We are slowly entering the second phase of Thursday's trading session.

The markets are still awaiting the BoE and ECB decisions on interest rates. The first will take place in less than 14 minutes, at 13:00. The ECB will decide at 14:15.

The European Central Bank is expected to keep interest rates unchanged for the fifth time, as the strong economy has so far withstood global tensions and the strong euro. The Bank of England is also expected to keep interest rates unchanged, despite growing concerns about the British labour market.

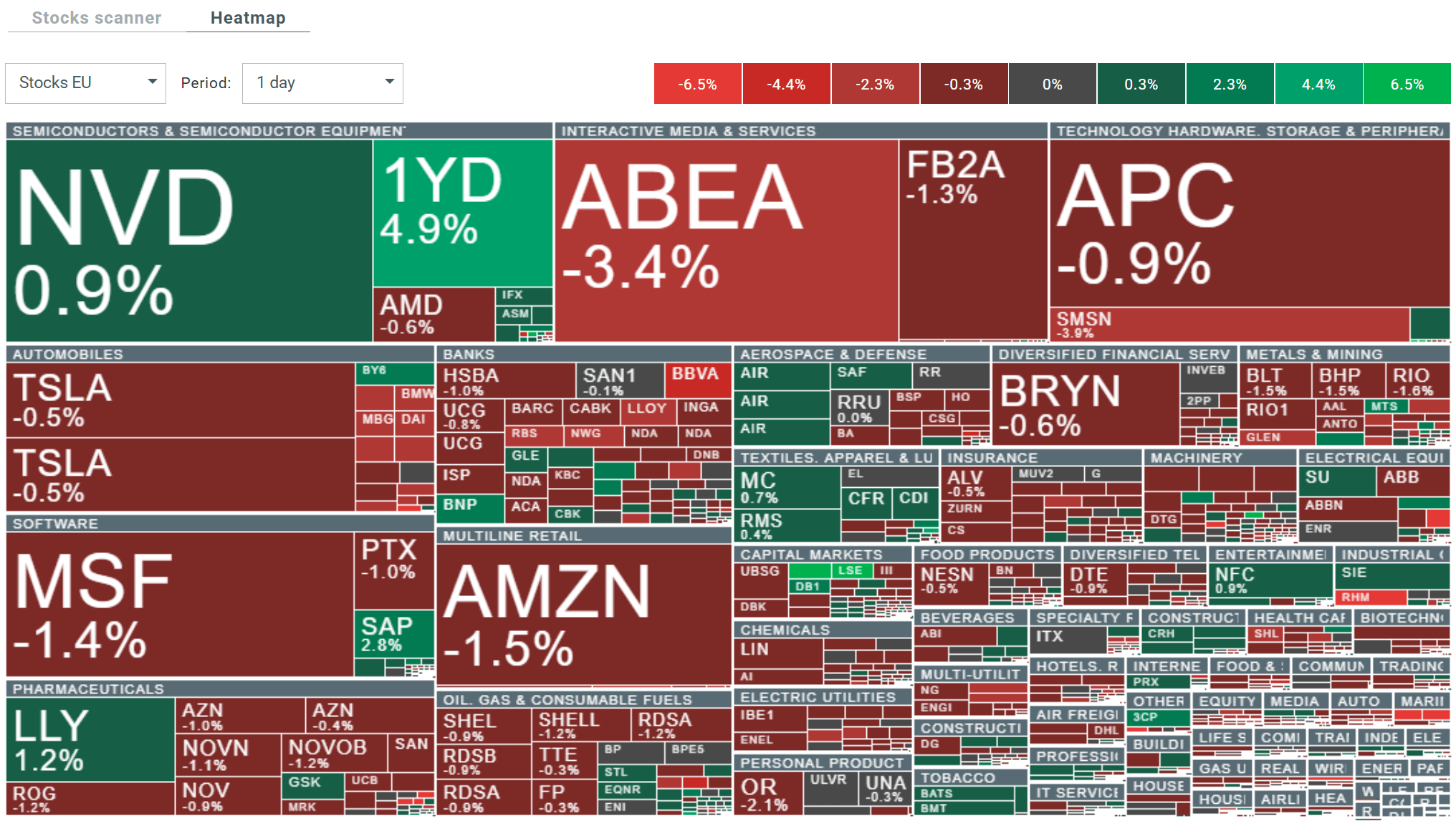

At present, Germany's DAX is down 0.46% on the cash market, France's CAC40 is up 0.2%, and the UK's FTSE100 is down 0.45%.

Precious metals return to dramatic declines: silver slumps 11% to $78, completely erasing the rebound of the last two sessions, gold retreats another 1.7% to $4,875, platinum contracts lose 6.5%.

The Stoxx Europe 600 index fell by 0.16%, with the technology and media sectors performing best and automotive stocks performing worst.

Source: xStation

Rheinmetall AG recorded a decline of 6.9% after analysts' forecasts led to a downward revision of the consensus earnings forecast for this year.

A.P. Moller-Maersk A/S fell 3.8% after the Danish container giant announced it would focus on cost discipline in the face of deteriorating freight rates caused by the reopening of the Red Sea.

KGHM Polska Miedź SA fell by 4.9%, leading declines in shares of companies in the basic materials sector.

Meanwhile, the decline in silver prices provided a boost for Pandora A/S, whose shares rose 6.3%, offsetting a break in share buybacks following a forecast of slower sales this year.

Shell Plc fell 2.3 per cent after its profit missed expectations.

The Swiss franc and the US dollar are performing best on the Forex market. We are seeing declines, particularly in the British pound.

We are seeing significant declines in cryptocurrencies. Bitcoin has fallen below £70,000 for the first time since November 2024.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.