Stocks in the Asia-Pacific region are showing mixed results after a relatively negative session on Wall Street, where the S& P 500 and DJIA indices fell from record highs, and US President Donald Trump turned his attention to the housing and defense industries, announcing a ban on large institutional investors buying more single-family homes and signing an executive order prohibiting the purchase of shares in defense companies.

Trump announced that he would not allow defense companies to pay dividends or carry out buybacks until they accelerated military equipment production, increased investment in manufacturing capacity, and reduced "excessive" executive compensation.

Source: BatchData via Reuters

At the same time, he stated that no manager in these companies should earn more than $5 million per year, and that money for investments should come from dividends, buybacks, and wage cuts, rather than debt or government funds.

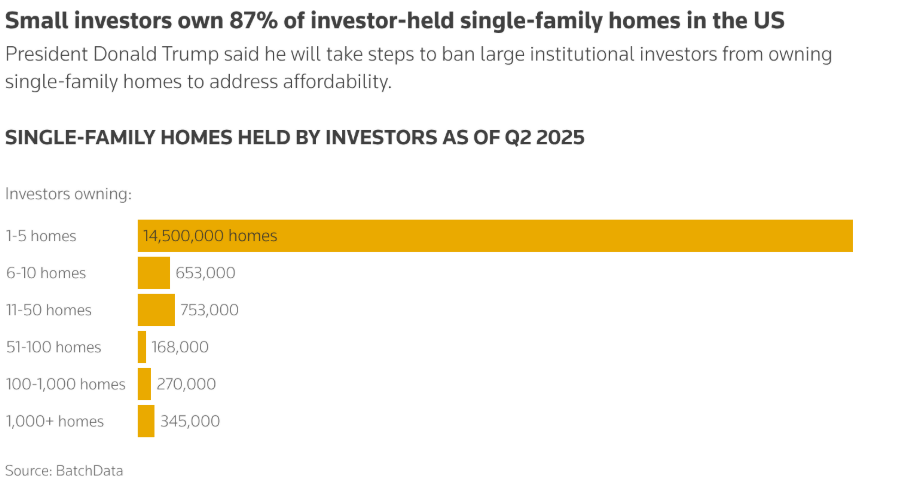

Trump announced a ban on large funds buying single-family homes, which temporarily knocked around $17 billion off Blackstone's market capitalization, but the "mega" funds themselves account for only about 2-3% of all transactions in the single-family home market, which means that removing this segment of demand will not significantly change prices, as the main problem in the market is very low supply resulting, among other things, from existing investor ownership and high interest rates.

In response to these comments by the US president, shares in companies such as Lockheed Martin and Northrop Grumman fell by 3%, while shares in real estate companies such as Blackstone fell by as much as 6%.

In November, real wages in Japan fell by 2.8% y/y – the sharpest decline since January – due to a sharp drop in bonuses and persistently high inflation, which is putting further pressure on household purchasing power and complicating the BOJ's plans to tighten policy. Bond markets reflected these tensions with weaker demand for 30-year JGBs, while the Nikkei extended its losses below 52,000 points on a wave of profit-taking in the AI sector and the return of trade tensions with China, including an anti-dumping investigation into Japanese dichlorosilane.

Andrew Hauser of the RBA confirmed the hawkish rhetoric, assessing November's CPI as in line with expectations and emphasizing that inflation above 3% is still too high, which likely signals the end of rate cuts in this cycle and maintains the risk of a hike in February, supporting short-term yields and limiting the AUD's weakness during today's session.

On the FX market itself, defensive currencies such as the Japanese yen and the Swiss franc are performing best today. On the other hand, we are seeing large losses on pairs related to the AUD and NZD, which are reacting to the weakness of the commodities market.

SILVER is currently down 2.1%, while GOLD is down 0.4% on the wave of position reduction in local peak zones. Palladium and platinum are also losing significantly. At the same time, WTI oil prices are falling below $56.5 per barrel, continuing their long-term downward trend.

Bitcoin opens the session with a decline of nearly 1%. The situation is similar on Ethereum, where the scale of the sell-off is currently similar.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.