Macroeconomics & Currencies

-

The UK at a Crossroads: Q4 GDP growth at just 0.1% QoQ, combined with a decline in GDP per capita, confirms a real economic slowdown. This ramps up pressure on the Bank of England (BoE) to consider more aggressive interest rate cuts.

-

Pound Resilience vs. Vulnerability: Despite the weak data, GBP is up 0.1% against the US Dollar today (trailing only CHF and NZD in the G10). However, the high trade deficit leaves the Pound exposed to further weakness if the UK’s yield advantage over the USD and EUR narrows.

-

Forint Under Pressure: EUR/HUF is up 0.4%. The Hungarian currency is struggling due to falling inflation (increasing the likelihood of rate cuts) and the ongoing dispute between Hungary and the EU, which threatens the release of crucial Union funds.

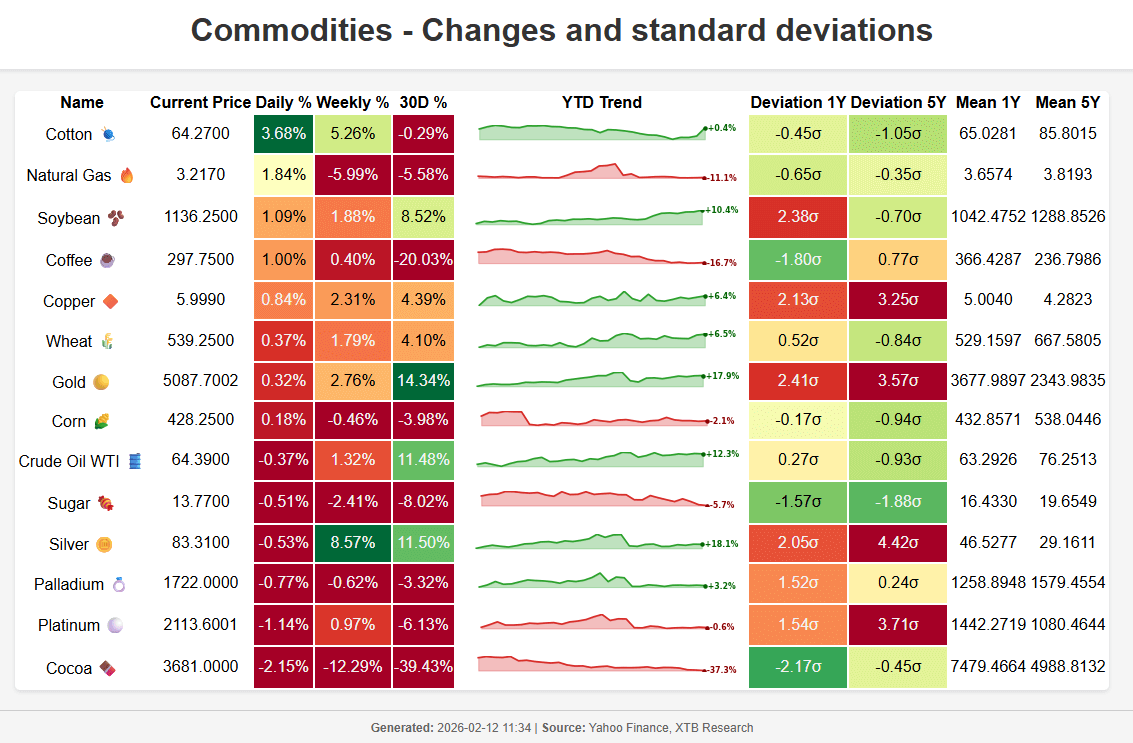

Commodities & Precious Metals

-

Oil Influenced by Geopolitics: WTI has retreated below $65 per barrel, though tensions remain high. The Israeli Prime Minister is reportedly pressuring Donald Trump to dismantle Iran’s ballistic missile program, while Trump appears to favor a quick nuclear deal over further escalation.

-

Pullback in Metals: Following a strong rally in the previous session, we are seeing a moderate correction. Gold is trading below $5,100, Silver remains above $83, and Platinum is holding just above $2,100.

-

Silver Supply Surge: There is a notable increase in silver sales to scrap yards in the US. This could boost recycling volumes and help narrow the global supply deficit.

Earnings Season & Corporate News

-

Unilever (-3%): While underlying sales grew by a better-than-expected 4.2% YoY, total revenue (€12.6 billion) missed estimates, leading to a 3% drop in the first hour of trading.

-

Mercedes-Benz (-2%): The automaker reported a staggering 57% drop in annual profits, largely due to tariff-related costs estimated at $1.2 billion. 2025 operating profit came in at €5.8 billion, missing the €6.6 billion forecast.

-

Tech Sector Slump: * Cisco plummeted 7% in post-market trading following disappointing quarterly results.

-

Robinhood shed nearly 9% yesterday as crypto-related revenues failed to meet expectations.

-

Watchlist: Focus shifts to Applied Materials and Arista Networks, both reporting after today’s closing bell.

-

Cryptocurrencies & Policy

-

Bitcoin Stabilizes: Following yesterday’s sharp sell-off, BTC is holding steady above $67,000. Ethereum (ETH) is rebounding after its recent dip below the $2,000 psychological level.

-

The Powell Dispute: Scott Bessent indicated that, following legal consultations, the investigation into Jerome Powell’s standing will likely be handled by the Senate Banking Committee rather than the Department of Justice.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.