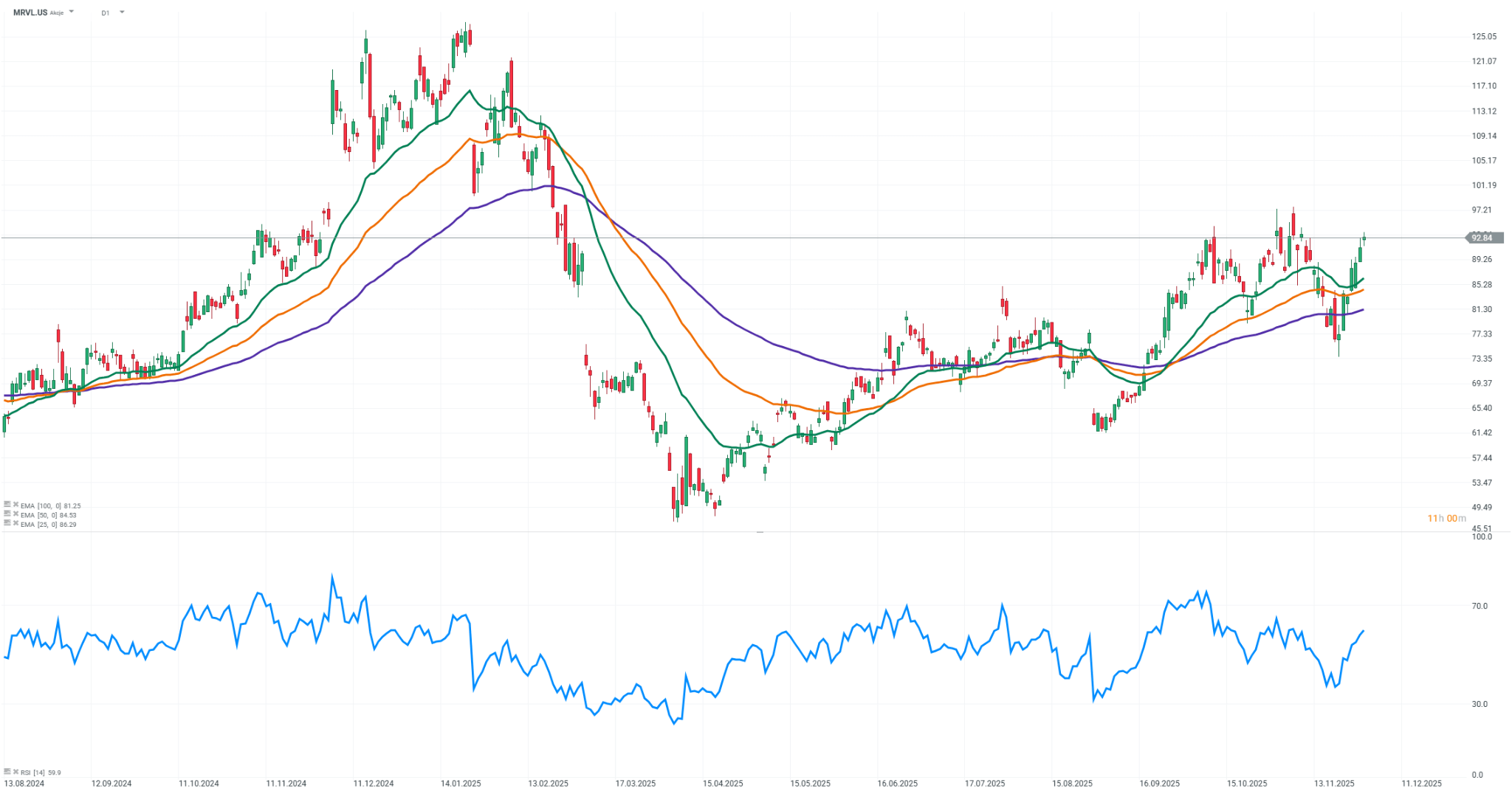

Marvell Technology surprised the market with a strategic move by acquiring the startup Celestial AI for $3.25 billion. Following the announcement, the company’s shares rose about 9% in premarket trading. The acquisition strengthens Marvell’s position in AI infrastructure for data centers by introducing Photonics Fabric technology, which allows data to be transmitted using light between chips and memory, increasing bandwidth, reducing energy consumption, and lowering latency. This positions Marvell as a direct competitor to companies such as Nvidia and Broadcom.

Financial forecasts indicate that Celestial’s technologies could generate $500 million in annual revenue by the end of 2028, reaching $1 billion the following year. With full deployment of the new products, Marvell expects $10 billion in revenue in the next fiscal year, with data center sales projected to grow 20–25% and chip revenues by around 20%.

Photonics Fabric is revolutionizing next-generation data centers by enabling major players, such as hyperscalers, to scale AI systems to very large capacities without excessive energy consumption. It allows data to flow at speeds exceeding 100 terabytes per second within a single CPO module, eliminating bottlenecks during AI model training. This makes Marvell a significant player in AI infrastructure and capable of competing with the largest companies in the market.

Two potential scenarios can be identified in the market. In the optimistic scenario, rapid technology deployment and strong demand from hyperscalers could push MRVL’s stock above $100, especially with Q4 sales projected at $2.2 billion. In the pessimistic scenario, regulatory delays or strong competition from Nvidia and Broadcom could slow growth. Nonetheless, the Celestial AI acquisition aligns with the trend of consolidation in the AI chip market and gives Marvell a chance to regain momentum after a challenging period.

Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.