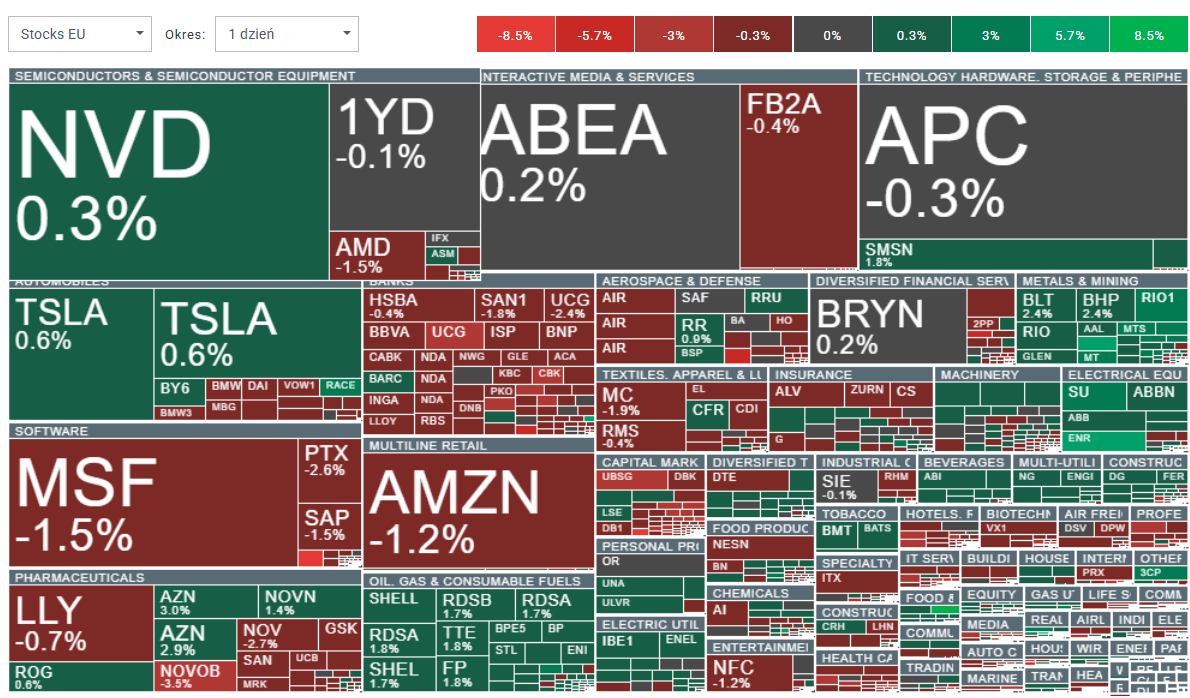

European indices are mostly trading slightly lower today. The Euro Stoxx 50 is down nearly 0.2%, with a similar pullback visible in Germany’s DAX. U.S. index futures are also edging lower. Meanwhile, precious metals are advancing: gold is up more than 1%, trading near $5,100/oz (its highest level since January 30), while silver is gaining around 3%.

Novo Nordisk shares are down more than 3.5%, cooling the recent rebound. Ferrari continues to extend yesterday’s post-earnings gains. Sentiment across the European banking sector remains weak. In contrast, mining and commodity-linked stocks are posting solid gains, extending their longer-term upward momentum.

-

Banks are driving Europe’s earnings season: The financial sector, which accounts for roughly one-third of MSCI Europe’s market capitalization, is posting the highest share of earnings beats (around 74%), with nearly three-quarters of its market cap having already reported. As a result, recent index gains are largely concentrated in banks.

-

Outside financials, the picture is less convincing: Technology is delivering solid upside surprises, but materials and energy are showing weaker beats, while consumer discretionary remains under pressure. For European indices to extend their rally, broader sector participation will likely be needed.

Source: xStation5

Oil rises on renewed Middle East escalation risk

Oil (OIL) is moving higher following comments from Donald Trump, who threatened to deploy a second aircraft carrier closer to Iran unless Tehran signs an agreement covering ballistic missiles and nuclear weapons. Today, Iran’s foreign ministry rejected any talks on limiting its ballistic capabilities. Markets are reading this as a signal of potential escalation in the Middle East and a higher perceived risk of U.S. military action against Iran.

Source: xStation5

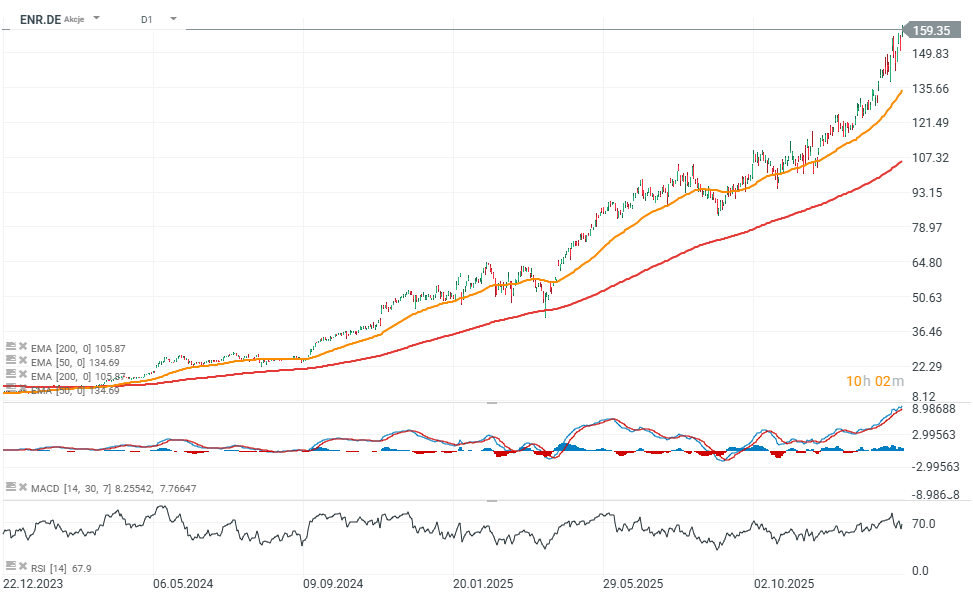

Siemens Energy at record highs

Siemens Energy is illustrating that the boom in power demand and grid infrastructure is translating into real orders — particularly in gas turbines and grid expansion, supported by industrial demand, data centers, and AI-driven electricity consumption.

Key points (per Bloomberg):

-

Group orders rose by more than one-third y/y to €17.6bn in fiscal Q1; the gas turbine business posted a record order intake.

-

Demand is being driven by rising electricity consumption from industry, data centers, and AI applications.

-

The stock is up about 25% since January, making it one of the strongest performers in the DAX this year.

-

Siemens Energy plans to invest $1bn in the U.S. (its largest single market) to expand production capacity for gas turbines and grid products; the U.S. accounted for roughly 40% of gas turbine orders in Q1.

-

Group profit more than doubled to around €1.1bn, supported by improvements in the grid technology business and productivity gains at Siemens Gamesa.

-

Gamesa orders fell 34%, which the company attributed to a tough comparison base a year earlier (including an offshore wind turbine deal worth about €1.4bn).

-

Management reaffirmed its 2026 guidance and still expects Gamesa to break even in the current fiscal year.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.