*Natural gas (NATGAS) prices are undergoing a dynamic correction, moving away from last week's highs of $5.5/MMBTU and testing key support around $4.3. Importantly, bearish sentiment persisted even despite the publication of a bullish EIA report.

Key conclusions:

-

The market ignores historical data: The EIA report showed a massive decline in inventories of -177 bcf (compared to forecasts of -166 bcf and the previous reading of -12 bcf). Although this reflects the cold start to December (the coldest since 2017), the market is already discounting the future, not the past. The downward reaction to such a strong reading is a sign of weak speculative demand.

-

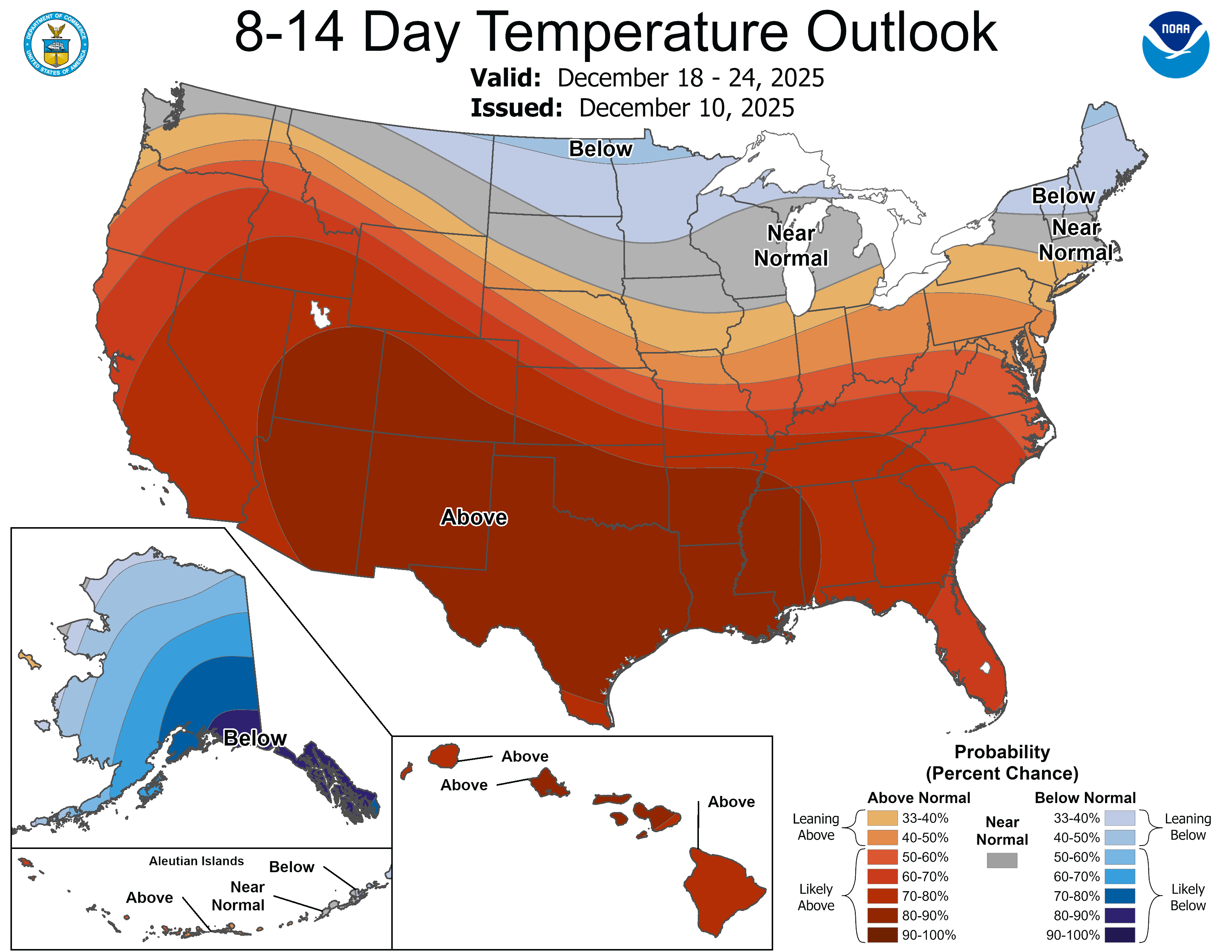

Weather front change: The main catalyst for the sell-off is the update of weather models (NOAA). Forecasts for the second half of December indicate the arrival of a heat wave moving from west to east across the US, which will drastically reduce the number of heating degree days (HDD) during the key period.

Sources: NOAA

-

Supply remains a burden: Record gas production in the US represents a ceiling for growth once weather pressures ease.

-

Technical situation: The price is testing support at $4.3/MMBTU, coinciding with the 50-day exponential moving average, which the market has not tested since 20 October. Interestingly, however, the RSI indicator for the last 14 days does not indicate that the instrument is oversold.

Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.