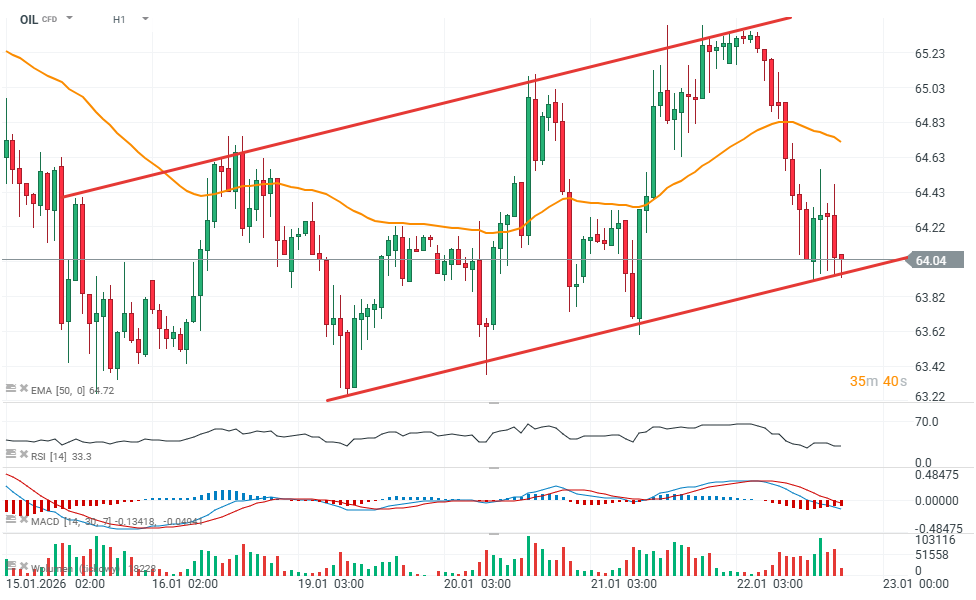

US energy market data released today pointed to a solid build in crude oil inventories and a larger-than-expected draw in natural gas stocks. As a result, oil prices slipped slightly toward the $64 per barrel area. Meanwhile, the “supportive” natural gas report triggered some profit-taking, although the base case remains a continuation of the strong uptrend.

-

Crude Oil Inventories (EIA): +3.602M bbl (forecast: -0.108M, previous: +3.391M)

-

Gasoline Inventories (EIA): +5.977M bbl (forecast: +1.466M, previous: +8.977M)

-

Distillate Inventories (EIA): +3.348M bbl (forecast: 0M, previous: -0.029M)

-

Cushing Crude Inventories (EIA): +1.478M bbl (previous: +0.745M)

-

Natural Gas Storage (EIA): -120 bcf (forecast: -98 bcf, previous: -71 bcf)

Source: xStation5

Source: xStation5

Daily summary: Wall Street, precious metals and EURUSD surge📈Bitcoin under pressure

Gold gains 1%, silver surges 3% 📈Precious metals near record levels again

NATGAS surges 11% amid US arctic frost reaching record level since 2022 📈

US Open: Rebound attempt on Wall Street 📈Meta Platforms surges 3.5%

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.