significantly improve the reliability of quantum calculations. IBM is also expanding its global network of quantum centers, including new facilities in Spain and India, to provide strong research and technological support.

As part of its investment strategy, IBM plans to allocate as much as $150 billion over the next five years to the development of quantum and AI technologies. Such massive financial commitments reflect the company’s strong determination to maintain and reinforce its leadership in the field of cutting-edge innovation. Moreover, IBM is involved in major infrastructure projects, such as the modernization of the FAA's air traffic control system in the United States, further highlighting the scale and significance of its ongoing initiatives. Following the publication of test results with HSBC, IBM's share price rose significantly, and analysts — including those from Morgan Stanley — have pointed to the company as a clear leader in quantum computing, emphasizing its growing potential both technologically and in terms of market impact.

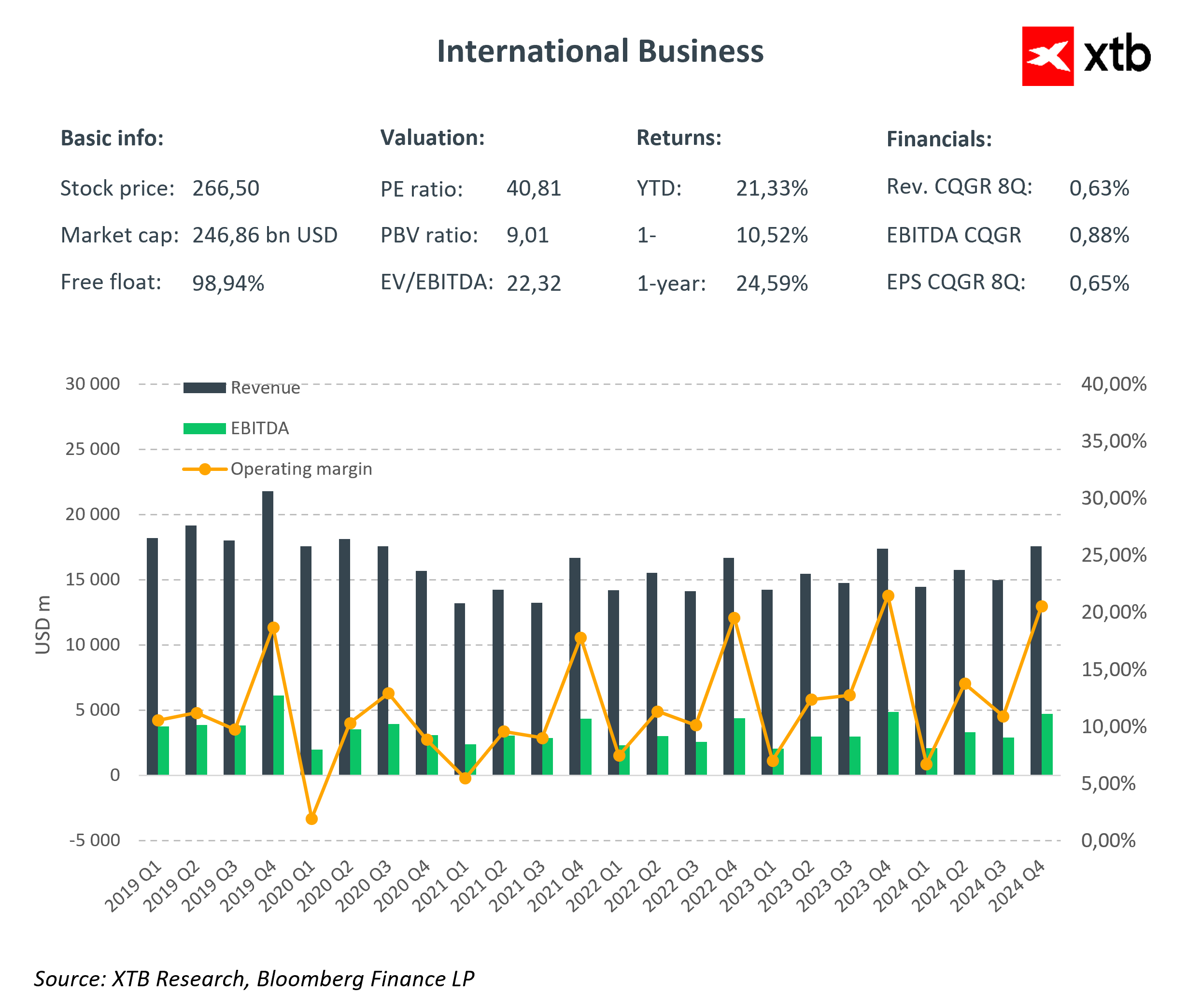

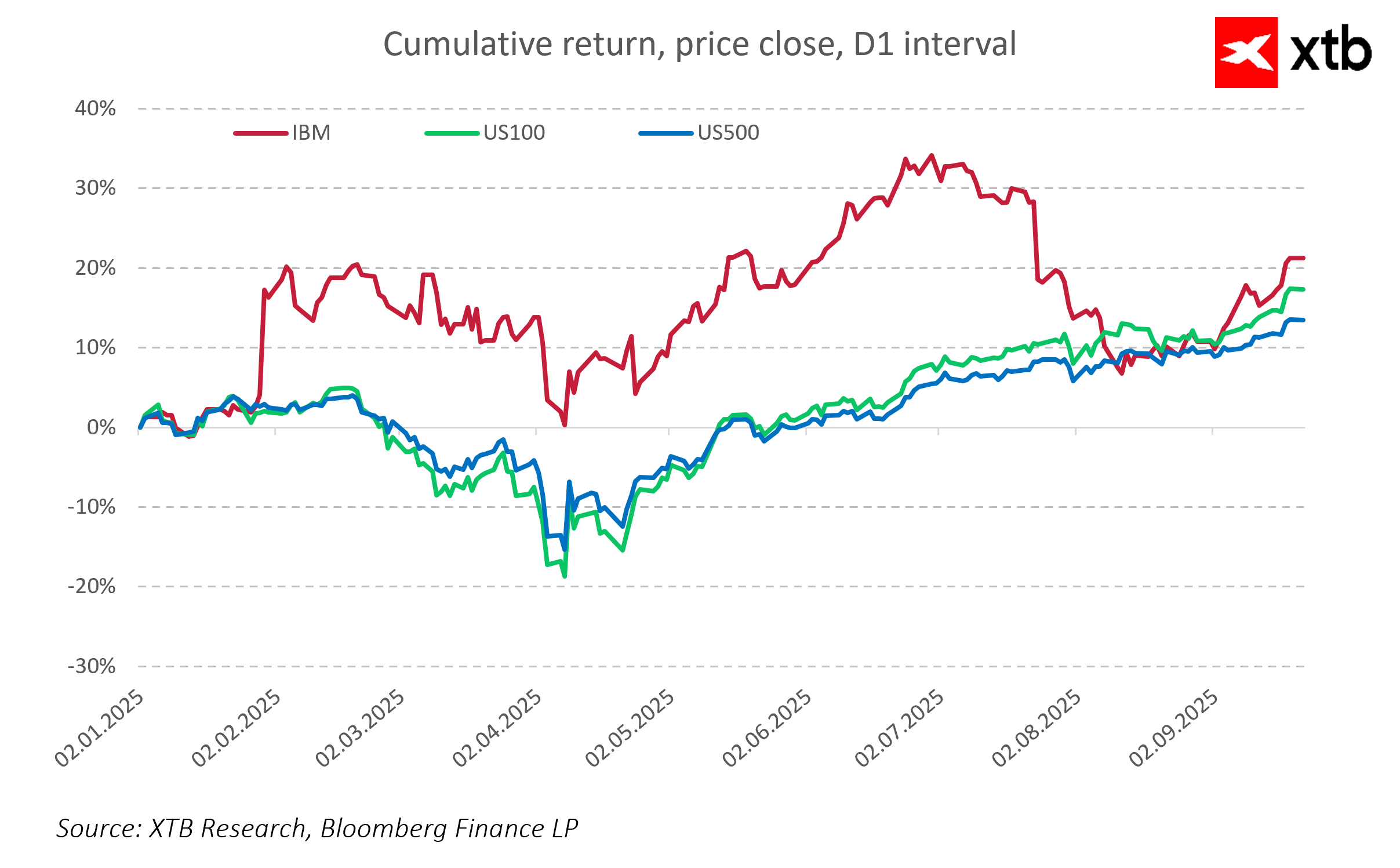

In recent months, IBM’s stock returns have slightly outperformed the broader market, as represented by the US100 and US500 indices. While the advantage is not dramatic, investors appear to be responding positively to the company’s ongoing progress in quantum computing and its ambitious investment plans. The growing interest in IBM shares suggests increasing market confidence in the company’s long-term strategy and its potential to shape the future of advanced technologies.

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.