Renowned investor Michael Burry has resumed his criticism of the technology sector. In his new Substack, "Cassandra Unchained," he described Tesla (TSLA.US) as absurdly overvalued, adding it to the list of speculative bubbles alongside Nvidia and Palantir. Burry closed his hedge fund Scion Asset Management in November and launched a paid newsletter for £39 per month. The investor explained that managing the fund involved regulatory restrictions that prevented him from communicating freely. More than 35,000 people already subscribe to his newsletter, where he plans to publish one to two posts per week.

Burry points to the annual dilution of value for Tesla shareholders of approximately 3.6% without share buybacks through employee compensation packages based on share issuance. By comparison, Amazon dilutes by 1.3% and Palantir by 4.6%. What Burry called "tragic algebra" is the constant erosion of value for current shareholders — mathematics that the market ignores, treating stock compensation as a non-cash expense.

What is more, shareholders approved Musk's remuneration package worth up to a billion dollars at the turn of October and November. It may be awarded over a decade if Tesla achieves aggressive milestones, including a market capitalisation of 8.5 trillion dollars. Burry sees this as a guarantee of further share issues – Tesla is trading at a price-to-earnings ratio of nearly 300 times earnings. For existing shareholders, this means an increasingly smaller piece of the "pie" at the same price.

Burry ironically notes that investors were involved in electric cars until competition emerged, then in autonomous driving systems until competition emerged, and now in robots until competition emerges. When Tesla's growth stalled, the narrative shifted to Cybercab and the Optimus robot. Every time the business looked weak, the story jumped to the next frontier.

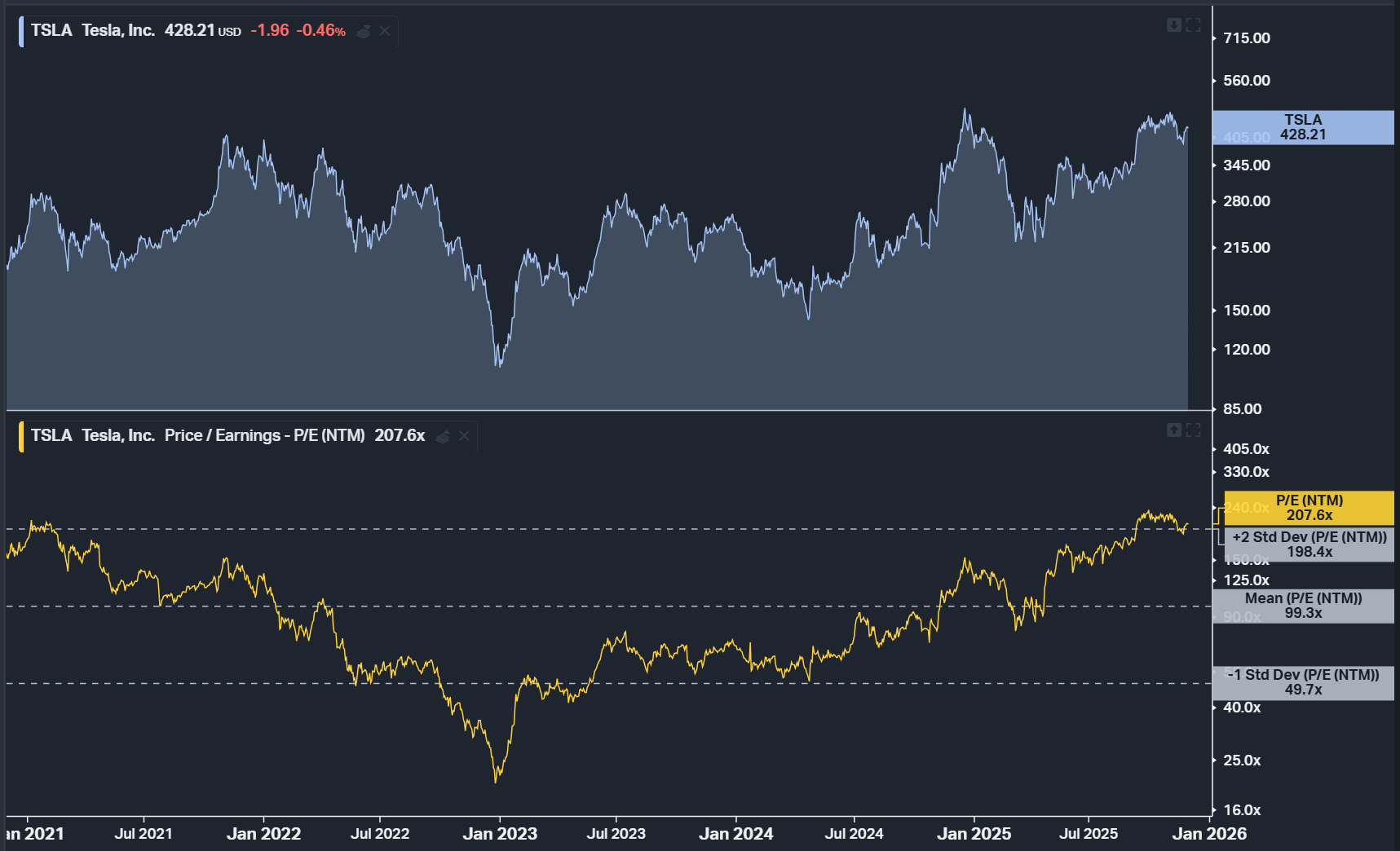

The forward P/E ratio for Tesla shares for the next 12 months is currently hovering around its highest level in five years. Source: Koyfin

TSLA shares are maintaining their long-term upward trend after returning above the 50-day EMA (blue curve on the chart) last week. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.