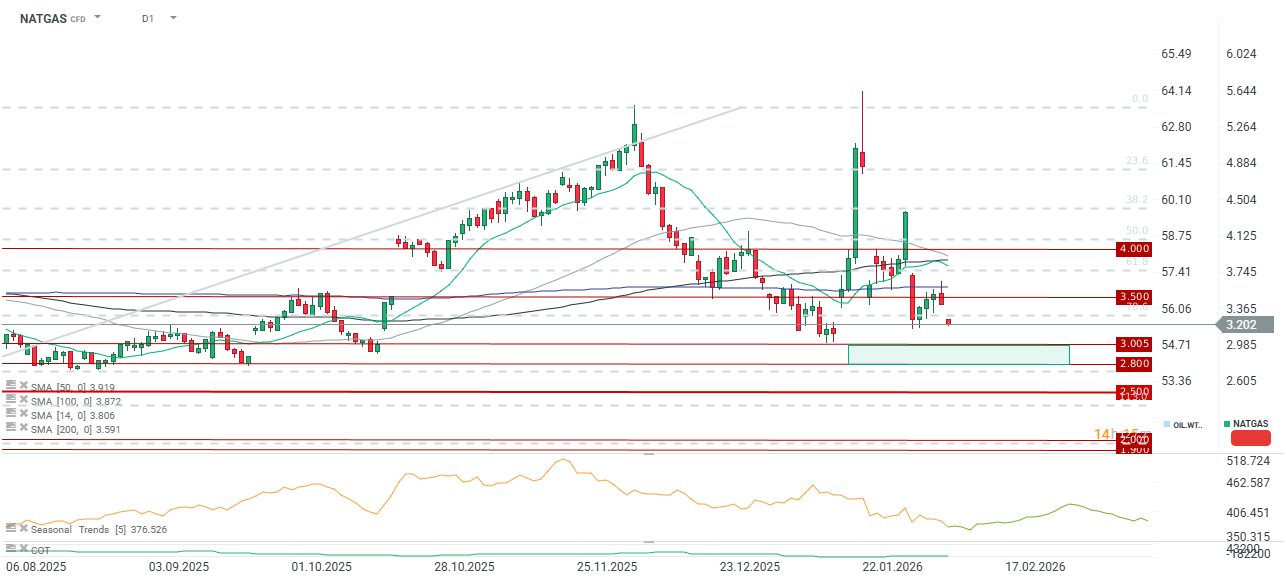

Natural gas prices have retreated by more than 6% at the start of the new week. Looking back to last Friday's peak, the price is now down as much as 12%. Markets are currently testing the $3.2 USD/MMBtu level, representing the local lows from early last week. Should this support be breached, prices would hit their lowest level since mid-January, with the potential to decline toward a significant demand zone around $2.8–$3.0 USD/MMBtu.

Primary drivers of the decline:

-

Shifting weather forecasts: Following January’s Arctic blast, meteorological models now indicate a warming trend across key US regions (such as the Midwest and Northeast), curtailing gas consumption for space heating.

-

Inventory dynamics: The latest storage report revealed a massive draw of 360 bcf (for the week ending January 30). However, upcoming temperature forecasts point to a significant reduction in heating requirements for February.

-

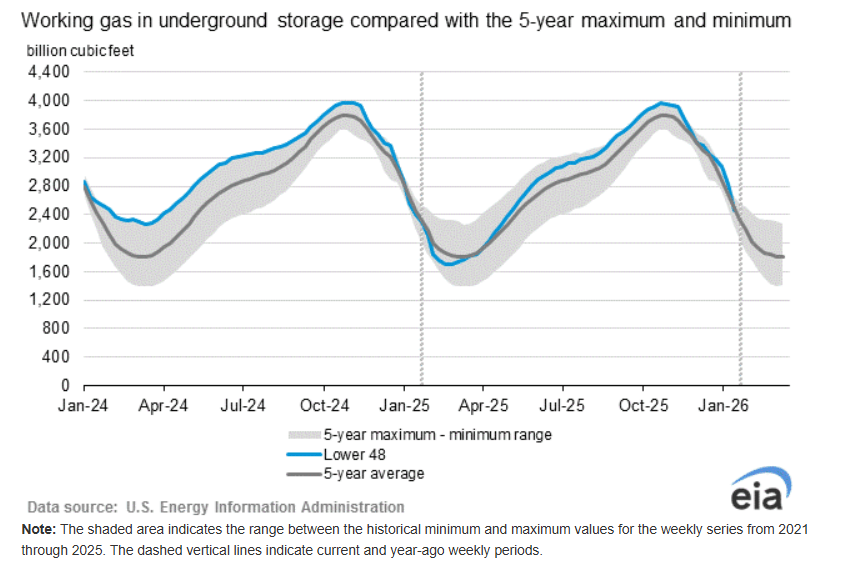

Stockpiles: Inventories remain above year-ago levels, while sitting marginally below the five-year average.

-

Softer industrial demand: Seasonal reductions in activity within the chemical and energy sectors, coupled with high storage efficiency, are weighing on prices.

Inventory and Seasonality Inventories remain relatively close to the five-year average. Forecasts suggest that gas consumption from the start of February will be significantly lower, which should result in smaller weekly drawdowns moving forward. Source: EIA

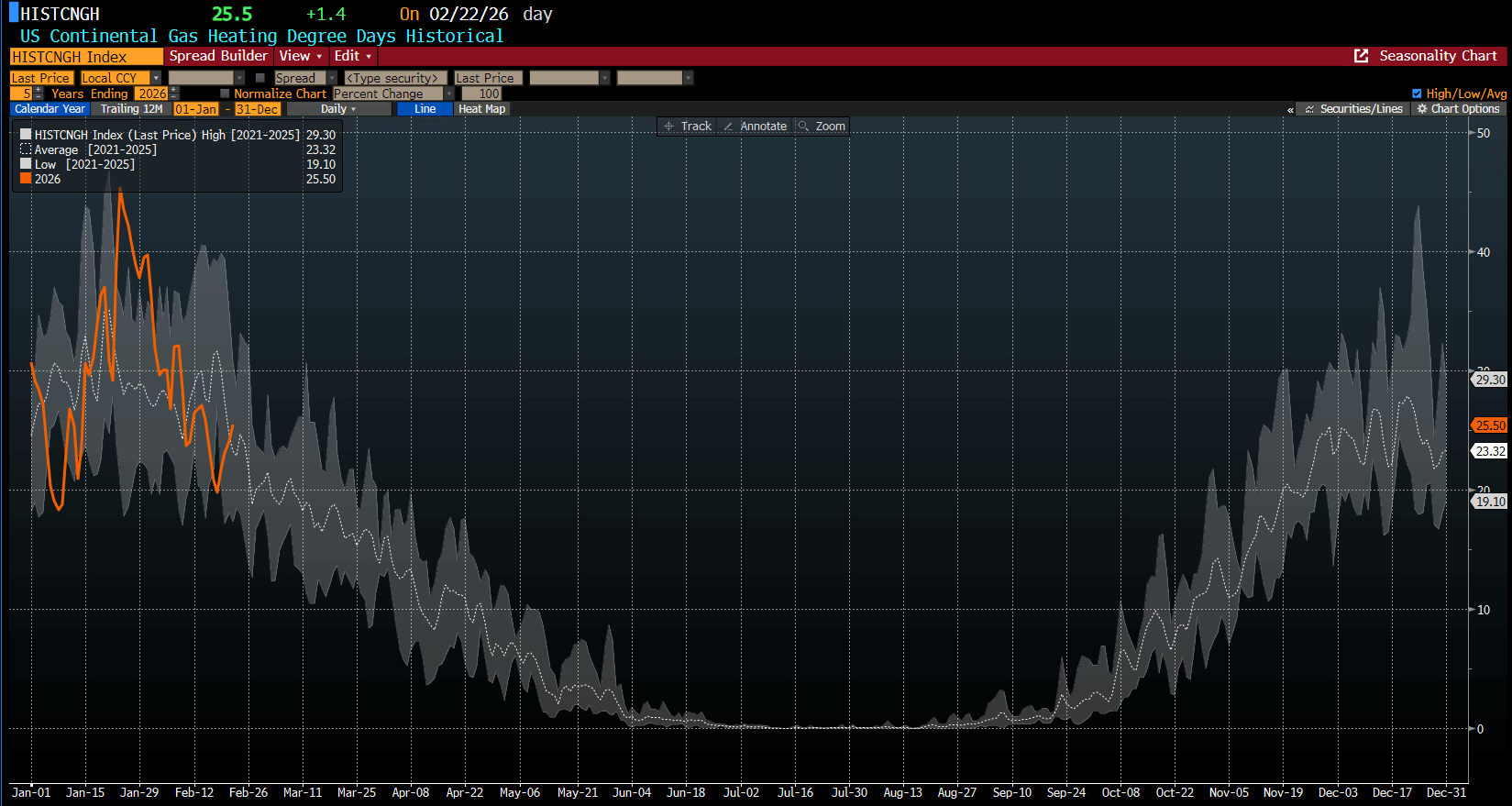

Heating Degree Days (HDD) The forecasted number of heating degree days for February 22 has risen toward the five-year average. Nonetheless, historical seasonality indicates a clear reduction in heating needs during the second half of February. Source: Bloomberg Finance LP

Heating Degree Days (HDD) The forecasted number of heating degree days for February 22 has risen toward the five-year average. Nonetheless, historical seasonality indicates a clear reduction in heating needs during the second half of February. Source: Bloomberg Finance LP

Technical Outlook Prices fell sharply at the start of the week. If the support near $3.2 USD is broken, the price may head toward the next demand zone situated between $2.8 and $3.0 USD/MMBtu. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.