U.S. natural gas futures (NATGAS) are climbing 4% today, led by a sharp rally in the front-month January contract, which surged into expiration while later-dated contracts also climbed. The key bullish driver is a near-term colder weather outlook for the North and West, with forecasts pointing to a stronger cold push from December 31 into early January, supporting expectations for higher heating demand.

-

Another major tailwind remains exceptionally strong LNG demand, as U.S. export flows to global markets are running at record or near-record levels, helping absorb domestic supply.

-

These supportive factors are partly offset by solid U.S. production, which continues to provide a meaningful supply cushion, limiting how far prices can run.

-

The latest EIA storage report added fuel to the rally: for the week ending December 19, U.S. inventories posted a 166 Bcf withdrawal, bringing total storage down to 3,413 Bcf.

-

That drawdown pushed U.S. inventories slightly below the five-year average for the first time since April, signaling that the market is moving from comfortable supply conditions toward a tighter balance.

-

Storage is now estimated at 24 Bcf below the 2020–2024 seasonal norm, after being 32 Bcf above average just one week earlier — a notable swing that traders quickly priced in.

-

The withdrawal was close to expectations, coming in just under the Wall Street Journal analyst consensus of 169 Bcf, reinforcing confidence that cold-driven demand is beginning to show up.

-

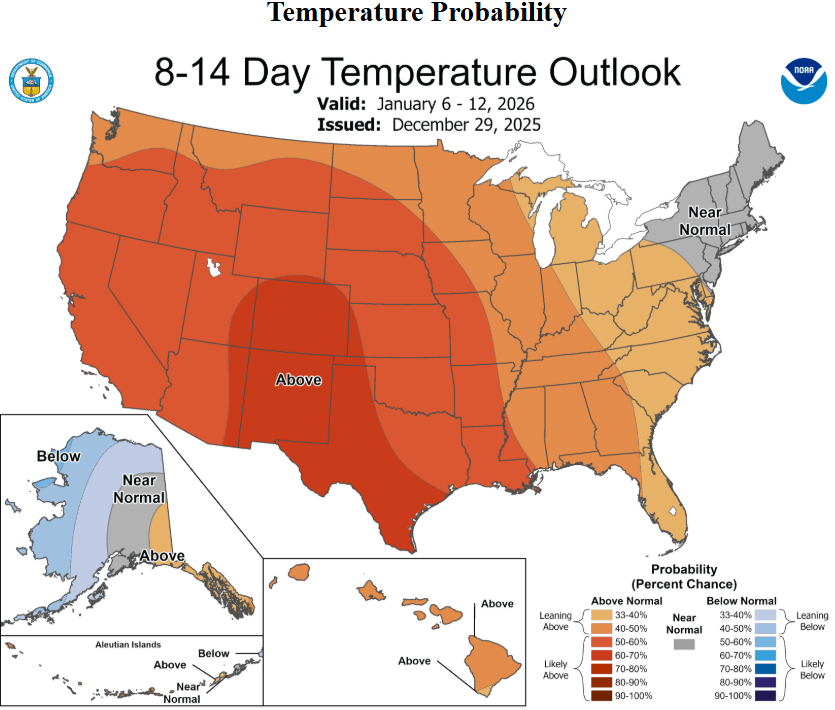

However, the rebound may be tested in the beginning of January, as Climate Prediction Center according to NOAA data signals warmer temperatures across the United States since 6 to 12 January 2026.

Source: NOAA, CPC

Natural gas futures climbs almost 4% today, rising to the highest level since 17 December. If the price will fall from todays level, test of $3.80 may be immitend. On the other side, if the price will continue to rise above EMA50 (orange line), fundamentals may support the trend even in January - especially if 6 - 12 January NOAA weather forecasts will change.

Source: xStation5

BREAKING: US Chicago PMI beats expectations 🗽USDIDX reacts

DE40: DAX hits a 2.5-month high 📈 Rheinmetall jumps on renewed Russia–Ukraine tensions

Chart of the day: CHN.cash (30.12.2025)

Silver jumps 3% as buyers step in after the crash 📈

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.