Economy and Currencies

-

Eurozone: Q4 2025 GDP grew 0.3% q/q and 1.3% y/y, matching preliminary data and market expectations. The foreign trade balance rose for the first time in three months to €11.6 billion (forecast: €11.7 billion; seasonally adjusted).

-

Poland: Consumer inflation (CPI) fell less than expected, moving from 2.4% to 2.2% (forecast: 1.9%). The slowdown was primarily driven by cheaper fuel and transport, while upward pressure came from excise goods (tobacco, alcohol). The reading remains below the NBP's target midpoint of 2.5% (+/- 1 pp).

-

US Dollar: The Dollar Index is gaining for the third consecutive day (USDIDX: +0.15%), still supported by the strong NFP report despite anticipation of the upcoming CPI report (forecast: 2.5%, previous: 2.7%). A tight labor market and solid business activity data suggest a risk of "sticky" inflation; dollar gains may reflect positioning for a potential upside surprise.

-

FX Moves: The Australian dollar (AUDUSD: -0.5%) and yen (USDJPY: +0.5%) are seeing the largest corrections. EURUSD has retreated 0.1% to 1.186, while USDPLN is gaining 0.1% to 3.553.

Indices

-

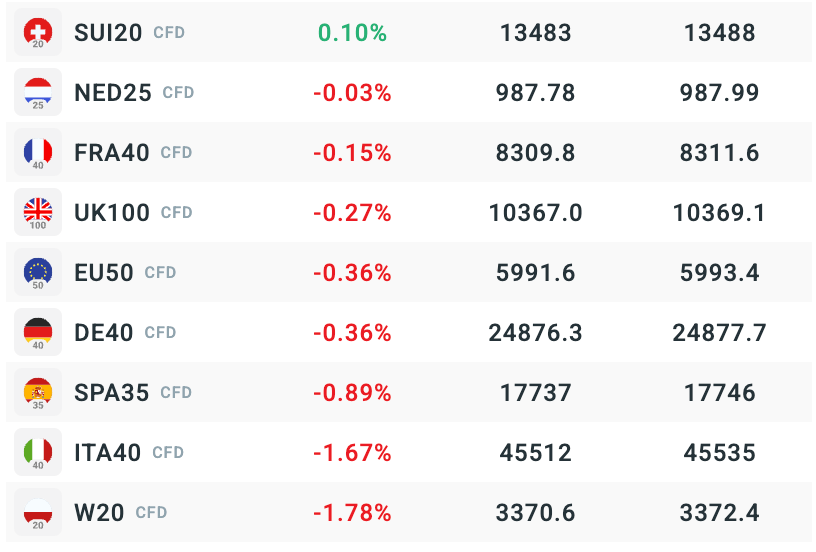

Market Sentiment: European index futures are trading mostly in the red, extending losses from yesterday's Wall Street sell-off (EU50 & DE40: -0.35%).

-

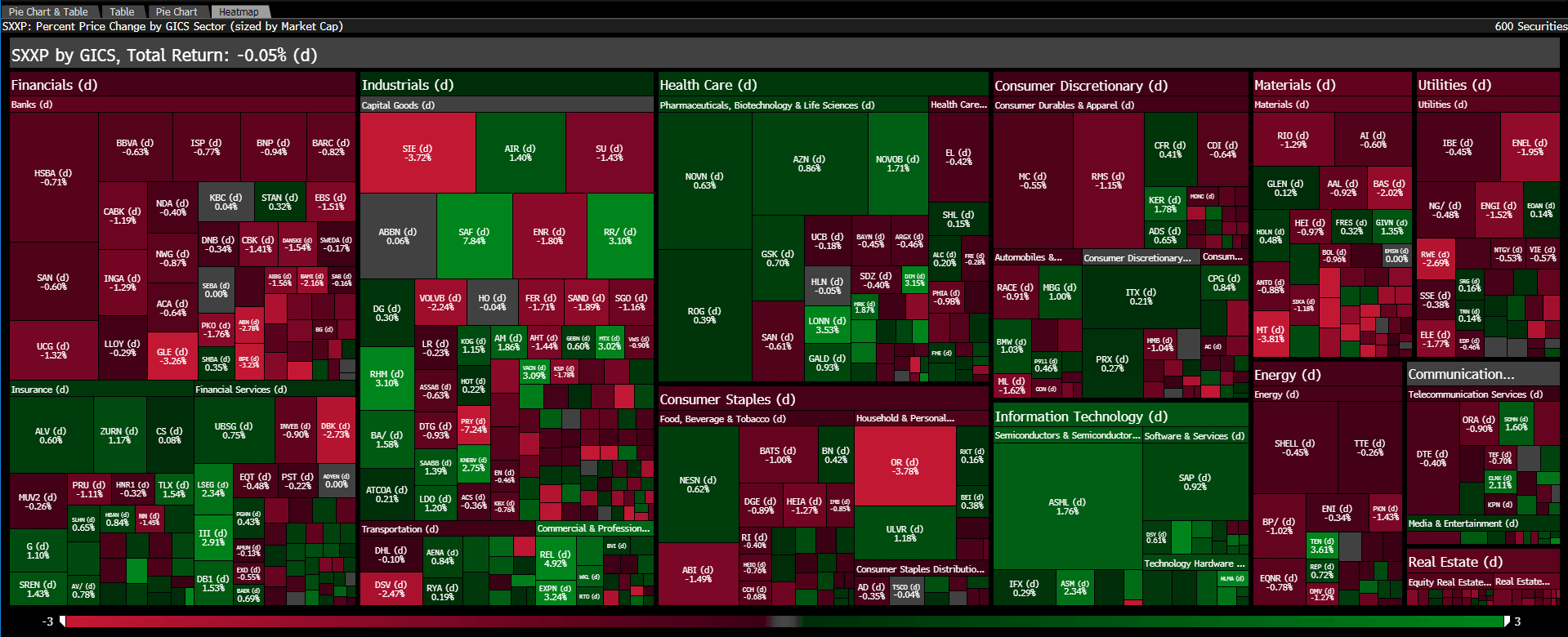

Sectors: declines are concentrated in financials, materials, energy and utilities. These are being partially offset by gains in major pharmaceutical, industrial and technology firms.

-

W20 (Poland): Leading losses at -1.8%.

-

SUI20 (Switzerland): The lone "green" exception at +0.1%.

The changes in stock index futures. Source: xStation5

Individual Stock Highlights

-

Siemens (-3.7%): Undergoing a sharp correction, completely erasing gains made after yesterday's initial positive reception of its financial results.

-

L’Oreal (-3.6%): Sliding after Q4 results showed marginal sales growth in China (0.6% vs. 5.6% forecast). Strong demand in North America and Europe (6% total growth) was not enough to satisfy investors.

-

Safran (+8.5%): Soaring after H2 2025 revenue hit €16.6 billion (+16% y/y). While EPS was softer, Free Cash Flow (€2.1 billion) significantly beat consensus. The market reacted positively to significantly raised 2028 targets.

-

Capgemini (+4.4%): Beat its 2025 revenue target (€22.47 billion) with strong Q4 growth (+10.6%) fueled by the WNS acquisition. AI-driven solutions remain the primary engine of growth, with a major restructuring planned to pivot fully toward AI services.

Today's performance of stocks and sectors of Stoxx 600 index. Source: Bloomberg Finance LP

Today's performance of stocks and sectors of Stoxx 600 index. Source: Bloomberg Finance LP

⏬EURUSD softens ahead of the US CPI

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.