U.S. Henry Hub natural gas futures (NATGAS) are gradually turning higher again after the contracts rollover and a correction from last week’s rally, following Monday’s surge and subsequent pullback from three-year highs. The earlier jump was driven by winter storm Fern and widespread production freeze-offs across key basins.

- The rally was demand-led first. Residential and commercial consumption climbed to around 69 Bcf on Monday, a seasonal peak typical of intense cold waves. Power-sector demand also spiked sharply. Gas burn for electricity generation is estimated near 50 Bcf, a level comparable to the hottest days of last summer, just in a winter setting.

- In the near term, the key question is how long this demand shock lasts. Forecasts suggest demand will remain exceptionally elevated until temperatures start to moderate early next week, which continues to keep the physical market very tight.

- On the futures curve, the front month is behaving like an expiring contract typically does. For example, the February Nymex contract is down roughly 3% ahead of Wednesday’s expiration, while market attention shifts toward the next delivery months.

- The March contract is down about 3.5% to the $3.84 area, highlighting the sharp gap between immediate supply tightness and expectations of a relatively quick normalization. This is a textbook example of storm-driven backwardation.

- The second pillar of the story is supply disruption. Production outages have appeared across multiple U.S. regions, initially estimated at around 2 Bcf per day, then deepening abruptly to as much as 12 Bcf per day, with the Permian and the broader Gulf Coast taking the biggest hit.

- The market’s main debate now is not whether the storm mattered, but how quickly production returns to normal. The prevailing scenario is continued tightness through midweek, followed by a noticeable supply rebound over the weekend.

The pullback does not mean the market has fully calmed down. Investors are starting to price in a peak in the cold spell and the subsequent recovery in output. Until temperatures and production genuinely normalize, elevated volatility remains the base case.

NATGAS (M15 timeframe)

Source: xStation5

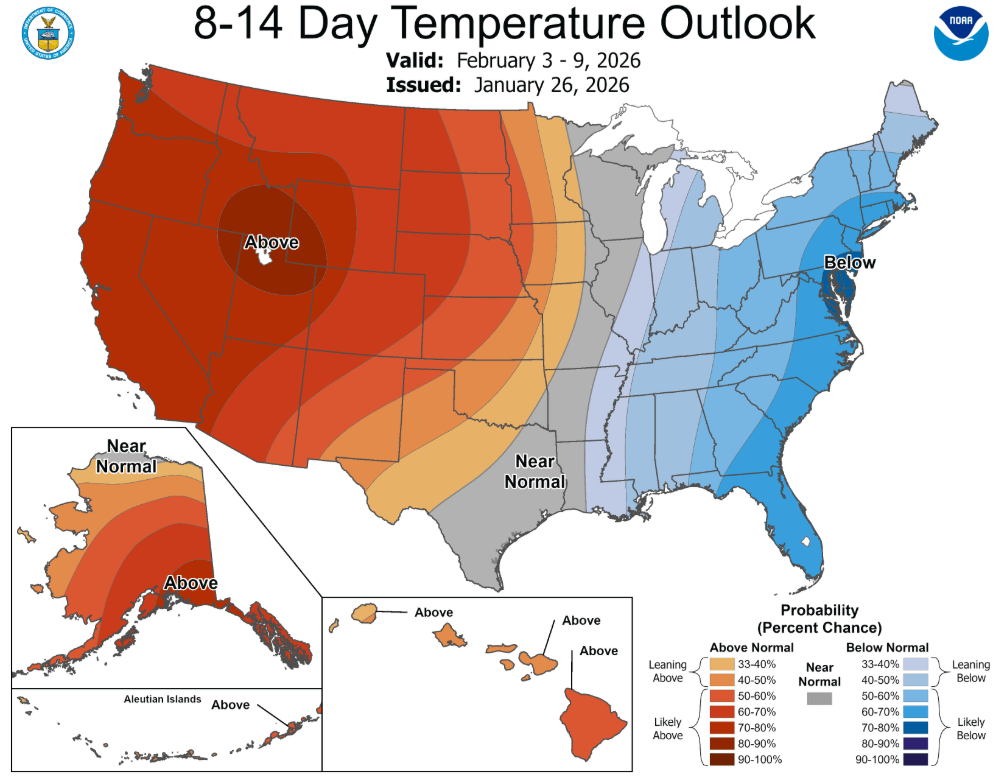

Weather forecasts for the U.S. indicate that cold temperatures may persist along the East Coast in early February.

Source: NOAA, CPC

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.