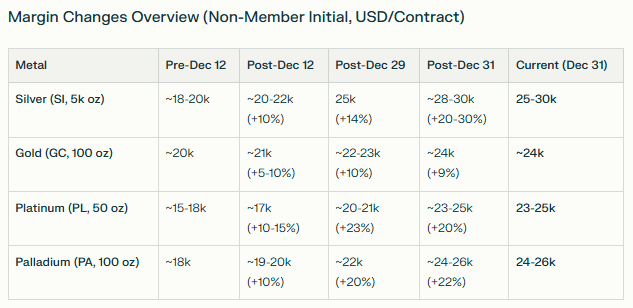

Following Friday’s close, the exchange announced a hike in both initial and maintenance margins for precious metals on its COMEX division. This has prompted a significant retreat across the sector, despite an earlier dramatic surge in silver prices beyond $80, driven by the announcement of Chinese export restrictions. Citing persistent volatility, the CME has signaled a further increase effective after today’s closing bell.

The following initial margin requirements have been compiled using AI tools, aggregating data from sources including the CME, Bloomberg, Yahoo Finance, and AIInvest. The table reflects initial margins; maintenance requirements typically stand at approximately 80-90% of these levels. The numbers may differ from the actual ones.

While speculative positioning on futures exchanges has not yet reached extreme levels, the current hikes may compel commercial investors to reduce their market exposure. However, a more sustained price correction would likely require action from long-term investors, such as profit-taking within exchange-traded funds (ETFs).

On Tuesday, silver and palladium ETFs reduced their bullion holdings, while gold and platinum funds increased their exposure. Since the start of the year, gold volumes in ETFs have risen by 19%, silver by 20%, platinum by 2%, and palladium by 50%. The current value of gold held in these funds stands at nearly $430bn, with silver at $65bn, platinum at $7bn, and palladium at almost $2bn.

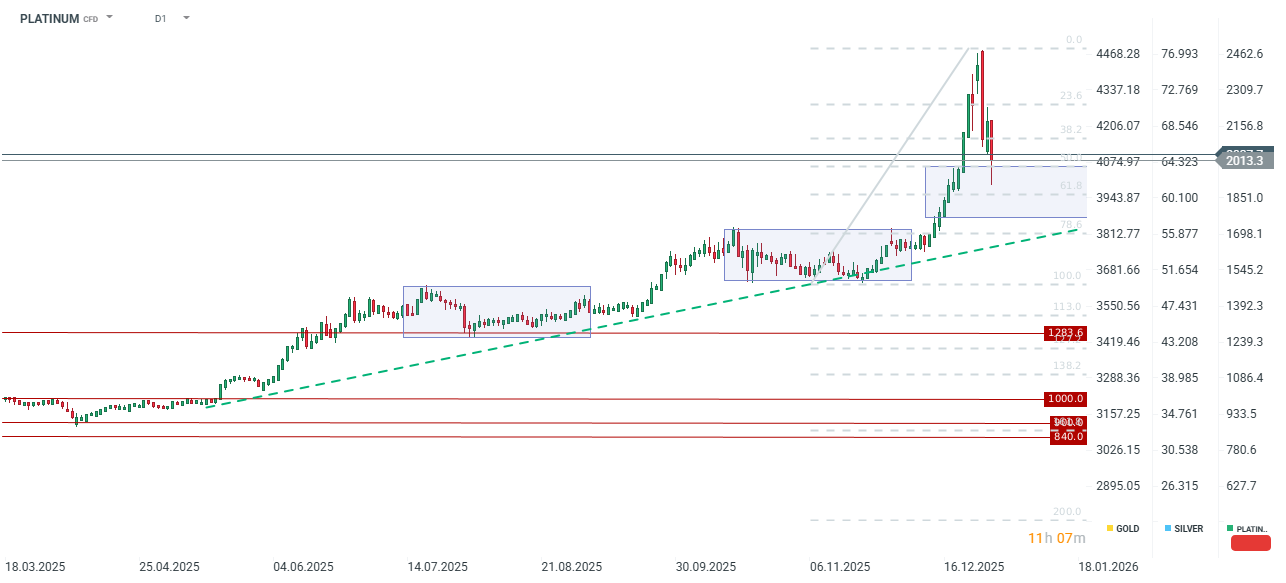

Platinum has retreated by more than 7% today, testing the $2,000 level after a rebound yesterday saw prices touch $2,200 per ounce. The metal is currently testing the 50.0% Fibonacci retracement level. Should this support be breached, the next significant technical floor lies near $1,700, coinciding with the 78.6% retracement of the most recent upward wave and the prevailing bullish trendline.

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.