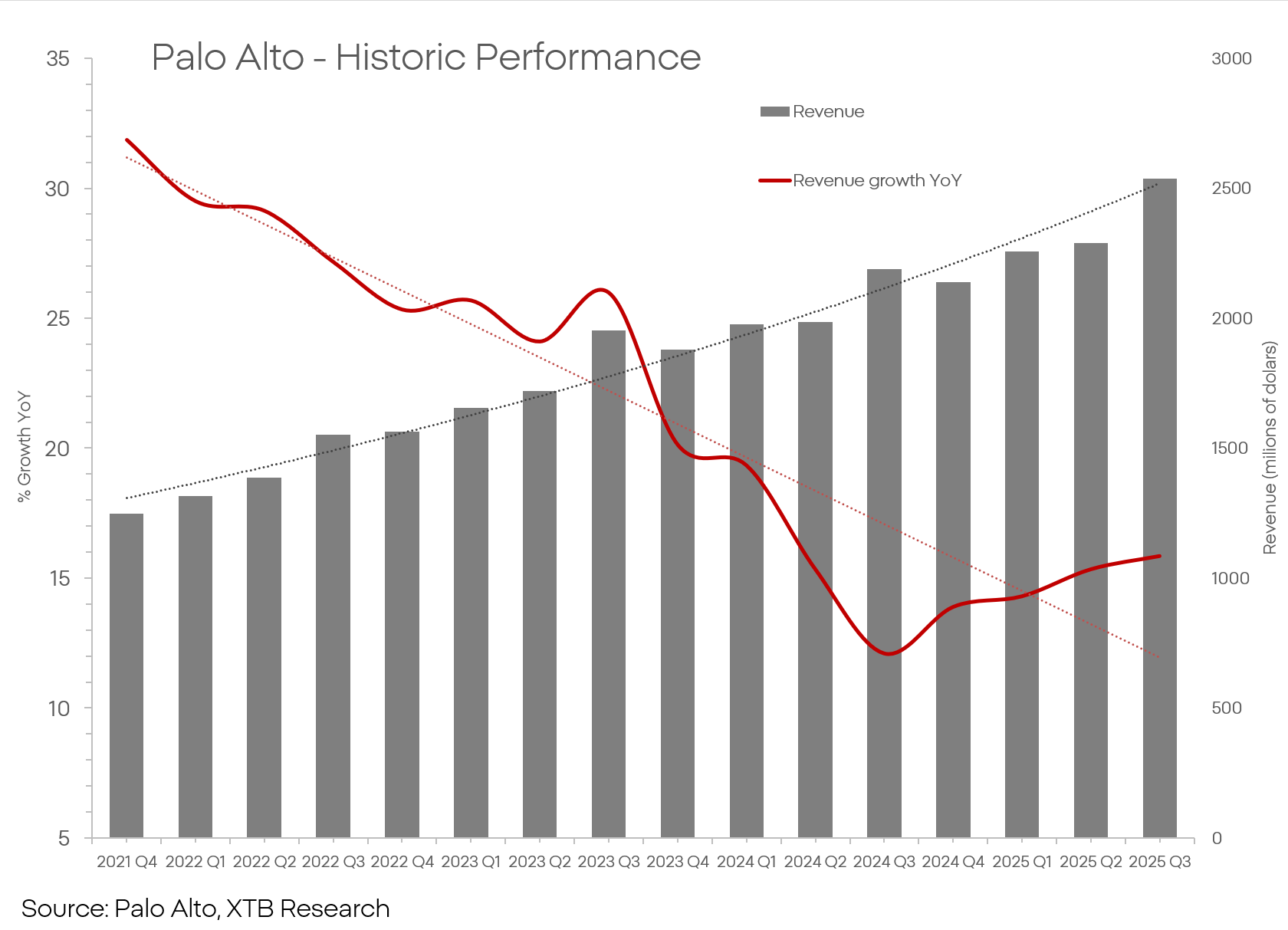

At first glance, the financial report doesn't reveal any reasons for concern or disappointment.

- Revenue: $2.47 billion compared to the expected $2.46 billion. Year-over-year growth of 16%.

- EPS at $0.93 compared to the expected $0.89. Year-over-year growth of 19%.

- Increase in order portfolio to $15.5 billion, with $5.85 billion being recurring revenue from "Next Gen Security" solutions - in this segment, growth was 24% and 29% year-over-year, respectively.

- Revenue growth is not at the expense of profits, with free cash flow increasing to $1.7 billion with an FCF margin of 19%.

Forecasts are meant to reassure investors about promising future results:

Revenue for the next quarter is expected to be between $2.47-2.50 billion, and revenue for the entire fiscal year is expected to exceed $10.5 billion with EPS between 3.8-3.9 - both figures above consensus expectations. By 2028, the operating margin is expected to exceed 40%.

At the same time, the company announced another major acquisition — this time it's Chronosphere, aimed at improving Palo Alto's offerings and capabilities regarding oversight and AI. This acquisition will cost $3.35 billion.

In light of this information, which of them caused the stock price to drop?

Primarily, it's not the numbers but the trends that speak here — specifically its slope. It's about the growth rate which, although impressive, is declining when compared to historical data. The growth is still incredibly impressive, but with a P/E ratio exceeding 140, impressive is not enough.

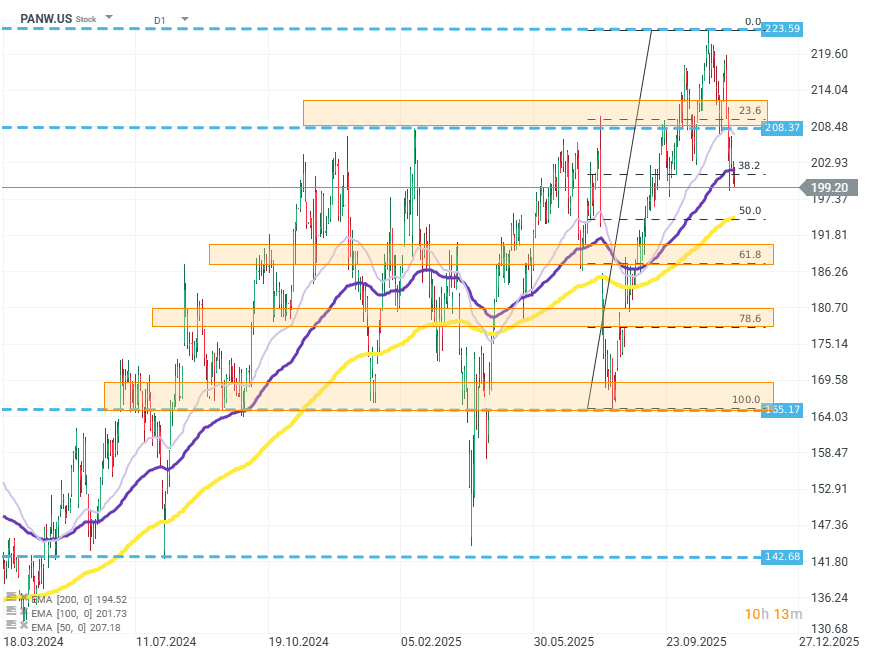

PANW.US (D1)

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.