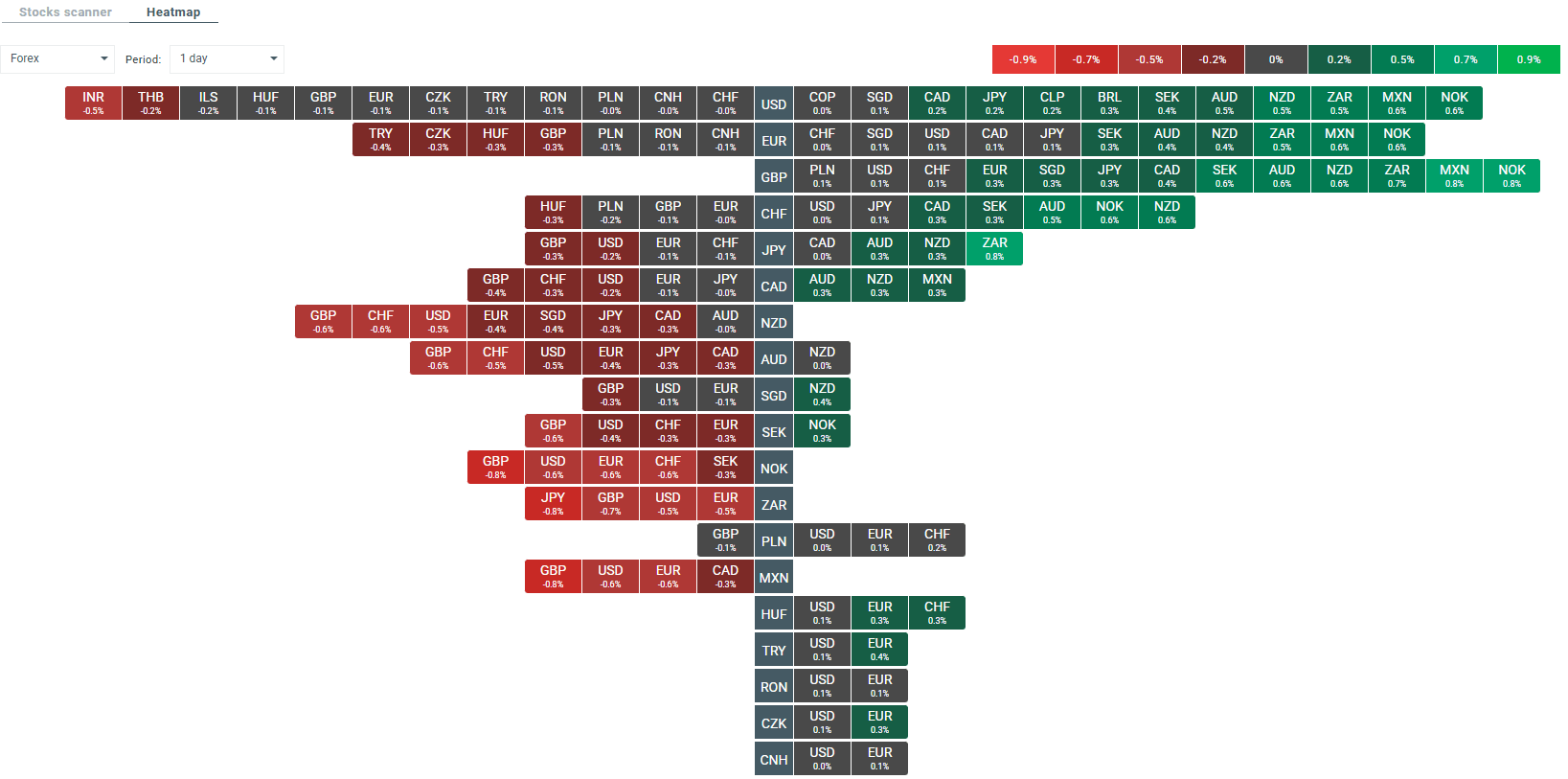

Heatmap of volatility on the FX market at present. Source: xStation

- The European session is relatively weak, with early signs of a rebound quickly being erased. At 1:30 p.m., Germany's DAX is down 0.95%, France's CAC40 is down 0.33% and Britain's FTSE100 is down 0.2%.

- The weakness is also affecting markets in Poland, where the key WIG20 index is down 1.33%, making it the leader in losses on the Old Continent.

- Danone shares plunged 5% after Dumex Dulac 1 infant formula was withdrawn from the Singapore market due to the presence of cereulide toxin in ARA oil. This is the largest one-day decline in six years, exacerbated by concerns about the company's reputation in the nutrition segment.

- Barry Callebaut is growing following the appointment of Hein Schumacher (former Unilever CEO) as head of the company – the world's largest cocoa supplier. The new leader is expected to help the company emerge from the crisis on the cocoa market.

- Burberry gains 5.3% thanks to better-than-expected sales results during the key holiday season. This demonstrates the resilience of the luxury retailer despite pressure on the sector.

- The main topic of today's trading is the speech by US President Donald Trump at the conference in the Swiss resort of Davos (2:30 p.m. CET).

- Bitcoin remains in consolidation after a correction of more than 30% in the fourth quarter, with risk aversion and correlation with the stock market limiting its upside potential. Attention in this regard has shifted to Davos, where cryptocurrency regulations in the US (CLARITY Act) are the subject of intense debate.

- Inflation in the UK accelerated for the first time in five months, reaching 3.4% y/y in December compared to 3.2% in November, slightly above economists' forecasts (3.3%). The rise in prices was mainly driven by an increase in tobacco excise duty and higher airfares.

- Antipodean currencies are currently performing best on the FX market. Meanwhile, the British pound and US dollar are experiencing declines.

- NATGAS is up 22% today amid the continuing cold spell in the US. Updated weather data from yesterday confirms the cooling trend that was already indicated on Monday.

- Oil is also regaining ground, with WTI currently up 1.5%. In this regard, investors will be paying attention to the API data, which will be released this evening and will provide clues as to changes in US oil inventories over the past week.

- Gold continues to perform well. The GOLD contract is up 2.2% today on renewed geopolitical concerns.

- Bitcoin is consolidating, remaining below £89,000.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.