-

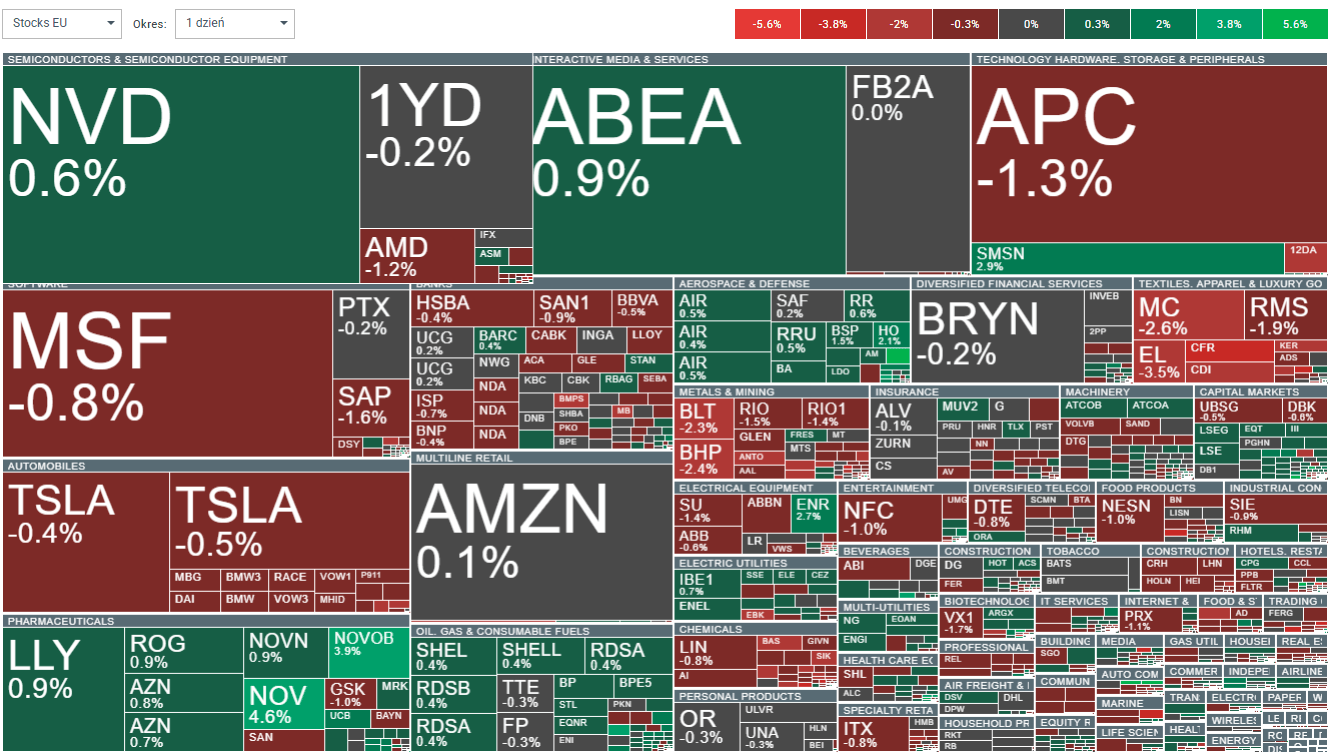

Sentiment in European equity markets remains mixed toward the end of the week. The Euro Stoxx 50 is down 0.40%, Germany’s DAX is up 0.10%, and overall moves are contained within a ±0.40% range.

-

Market mood in Europe is increasingly shaped by the technology sector, which is up 11.8% YTD. This makes it the second-best performing sector after basic resources and clearly stronger than US technology stocks, which are currently consolidating.

-

Companies such as ASML, ASM International, and BE Semiconductor account for nearly 40% of the Stoxx 600 Technology Index and have generated almost 90% of the sector’s gains this year.

-

Optimism was further reinforced by TSMC, which delivered very strong capital expenditure guidance, supporting expectations of a sustained upswing among its supply-chain partners. The world’s largest contract chipmaker forecasts capex growth of around 30% in 2026, along with a significant increase in spending over the following three years.

-

Confirmation of strong demand in TSMC’s results is clearly positive for European suppliers of data-center and semiconductor manufacturing equipment. Demand for production tools is expected to remain strong beyond 2026, especially as new fabs come online and physical capacity constraints gradually ease.

-

Morgan Stanley raised its price target for ASML to EUR 1,400 (from around EUR 1,165 currently, implying roughly 20% upside). This is among the highest valuations on the market. The bank expects strong order inflows over the next two to three quarters, with improved growth prospects likely to persist at least through 2027.

-

The current rally marks a reversal of earlier weakness among European semiconductor equipment makers, which had lagged US peers at the start of the AI boom.

-

Valuations of European tech companies are gradually catching up with their US counterparts. ASML trades at around 43x forward earnings, compared with its 10-year average of roughly 29–31x. The Stoxx 600 Technology Index is valued at about 27x forward earnings, broadly in line with US levels.

-

Global markets show mixed sentiment: US100 and US500 futures are slightly higher, while Asian equities have reached record levels following TSMC’s results.

-

In commodities, oil has edged higher to around USD 59.80 per barrel, while precious metals such as gold and silver are seeing modest declines.

-

Investor attention may also turn to European clean-energy stocks after a US court allowed Equinor to resume construction of a large offshore wind farm near New York.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.